Guar exports slide after international price falls

Takes toll on Pakistan’s producer, earnings record massive decrease.

Guar exports slide after international price falls

Crash in the international market price of guar (cluster bean) following a bumper crop in the subcontinent in the last year has led to a slide in export earnings from the lesser-known plant, which has emerged as a major export for Pakistan in recent years.

The downward pressure on price, mainly due to excess supply, has also taken a toll on the earnings of one of the largest local guar gum maker Pak Gum and Chemicals Limited, the only listed firm in the business of processing the gaur seed into more valuable gum.

“We had an unprecedented crop in Pakistan with output touching nearly 250,000 tons,” said Waheed Sheikh, a manufacturer of guar gum. “Price dipped due to it. But the annual average increase in demand, which is 10%, has remained intact.”

The story was the same in India.

Pakistan and India, together, account for almost all the global output of the crop. India is the largest producer – and by some distance – with a market share of 90% and production of over 2.4 million tons.

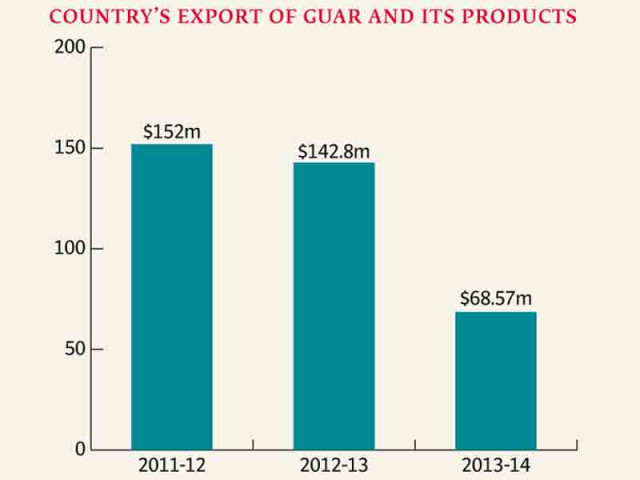

Pakistan’s export of guar and guar products dropped 52% to $68.57 million in fiscal year 2013-14 compared to the previous year, according to the Pakistan Bureau of Statistics (PBS). In terms of volume, export went down 17% to 19,721 tons. Depressed price and lower export continued into July 2014.

Guar and guar products export was just $29 million in 2006-07. It shot up to a record high of $152 million in 2011-12.

A 100-kg bag is being traded between the price ranges of Rs5,700 to Rs6,200, said guar trader Muhammad Ilyas. “We are not expecting the price to move up any time soon.”

In 2012, the same bag was selling for Rs40,000.

Estimates on the exact size of the cultivated area of guar remain vague as it is grown in far-flung arid and semi-arid areas of Punjab, Sindh and Khyber-Pakhtunkhwa. Most of the production takes place in Sargodha and Tharparkar.

But, according to the PBS, guar was cultivated over 154,821 hectares in 2008-09.

Pakistan has 11 companies making guar split with Pak Gum Industries being the largest producer. Pak Gum and Chemicals Limited (PakChem) is also the only one listed on the stock exchange.

PakChem’s net profit declined 51% to Rs33 million in the six months to June, 2014, over the same period of the previous year. No one from the company was available to comment.

Guar has traditionally been used in the subcontinent as animal feed and natural fertiliser. Guar split powder, when mixed with liquid, turns into a thickener, which has industrial applications ranging from making ice cream and beverages to textile manufacturing.

But the global surge in demand for guar powder or gum has been led by its increasing use for oil and shale fracturing.

Most of the Pakistan guar is bought by Chinese businesses, which then use it to make gum and sell it at higher prices to oil and gas companies in the US.

Trader Ilyas said government officials have not paid attention to the crop. “No one talks about it. As a matter of fact before 2012 many people didn’t have any clue about guar’s potential.”

Traders have long complained that Indian guar gum fetches a better price as the Pakistani companies involved in the business haven’t invested in latest equipment.

“Businessmen want to make high quality guar gum locally but it’s not easy. Investment of at least Rs100 million is needed in plant and machinery. Money has to be spent to comply with various ISO certifications. Add to that power and gas shortages and the prospect becomes difficult,” said a trader.

Published in The Express Tribune, August 30th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ