Weekly review: KSE-100 feels impact as global equity markets tumble

Benchmark index dips 492 points or 1.1% to settle at 43,809

File photo

PHOTO: EXPRESS TRIBUNE

After oscillating between red and green zones, the benchmark KSE-100 Index dropped 492 points or 1.1% to settle at 43,809 points at the end the week on Friday.

Following the global equity rout, shockwaves were felt by investors from Wall Street to Shanghai. The impact was also felt in the Pakistan Stock Exchange as the KSE-100 opened over 800 points in the red on Tuesday.

Panic drove investors to sell off stocks and turn away from the market. However, despite this, the index managed to make a decent recovery, recouping more than half its losses.

Stocks rebounded on Wednesday as the index recouped previous day’s losses because of a sharp recovery in the international market. However, the positivity was short-lived and the market once again slipped into the red zone on Thursday, with the turmoil in international market deepening.

The driving force behind the turmoil in the international equity markets had been the decline in US markets, which reacted to a sharp rise in interest rates.

Apart from the global sell-off, the ongoing pension liabilities’ case against big banks and falling oil prices also dented investor sentiments. In addition, lack of positive triggers and continued foreign selling aggravated the matters as investors preferred to book profits.

Despite this, Friday brought a slight change in events, leading the benchmark index to finish higher by 128 points.

Overall participation slowed as average traded volumes were down 4% to 245 million shares per day whereas average traded value slipped 3% week-on-week to $87 million per day. In terms of sectors, the downward pressure was led by cement stocks (down 194 points) as the results season unfolded to reveal shrinking margins, oil and gas exploration companies (162 points) due to falling crude prices and fertiliser manufacturers (45 points) on the back of foreign selling.

The steel sector too came under selling pressure as the court’s suspension of the regulatory duty confused investors. On the other hand, positive contribution to the index came from food and personal care products (up 32 points) and commercial banks (25 points).

Scrip-wise, major laggards in the week were Pakistan Petroleum Limited (down 112 points), Lucky Cement (58 points), DG Khan Cement (48 points) and Habib Bank (34 points) while positive contributions were made by United Bank (up 63 points), Murree Brewery (36 points) and Colgate Palmolive (24 points).

Foreigners continued to be net sellers of $8.5 million during the week. Selling was witnessed in fertilisers ($4.4 million), cement ($3.1 million) and exploration and production stocks ($1.8 million).

On the domestic front, buying was reported by individuals ($8.7 million), insurance companies ($7 million) and brokers ($3.6 million). Mutual funds and banks offloaded shares worth $5 million and $4.3 million, respectively.

Winners of the week

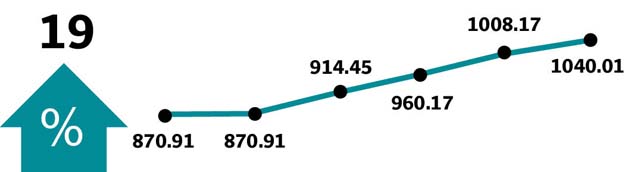

Murree Brewery

Murree Brewery Company Limited specialises in the manufacture of beer and Pakistan Made Foreign Liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

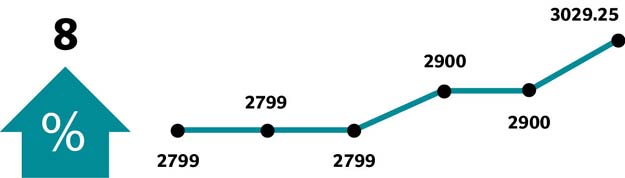

Colgate Palmolive (Pak)

Colgate-Palmolive Pakistan Limited manufactures and sells detergents, personal hygiene and a variety of other products.

Losers of the week

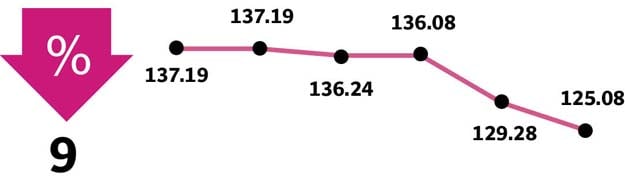

Cherat Cement

Cherat Cement Company Limited manufactures and sells cement and clinker.

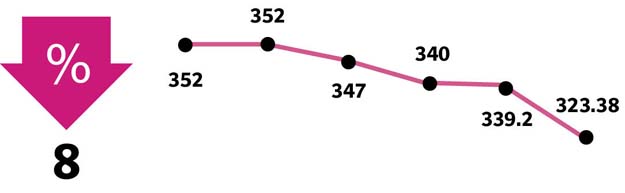

IGI Insurance

International General Insurance Company of Pakistan Limited provides property and casualty insurance products and

services. The company’s products include fire, marine and motor insurance.

Published in The Express Tribune, February 11th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ