Weekly review: Index gains 1.3% as clarity emerges

Benchmark index closes at 49,624, profit-taking on Friday trimmed gains

Benchmark index closes at 49,624, profit-taking on Friday trimmed gains.

After remaining under pressure in the previous week, due to various reasons, stocks bounced back in action Tuesday onwards before profit-taking trimmed gains on Friday. Asset values remained volatile during the first half of the week with hefty sell-offs amidst crackdown of regulatory watchdog on some brokerage houses who were allegedly involved in misuse of in-house financing, fraud and deceptive business practices.

However, the joint press conference by Securities and Exchange Commission of Pakistan (SECP) and Pakistan Stock Exchange (PSX) aimed at pacifying investors’ concerns over crackdown on brokers helped instill confidence.

The market eventually recovered after progress and development on the MFS product.

Moreover, news of six blue-chip companies - Habib Bank Limited (HBL), Mari Petroleum, Searle Pakistan, Engro Fertilizer, Fauji Cement Company and Nishat Mills Limited - being included in the Financial Times Stock Exchange (FTSE) global equity index further helped improve market sentiments even further.

HBL (+4.6%) was the driving force in the index recovery, alone adding 160.6 points to the index as investors cheered robust loan growth the bank reported in its annual 2016 financial results.

On the sector front, refineries gained 7% week-on-week as Attock Refinery Limited (+9.6%) rallied on the back of commencement of EURO-II diesel supply to OMC’s, while engineering (+3%) was supported by CSAP (+13.7%) in hopes of further line-pipe contracts.

On the flipside, foods declined 2% as heavyweight Nestlé shed 4.7% week-on-week, while some profit taking was witnessed in cements (-1%).

Minor contribution came in from Sui Northern Gas Pipeline (+9.9%) and Millat Tractors Limited (+8.8%), contributing 51.5/48.1 points, with the former rallying over news of upgradation of pipeline infrastructure while latter came in limelight over anticipation of robust monthly sales.

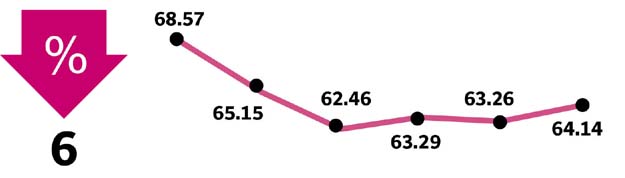

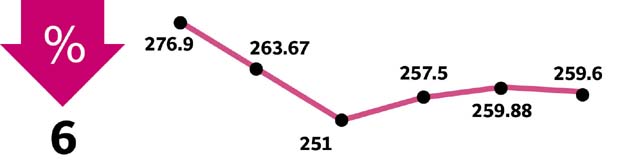

Average volume traded decreased by 6.4% week-on-week while average value traded decreased by 1.0% week-on-week.

Foreigners remained net sellers during the week, mopping up $32.7 million worth of shares.

Winners of the week

PICIC Growth Fund

PICIC Growth Fund is a closed-end fund registered in Pakistan. The fund’s objective is to generate capital growth. The fund invests in stocks listed at the stock exchange.

Crescent Steel

Crescent Steel & Allied Products Limited manufactures steel-lined pipes and multi-layer pipe coatings, which are used for water, oil and gas transmission. The company also has a cotton division that manufactures cotton yarn.

Indus Dyeing

Indus Dyeing & Manufacturing Company Ltd manufactures and sells yarn.

Losers of the week

Feroze1888

Feroze1888 Mills Ltd manufactures and sells a wide range of cotton towels and fabrics.

Nishat (Chunian) Limited

Nishat Chunian Limited manufactures and sells yarn and fabric. The company operates spinning, weaving, dyeing and finishing units.

Shifa Int Hospitals Ltd

Shifa International Hospitals Limited establishes and runs medical centers and hospitals in Pakistan. The company’s clinical services include medicines, paediatrics, surgical, obstetric and gynaecology, dentistry, rehabilitation services and ophthalmology.

Published in The Express Tribune, March 5th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ