Weekly review: Political noise overshadows positives as index ends 0.4% down

Despite support from oil prices, KSE-100 experiences volatile ride

PHOTO: ONLINE

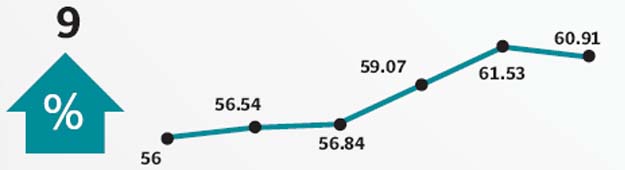

The market struggled to break the 42k level and ended 0.4% down week-on-week to close at 41,291 points.

After starting from an all-time high of 41,464, rise in political noise was enough to make investors jittery.

It gave way to profit-taking in the first two sessions, with support coming at the 40,500-point level.

Some respite came on the back of favourable financial results and news that the Sindh Pension Fund has allocated Rs5.75 billion to invest in equities, which drove the index higher by 622 points on Thursday, before profit-bookers took the opportunity to cash in on gains on the last day of the week.

Attock Petroleum and United Bank Limited (UBL) gained traction after posting better-than-expected results. On the other hand, Attock Refinery (ATRL) and National Refinery (NRL) turned out to be losers after posting a result below market expectations.

Oil sector posted some gains midweek but remained under pressure even after the increase in oil prices on the back of latest government proposal to force application of 50% windfall levy on oil prices under recently signed supplemental agreements.

Major contributors of the sector were Oil and Gas Development Corporation +38.7 points and Pakistan Petroleum Limited +33 points. Cement sector cumulatively declined by 4.4% on account of surging international coal prices, where Richard bay coal contracts reached $90/ton. Lucky Cement and D.G Khan Cement dragged the benchmark index collectively by 126.2 points.

Honda Altas commenced its new production site was taken positively by the investors as the stock posted some gains, while news that Hub Power Company is going to reduce capacity of its new power plant because of timing issues dented investors’ confidence in the scrip.

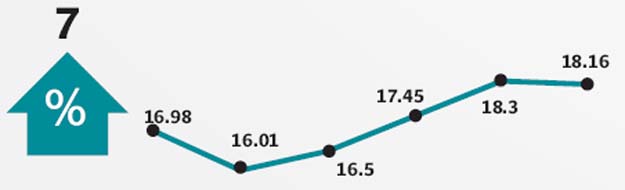

Additional news during the week did little to placate the KSE-100 index. Trade deficit for 1QFY17 stood at $7.06 billion, up 30% year-on-year, foreign direct investment fell by 38% year-on-year to $249 million for 1QFY17.

Foreigners turned net sellers offloading shares worth of $8.64 million during the outgoing week and average daily volume augmented by 17% week-on-week to 472 million.

Winners of the week

Attock Petroleum Limited

Attock Petroleum Ltd retails petroleum products. The company operates gasoline filling stations in Pakistan and Afganistan.

Sui Northern Gas Pipelines

Sui Northern Gas Pipelines Limited purchases, purifies, transmits, distributes, and supplies natural gas, in addition to marketing liquefied petroleum gas.

The Bank of Punjab

The Bank of Punjab (Pakistan) operates under the status of a scheduled bank in Pakistan. The bank provides commercial banking services.

Losers of the week

International Steels Limited

International Steels Limited manufactures steel. The company produces cold rolled, sheet, and hot dipped galvanised sheet steels. International Steels serves the construction, appliances, automotive, agricultural implements, and packaging industries.

Orix Leasing

Orix Leasing Pakistan Limited is a leasing and diversified financial services company. The company offers full pay out finance leases for machinery, office automation, computers, vessels, aircraft and automobiles. Orix financial service products include loans, rentals, security brokerage, options trading and life insurance products.

DG Khan Cement

DG Khan Cement Company Limited manufactures and sells portland cement.

Published in The Express Tribune, October 23rd, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ