How flawed LNG deals fuelled Pakistan’s Rs2.6tr gas-sector meltdown

Country no longer needs LNG supply, inks deal with Qatar for diverting cargoes

Was the launch of liquefied natural gas (LNG) imports by the Pakistan Muslim League-Nawaz (PML-N) government about a decade ago a blunder? This question arises when we look at the current situation.

Pakistan and Qatar have recently reached an understanding to divert 24 LNG cargoes, meant for Pakistan in 2026, to other destinations. The government claims it will save Rs1,000 billion.

The same stories had been heard in 2015 when the PML-N struck an LNG import deal with Qatar. It was claimed that the country would save $1 billion when compared with furnace oil imports for power generation.

At that time, the government was in a hurry and it even removed from office the managing director of Pakistan State Oil (PSO) for insisting on completing all legal formalities like back-to-back agreements between suppliers, users (power plants) and customers.

The problem was compounded during the next Pakistan Tehreek-e-Insaf (PTI) government, when the second LNG deal was signed with Qatar for supply of additional four cargoes per month, despite the country having demand-and-supply challenges.

The LNG deals reflect that they were inked without proper planning, due diligence and meeting all legal formalities.

Later, the auditor general of Pakistan pointed out that all stakeholders had failed to undertake comprehensive planning. It said that LNG was required to be supplied to public/private/bulk consumers under firm contracts with a take-or-pay clause.

But no firm back-to-back contracts were finalised with the independent power producers (IPPs) and contracts were reached with government-owned power plants (GPPs) for only up to 66% take-or-pay basis, instead of 100%.

The auditor general said that the whole LNG sale/purchase business remained at risk. In the absence of assurance of payments for contracted offtakes, all three public-sector entities – PSO, Sui Southern Gas Company (SSGC) and Sui Northern Gas Pipelines Ltd (SNGPL) – had been exposed to the risk of financial insolvency.

The Competition Commission of Pakistan (CCP) has also recently identified several barriers in the LNG sector, which are blocking competition, and has urged the government to unbundle the public gas utilities, introduce stronger regulations and ensure the entry of the private sector.

Lobbies at work

Different lobbies dominate the energy market. During the days when LNG imports began, two lobbies were working. One put its weight behind LNG purchases whereas the second supported imported coal-based projects.

Interestingly, both succeeded in their lobbying as Pakistan started LNG imports along with launching LNG-based power projects and on the other side, it launched imported coal-fired power plants.

However, both projects failed later, putting a burden on the government. LNG imports have not only imposed a high cost on consumers, but have also forced the curtailment of local gas supplies. This has prompted protests from domestic oil and gas exploration companies, who have no choice but to slow down supplies from fields.

The government's failure to properly manage LNG imports has put an additional burden of Rs242 billion on consumers during the current financial year. Exploration companies also approached Prime Minister Shehbaz Sharif, saying they had suffered losses of billions of rupees due to gas curtailment. They warned that they had not been able to kick off work on new projects due to cash-flow problems.

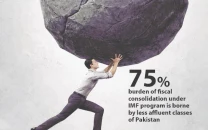

Additionally, the public gas utilities have been diverting imported LNG towards domestic consumers in winter to overcome the crisis. But no legal framework is in place to recover the dues, which has led to the accumulation of circular debt. At present, the gas-sector circular debt is standing at a whopping Rs2.6 trillion.

This circular debt, like the power sector, has choked the entire energy chain, directly impacting exploration companies including Oil and Gas Development Company (OGDC), which are striving to explore new avenues and forge joint ventures with foreign companies for mining and hydrocarbon exploration.

Way forward

At present, the country has only two gas utilities. These should be unbundled in a bid to help curb losses. Secondly, they are operating with a guaranteed rate of return – a formula that should be revised to run them on a commercial basis.

Private-sector participation should be encouraged in the gas marketing and distribution business. The government has already allowed allocation of 35% gas from new fields to the private sector. This will bring efficiency due to competition in the market.

Finally, the government should stop enhancing the gas distribution network. Instead, liquefied petroleum gas (LPG) consumption should be encouraged in the domestic sector. As PPP is part of the current coalition government, the weighted average cost of gas could be applied to recover cost.

The writer is a staff correspondent

COMMENTS (3)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ