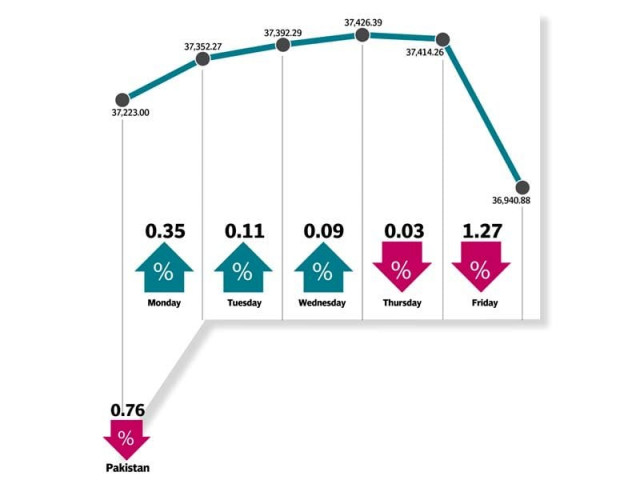

Weekly review: Index down 0.75% week-on-week after hitting all-time high

Bourse ends at 36,941 as post-budget rally overtaken by profit-taking and panic selling

Bourse ends at 36,941 as post-budget rally overtaken by profit-taking and panic selling

For the most part, the index reacted in a positive fashion as the post-budget rally meant interest in select sectors. However, the start of Ramazan resulted in subdued activity before Friday’s rumour resulted in panic selling.

The market opened on Monday following neutral-to-positive budget measures and settled comfortably with fertiliser and textile names leading the way. With the start of Ramazan the index remained marginally subdued and by mid-week the bourse seemed determined to lead a dull ride. However, Friday resulted in massive profit-taking and panic selling over rumours of Pakistan’s possible inclusion in the MSCI emerging markets index taking a hit.

It resulted in the benchmark-100 index nosediving 1.2% or 473 points to go below the 37,000-point mark.

Incentives announced in the budget announcement were the driving force behind index activity this week with textile and fertiliser sectors grabbing investors’ attention.

Towards the end of the week market participants refrained from taking fresh position ahead of key decision slated for next week regarding Pakistan’s potential upgrade into emerging markets in the MSCI index.

Additionally amidst thin participation, sentiment turned slightly sour for financials in the backdrop of the budget where 4% super tax was continued for another year with no new incentives for the industry. UBL (-4.6%), HBL (-2.7%) and MCB (-1.5%) led the declines, chipping away a cumulative 160 points from the index.

In a latest development, Engro Corporation (Engro) informed through a PSX notice that it has successfully sold 295 million shares of Engro Fertilizers (Efert) to local and foreign investors through private placement. The said development, however, brought Efert under pressure as the deal was executed at 4.2% discount to Efert’s previous day closing price.

In other news, Honda Car started pre-bookings for its new 2016 Civic. The announcement gave a boost to the company’s share price at the PSX.

Foreigners remained net sellers during the week, offloading $7.85 million worth of shares excluding $78 million inflow in Efert’s private placement.

Volumes took a breather during the week with the onset of Ramazan, inducing short trading hours. Average trading volume declined by 6% week-on-week to 152.0 million shares.

Winners of the week

Feroze 1888

Feroze 1888 Mills Limited manufactures and sells a wide range of cotton towels and fabrics.

National Refinery

National Refinery Limited manufactures and distributes lube base oils and petroleum fuels. The company markets its products to customers throughout Pakistan.

Pak Services

Pakistan Services Limited is the holding company for Pearl Continental Hotels (Private) Limited, which constructs, operates and manages hotels. The group also owns a number of smaller companies that provide rent-a-car, travel arrangements and tour packages.

Losers of the week

International Steel Limited

International Steels Limited manufactures steel. The company produces cold rolled sheet, and hot dipped galvanised sheet steels. International Steels serves the construction, appliances, automotive, agricultural implements, and packaging industries.

EFU Life Assurance

EFU Life Assurance Limited provides a variety of insurance services. The company’s services include loan protection plan, savings plan, executive pension plan and education plan.

Indus Dyeing

Indus Dyeing & Manufacturing Company Limited manufactures and sells yarn.

Published in The Express Tribune, June 12th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ