Business

More News

-

Financial distress: ‘Economy suffering from uncertainty’

FCCI President Suhail Bin Rashid has asked politicians to shun extremism detrimental to the national economy.

-

Drive to enhance tax collection amiss

Low number responds to FBR notices.

-

Transparent drug pricing policy to attract investment

Industry asks regulator to consider WHO’s guidelines.

-

Young entrepreneurs offered seed money, mentorship

NEW-G and INJAZ Pakistan build platform for startups.

-

Corporate results: Jubilee Life Insurance posts 50.5% growth in profit

Declares interim cash dividend of 25%, EPS increases to Rs8.29.

-

Corporate results: Engro Fertilizers profit up 137%

Earns Rs3.4b in first half of calendar year.

-

Assistance needed: Construction industry reaches out to government

Private sector cannot provide cost-effective housing to masses without support.

-

No green signal: PM stops removal of OGRA member accused in scam

Sends case to Federal Public Service Commission for recommendation.

-

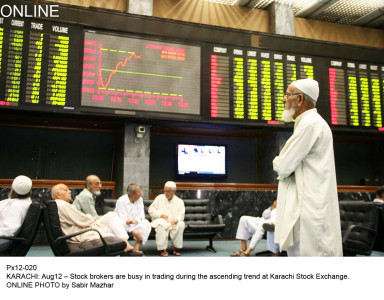

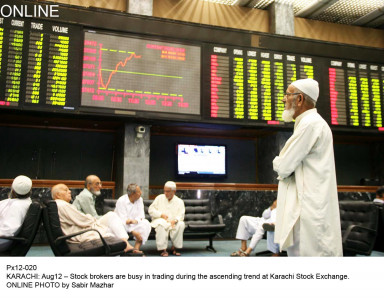

Market watch: Index in recovery mode

Benchmark KSE-100 gains 201.05 points.

-

Dar disapproves of PTI calling Budget 2014-15 pro-elite

In official response to PTI's white paper, Dar says allocation of resources in favour of poor as well as youth

-

Delegation leaves for business festival in UK

KCCI officials optimistic about promoting Pakistan’s image.

-

2QCY14: MCB Bank posts impressive growth

MCB recorded an increase of Rs4.6 billion of the gross markup income.

-

Sell-off: Federal govt borrows Rs83.6b by auctioning PIBs

Amount raised significantly less than the actual target of Rs100 billion.

-

Pakistan, India: Trade goes on despite political ups and downs

Studies say higher trade will increase Pakistan’s GDP by 2%.

-

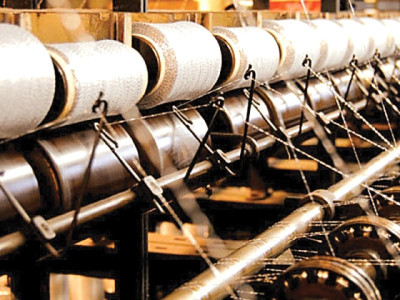

APTMA laments ‘unstable, uncertain’ scenario

Chairman Tanveer calls for end to political, energy crisis.

-

Price hike demand: Mari Gas should distribute profit first, says ministry

Has reserves of Rs9b, price may be increased from $0.73 to $2.1 per unit.

-

Housing exhibition: ABAD’s expo hailed

Major allied industries brought under one roof for display of products.

-

Remittances up 17.45%

Overseas Pakistanis remit $1.65b during first month of current fiscal year.

-

Slowing down: Car sales hit speed bump in July, may pick up later

Monthly demand hits 67-month low as tax burden mounts.

-

Market watch: Index posts recovery, ends in black

Benchmark KSE-100 gains 233.09 points.

-

Stock exchange blues

The long march should not disrupt fundamentals of the market as profit-making companies will continue to make profits.

-

High point: PMI shows growth

It was a growth of 2.9 points after three previous consecutive drops due to Ramazan and Eid.

-

Forum to highlight importance of SMEs

Will make policy interventions to address sector’s issues.

-

South Asia ties: Traders underscore need for trust-building

Plea for removing doubts among importers and exporters.

-

Swiss mission promises help to enhance exports

Says foreigners not well aware of security situation in Karachi.

-

PTDC plans fresh measures to encourage tourism

Managing director looks to make body a self-sustaining one.

-

Annual field maintenance: Gas consumers brace for worst shortages ahead

Only residential consumers could receive supplies until October

-

Businessmen call for calm amid political strife

Traders have mixed emotions about the ruling party’s achievements

-

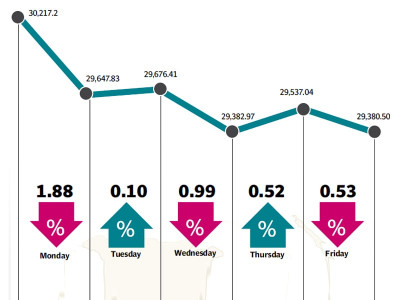

At the bourse: Uncertainty rocks KSE

Benchmark index sheds 1,309 points, volatile trading expected .

-

Corporate results: Pak Suzuki’s profits slide 11%

Automaker posts earnings of Rs1.03b; EPS remains at Rs12.58

-

Pattern: Need to re-evaluate and study date consumption

Country’s imports rise due to mismanaged production.

-

Seven months on: Trading in T-bills, PIBs via bourse remains thin

New mechanism was expected to broaden investor base.

-

Foreign investors: Confidence flags in wake of political turmoil

Future investment in all-important energy projects at stake.

-

Fallout: UFG and its disastrous consequences

Who bears this huge loss is unending debate.

-

Comment: State of denial amid grave economic challenges

Q Block needs to address its issues and take remedial measures

-

Economic zone: Allotment committee meeting held

As the zone is located in Khairpur, a major grower of dates, different phases of date growing were also discussed.

-

China inflation up 2.3% year-on-year in July

Deflation risk may rise if momentum weakens, say economists.

-

Court settlement: Google agrees to fight illegal online pharmacies

Internet search giant commits to spending at least $250m over 5 years.

-

Anti-poaching agreement: Judge rejects Silicon Valley settlement

Says amount ‘falls below the range of reasonableness’.

-

Gas consumption: Govt works out plan to feed imported LNG to 7 IPPs

Power plants will be able to produce 3,000MW at cheaper cost.

-

In action: Lifting the curtain on the cinema business

Huge investments pouring in through modern multiplexes.

-

Ex-bureaucrats favoured: Govt’s approach to appoint tax reform chief questioned

Officials with irrelevant expertise being considered for the job.

-

Weekly review: KSE-100 falls 933 points as political tension flares up

Oil and gas, banking and cement sectors take hit as investors exercise caution.

-

Energy sector: Turkmenistan offers support

A joint working group to prepare feasibility of energy projects.

-

Construction sector: Foreign companies to take part in building expo

Industry to introduce 100 new projects in next four months.

-

Business opportunities: Netherlands extends helping hand

Country looking to expand trade potential.

-

Financial losses: PIA delays hiring of firm for forensic audit

Court’s order remains unimplemented even after one and a half years

-

Textile sector: PTEA, ILO weave together programme for compliance

Aim is to ensure textile industry’s adherence to labour laws.

-

Liquidity: Another SBP injection of Rs59b

Total reaches Rs420.25b in six open market operations since start of year

-

Trending: A platform for emerging startups

Local entrepreneur launches website to document Pakistan’s startup culture.