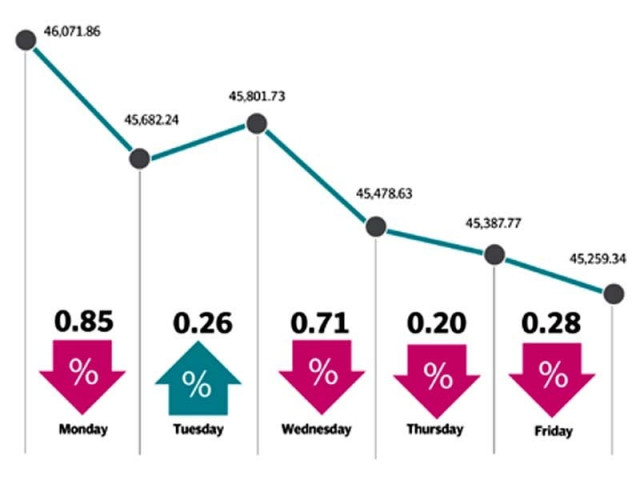

Weekly review: KSE-100 plummets 813 points as sentiment remains negative

Selling in banking and oil stocks leads decline

Uncertainty at the political front ahead of the general elections and worrying macroeconomic indicators dampened sentiments, giving an excuse for a prolonged correction and profit-booking. Lack of positive triggers also led to an overall dull week.

A major sell-off in Oil and Gas Development Company (OGDC) on Monday spooked investors, which weighed down the index, with even the positive news of soaring oil prices failing to rekindle interest in the stock. However, things took a turn on Tuesday as the three-day losing streak came to an end, as cement stocks garnered investor attention. Unfortunately, the index was unable to sustain the positive trend and finished the following three sessions in the red.

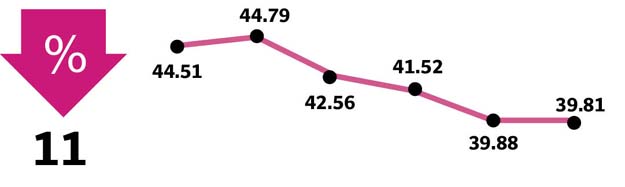

Heavy selling in banks, cements and oil exploration and production companies led the decline. Banking sector declined by 1.9% during the week, partly due to the a circular issued by the State Bank of Pakistan (SBP), mandating strategically important banks to maintain Higher Loss Absorbency (HLA) Capital Surcharge in the form of additional Common Equity Tier 1 (CET 1).

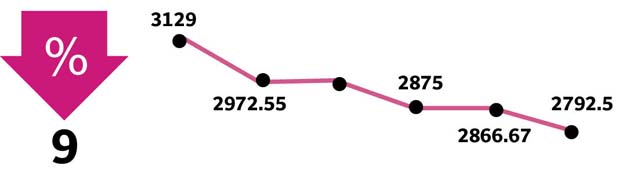

Cements were down 4.2% week-on-week due to the pricing development last week where average prices in the south came down by Rs15/bag and rumours of price cut in north over this week; however, discussions with companies’ management negate the rumours of price declines in the north, stated Elixir Securities in its weekly report. E&P sector declined 3.6% week-on-week mainly due to foreign selling worth $50 million in OGDC stock.

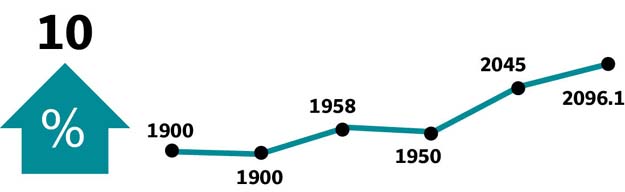

Meanwhile, positive contribution came from tobacco (up 7.4% week-on-week), chemicals (up 5.8% week-on-week) and pharmaceuticals (up 1.6% week-on-week).

Trading activity remained dull where average traded volumes and average traded value fell by 37% week-on-week and 19% week-on-week to 155 million shares and $65 million, respectively. In terms of scrips, lower than expected earnings of UBL further dampened market sentiment and sent the large cap banking stocks lower.

OGDC remained in focus during the entire week as the rumour mills kept churning regarding another block sale, which kept the activity in the stock at bay, as the buyer’s awaited further clarity.

Major laggards during the week were HBL (-160 points), OGDC (-155 points), UBL (-89pts), LUCK (-84 points) and FFC (-71 points). Meanwhile, major positive contribution came from PAKT (+50pts), COLG (+45pts), ABOT (+25pts), BAFL (+25pts) and DAWH (+24pts). Pakistan Oilfields (POL) and Mari Petroleum (MARI) also dampened sentiments as they posted lower than expected earnings.

Foreign selling this week clocked-in at $ 42 million compared to a net buy of $17 million in the last week, concentrated majorly in Exploration & Production ($46 million) and commercial banks ($4 million). On the domestic front, major buying was reported by mutual funds ($25 million), individuals ($15 million) and other organisations ($6 million).

Domestic selling was largely executed by companies ($3 million) and insurance companies ($2 million).

Winners of the week

Colgate Palmolive (Pak)

Colgate-Palmolive Pakistan Limited manufactures and sells detergents, personal hygiene and a variety of other products.

Pakistan Tobacco

Pakistan Tobacco Company Limited manufactures and

sells cigarettes.

Losers of the week

Fauji Fertilizer Bin Qasim

Fauji Fertilizer Bin Qasim Limited manufactures, purchases, and markets fertilisers. The company produces granular urea and DAP. Fauji Fertilizer provides its products to farmers in Pakistan.

Bannu Woolen Mills

Bannu Woollen Mills Limited manufactures and sells woollen yarn, cloth and blankets.

Published in The Express Tribune, April 22nd, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ