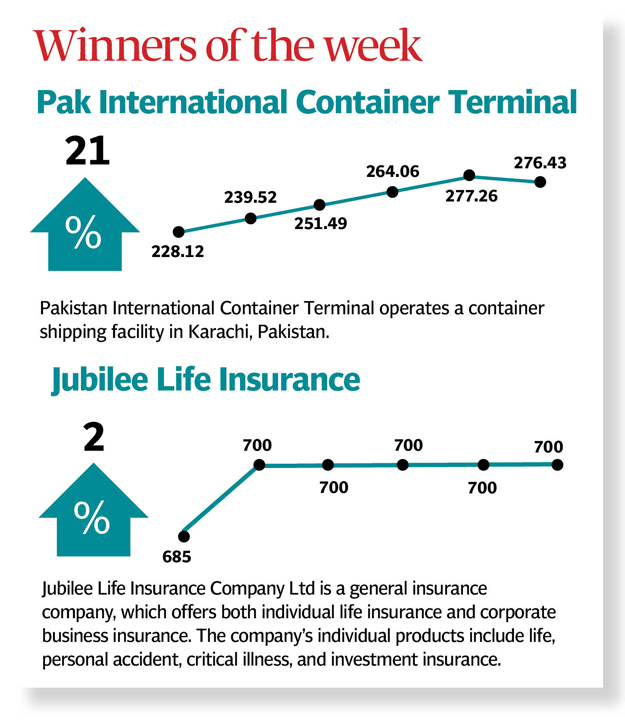

Weekly review: KSE-100 plunges 1,626 points in turbulent week

Political uncertainty, Avenfield verdict, macroeconomic concerns pull down the market

Market activity remained dull during the week with average daily traded value declining by 42% week-on-week to $35 million, while volume decreased by 39% to 111 million.

PHOTO:AFP

The week kicked off on a dull note as volumes remained low due to negligent buying interest. The trend continued for the following session with political uncertainty and poor economic conditions driving the market. The index came further under pressure as Fitch Ratings warned Pakistan to focus on declining foreign exchange reserves and the widening current account deficit. Earlier, Moody’s ratings agency downgraded Pakistan’s outlook to negative from stable. These two developments have raised concerns regarding the country’s deteriorating economic condition.

Events became turbulent on Wednesday as the KSE-100 index plunged 1,219 points due to uncertainty regarding the Avenfield Properties reference. The reference is among those filed by the National Accountability Bureau (NAB) against former prime minister Nawaz Sharif and his children on orders given by the Supreme Court during the Panamagate case.

Market watch: KSE-100 ends negative for fifth successive session

On a broader level, political volatility and macroeconomic headwinds remained the major culprits due to which investors scrambled to offload positions ahead of the general elections scheduled to be held on July 25. As rupee weakens and oil prices rise, triggering inflation, rising interest rates and subdued demand is likely to take toll on economic growth. All these factors led the market to continue its declining trend for the fifth session on Thursday.

However, Friday brought the losing streak to an end as the KSE-100 index ended marginally higher, boosted by a last-minute burst of buying activity, as the Supreme Court announced its verdict; prison sentence for the former prime minister and his daughter along with hefty penalties.

Market activity remained dull during the week with average daily traded value declining by 42% week-on-week to $35 million, while volume decreased by 39% to 111 million.

Sector-wise, oil & gas exploration companies (down 286 points), commercial banks (279 points), cements (163 points) due to rise in coal prices, oil & gas marketing companies (137pts), and fertiliser (118pts) dented the index most.

Weekly review: KSE-100 plummets 813 points as sentiment remains negative

Scrips that remained under pressure were OGDC (100 points), PPL (97 points), HBL (85 points), NESTLE (80 points) and UBL (77 points).

Market watch: Buying spree in final minutes helps KSE-100 break losing streak

Foreign selling continued this week clocking-in at $8.7 million compared to a net sell of $15.5 million last week. Mutual funds remained major net sellers as they sold shares worth $18.6 million during the week. Selling was witnessed in commercial banks ($2.7 million) and exploration and production ($2.2 million). On the domestic front, major buying was reported by individuals ($9.3 million) and banks/DFI ($7.4 million).

Among major highlights of the week were; Nepra slightly revised up multi-year tariff for K-Electric to Rs12.81/kWh, POL products’ prices enormously increased, SBP disposed of objections against KASB Bank merger, cement sales up 9.3% to 2.979 million tons in June, construction of new dams inevitable: SC, and SBP’s forex reserves plunge by $6 billion in fiscal year 2018.

Published in The Express Tribune, July 8th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ