Weekly review: KSE loses 1% as bullish momentum dies down

Increased selling drives down stocks; foreigners offload shares amid falling oil prices.

Increased selling drives down stocks; foreigners offload shares amid falling oil prices.

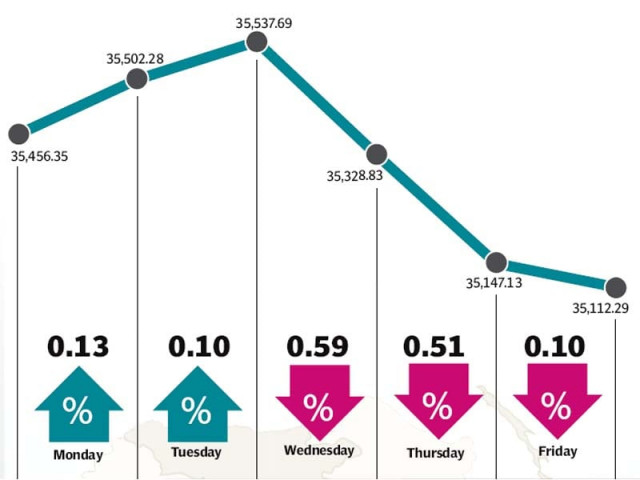

The benchmark Karachi Stock Exchange (KSE) 100-share index lost 1% week-on-week (WoW) to close at 35,112 points in the week ended on July 10.

Trade activity started on a positive note on Monday with the continuing bullish momentum. This pushed the index to a new all-time high of 35,538 on Tuesday. However, political uncertainty and selling in oil stocks amid falling international crude prices, which hit a three-month low, wiped off the early gains.

Over the week, the average trading volumes improved by 6% week-on-week to 378 million shares per day, while average daily trading value rose 23% to $160 million.

Among local investors, mutual funds remained noticeable buyers on account of increased liquidity while banks were largely sellers.

Oil prices fell during the week by about 2%, reeling from the effect of Greece’s financial crisis and China’s stock market woes, leading to a considerable battering of the exploration and production (E&P) sector (down an average 5.5% WoW). However during the last session of the week on Friday, the sector posted gains on improved crude prices. Hascol hit its upper circuit within the first hour of trading, similarly Pakistan State Oil, Pakistan Oilfields Limited and Pakistan Petroleum Limited ended 0.7%, 0.6% and 0.3% higher, respectively.

The cement sector continued to outperform others on strong June 2015 sales, while insurance stocks (+4% WoW) also attracted investor interest. The banking sector remained impressive on rising deposit growth and increasing yields of treasury bills.

Among market-moving news, the debate over the controversial banking transaction tax heated up until the government and traders reached an agreement on Thursday to bring down the 0.6% withholding tax to 0.3% for the non-filers of tax returns till September 2015.

In the week, foreign funds flew out of the market, with foreigners selling $23 million worth of holdings compared to $1.6 million last week.

The Karachi Stock Exchange’s market capitalisation stood at Rs7.57 trillion ($74.7 billion) at the end of the week.

Winners of the week

Punjab Oil

Punjab Oil Mills Limited manufactures and sells vegetable ghee, cooking oil, and laundry soap.

TRG Pakistan

TRG Pakistan Limited acquires, manages and maintains the business of telephone answering service and other business process outsourcing companies. The company has call centre operations in North America, Africa, and Europe.

Jubilee General Insurance Company

Jubilee General Insurance Company Limited is an insurance provider. The group supplies a number of lines of coverage, including health, fire, marine and miscellaneous.

Losers of the week

Arif Habib Corporation

Arif Habib Corporation is a holding company. The company holds interests in the securities brokerages, investment, financial advisory, investment management, commercial banking, commodities, private equity firms and cement and fertiliser industries.

Pakistan Oilfields

Pakistan Oilfields Limited specialises in the exploration, drilling, production and transmission of petroleum. The company also markets Liquefied Petroleum Gas (LPG).

Service Industries

Service Industries Limited specialises in footwear, tyres and tubes for two-wheelers. It markets its products with seven different brands.

Published in The Express Tribune, July 12th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ