Weekly review: Bulls regain control of market as KSE-100 surges 7%

Positive news, attractive valuations bring renewed interest.

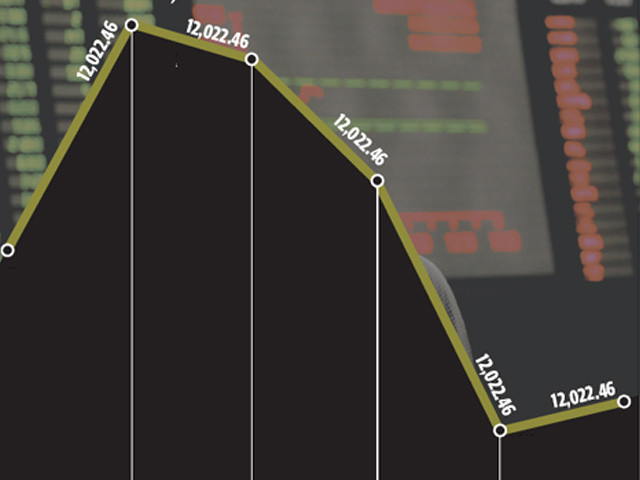

Bulls returned to the market and held a firm grip on proceedings at the Karachi Stock Exchange, as the benchmark KSE-100 index rose seven per cent, or 776 points, during the week ended March 4, recouping losses suffered in the previous week.

Positive news about the margin trading system (MTS), rising petroleum prices and attractive valuations following the previous week’s correction, combined to provide much-needed incentive for investors who flocked to purchase shares. The market saw five consecutive days of gains.

The rally was broad-based and the index managed to breach the 12,000-point barrier on the final trading session of the week.

After last week’s sharp decline of seven per cent, the market offered attractive valuations on many scrips, as a result of which foreigners turned net buyers again. Foreigners had offloaded $5.6 million worth of shares in the previous week, sparking rumours that a capital flight was in the offing. But those rumours were shattered as they became net buyers of $2.9 million during the week.

The curtain will finally be raised on the anxiously awaited margin trading system in the coming week and is sure to provide a boost to the market. MTS will provide investors with an opportunity to borrow money to engage in stock purchasing, thus, boosting liquidity in the market.

With the ongoing crisis in Libya resulting in higher petroleum prices, the energy and power sector was again in the limelight, as heavy purchasing was witnessed in Pakistan Oilfields, which climbed by more than 13 per cent during the week. The sector carries the heaviest weight (24 per cent) in the index and accounted for bulk of the gains during the week.

The earnings season also came to a spectacular end, as the National Bank of Pakistan announced extraordinary earnings of Rs17.6 billion, translating into earnings per share of Rs13.05. The country’s largest bank announced a cash dividend of Rs7.5 per share, along with a 25 per cent stock dividend, beating market expectations by a huge margin. As a result, the stock gained more than 20 per cent.

Average daily volumes rose by almost 50 per cent and stood at 146 million shares traded per day. Average daily value of shares traded also rose by 61 per cent and stood at Rs6.07 billion. The market capitalisation rose by 6.4 per cent to Rs3.23 trillion by the end of the week.

What to expect?

The implementation of MTS will surely provide a boost to the market in the short run and the index can be expected to climb in the coming week. Rising oil prices will continue to fuel interest in the energy and power sector, which will also aid the market’s growth in coming weeks.

Yet, it should be kept in mind that the ‘correction’ of the previous week has been completely wiped out in the gains witnessed this week. Thus, a proper correction could still be around the corner. For the short run though, the market is ripe for investment.

Monday, February 28

The stock market recovered slightly, as investors got into action and bought shares at lower levels.

During the outgoing week, the index shed 818 points or 6.8 per cent, the biggest weekly drop in the last 14 months

Tuesday, March 1

The stock market recorded a massive recovery on the back of renewed interest in buying from local and foreign investors. The market was given an early lift with fresh buying in oil stocks

Wednesday, March 2

Stocks gained 91 points as investors accumulated shares before the launch of the margin trading system.

Finance Minister Hafeez Shaikh’s expected visit to the stock exchange on March 5, to launch the margina trading system attracted investors

Thursday, March 3

Bulls stayed in the market for a fourth consecutive day on Thursday, as the market gained 63 points.

The Karachi Stock Exchange (KSE) benchmark 100-share index rose 62.84 points to end at 11,762 point level

Friday, March 4

The market continued its recovery in the final trading session of the week as the bourse gained 238 points.

Bullish activity continued as Finance Minister Hafeez Shaikh’s scheduled visit to the market on Saturday sparked a buying spree across the board

Published in The Express Tribune, March 6th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ