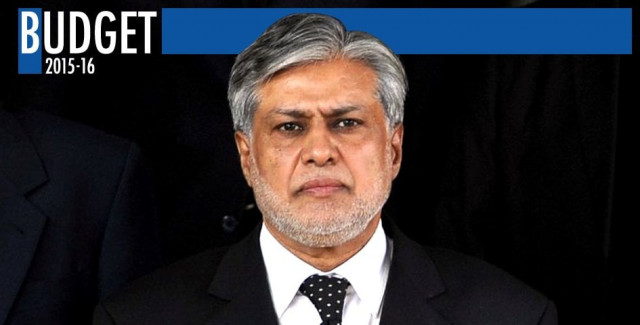

Budget 2015-16: Finance Minister Ishaq Dar unveils Rs4.451 tr budget

New budget is expected to focus on spurring economic growth

The new budget, with a Rs4.451 trillion outlay, is expected to focus on spurring economic growth and attracting investment.

The National Economic Council has already approved Public Sector Development Programme of Rs700 billion for the next financial year.

The country will target growth next year of 5.5% when it unveils its 2015-16 budget, with historically low interest rates and infrastructure spending expected to fuel the fastest expansion since the global financial crisis.

Read: Budget 2015-16: Govt eyes 5.5% GDP growth next year

100% increase in tax on mobile handsets

Beginning July, prices of mobile phones will increase by up to Rs1,000 as the federal government has proposed to double the general sales tax (GST) on all types of imported mobile phones.

Read the full story here

Capital gains tax imposed on sale of shares

For shares sold after two years, the rate of tax would be 7.5%. Previously, shares sold after a holding period of two years were exempted from tax.

For shares sold between 1-2 years, the rate would be 12.5% — increased from 10%. While, for shares sold within a year, the rate would be 15%.

Read the full story here

Government expects to receive Rs382b from oil and gas

Keeping in line with the fall in international crude prices, the government has cut the target of revenue collection from the oil and gas sector to Rs382 billion for the next fiscal year 2015-16.

Read the full story here

Minimum wage increased to Rs13,000

Minimum wage has been increased from Rs12,000 to Rs13,000.

Tax exemptions for airlines, airports

The government announced tax exemptions on import of aircraft, their spare parts, training simulators and equipment used in repair and maintenance of airplanes in a bid to stimulate Pakistan’s flagging aviation sector.

Read the full story here

Salary tax rate reduced

For salaried individuals making between Rs400,000 to Rs500,000 annually, tax rate has been reduced from 5% to 2%.

Meanwhile, FBR’s authority to give tax exemption has been revoked.

Further, federal excise duty on cigarettes has been raised by 5%.

Read the full story here

Additional tax on high electricity bills

An additional 10% tax has been imposed on electricity bills above Rs75,000 per month.

Additionally, the government has announced a further reduction of 32% in consumer subsidies, particularly on energy supplies, in the budget for next fiscal year.

Read the full story on subsidies slashed here

Pension increased by 7.5%

Pension has been increased by 7.5%.

Forex reserves to stand at $19 billion by end of year

“Forex reserves will be $19 billion by the end of this year,” the finance minister said.

Rs20 billion allocated for PM’s special schemes

Rs20 billion allocated for special schemes launched by the prime minister. These include provision of laptops, business loans and interest-free loans, among others.

Markup rate of Business Youth Loan Scheme reduced to 6%

Markup rate of Business Youth Loan Scheme has been reduced from 8% to 6%.

Rs600 billion allocated for farmers

“We are working for the uplift of the agriculture sector and for this purpose a Credit Guarantee Scheme will be initiated,” Dar said.

“Moreover, crop loan insurance and livestock insurance schemes will be launched.”

Dar announced for this purpose Rs600 billion have been allocated as compared to Rs500 billion in the previous year.

Read the full story here

Fiscal deficit to be contained at 5%

The fiscal deficit is said to be restricted at 5%.

Rs 20.88 billion allocated for health

Rs 20.88 billion have been allocated for health.

Rs71.5 billion allocated for education

Rs71.5 billion have been allocated for higher education, 14% more than the previous year.

Rs3 billion allocated for Ramzan package

Further, Rs3 billion have been allocated for Ramzan package.

Green Line Metro Bus for Karachi

Dar announced Rs16 billion has been allocated for Green Line Metro Bus service for Karachi, to be completed by December 2016.

Rs3.5 billion for security for CPEC route

In the new budget, an allocation of Rs3.5 billion is given to Ministry of Interior for raising 28 Civil Armed Forces Wings for ensuring security for CPEC route and Chinese working in Pakistan.

Rs78 billion for Pakistan Railways

A sum of Rs78 billion has also been given to Pakistan Railways.

The Higher Education Commission has been given Rs20.5 billion, Rs4.5 billion less than this year’s HEC development budget.

An amount of Rs23.2 billion has been given to Kashmir Affairs and Gilgit Baltistan and Rs19.7 billion to State and Frontier Region’s Division.

The government’s planning to implement CPEC projects seems haphazard, as the allocations for CPEC were changed for the third time.

Rs100 billion for TDPs

Government proposes Rs100 billion allocation out of the development budget for special development programme for Temporarily Displaced Persons and Security Enhancement.

PAEC budget reduced

Pakistan Atomic Energy Commission (PAEC) budget has also been reduced from Rs59.3 billion to Rs30.4 billion for the new fiscal year.

Rs31 billion allocated on water management

“We are investing a sum of Rs31 billion on water management,” Dar added.

Rs112.28 billion allocated for WAPDA

Rs112.28 billion have been allocated for the Water and Power Development Authority for fiscal year 2015-16.

Govt allocates Rs700 billion for development spending

EXCLUSIVE: Amid last-minute changes to accommodate the prime minister, the federal government has allocated Rs700 billion for Public Sector Development Programme for the new fiscal year –up by 29% or Rs158 billion over outgoing fiscal year’s revised budget.

Accommodating the PM: Govt allocates Rs700 billion for development spending, up 29%

Rs25 million have been allocated for scholarships

Further, Dar announced Rs25 million have been allocated for scholarships.

Rs102 billion allocated for Benazir Income Support Programme

Regarding the Benazir Income Support Programme, Dar said during 2014-15, it stood at Rs40 billion, however, it was later raised to Rs57 billion and now Rs102 billion rupees are being released for it.

'Electricity growth of 19,600MW expected by 2017'

“We are expecting an electricity growth of 19,600 megawatts by 2017,” Dar added.

He said the government is working on projects, including those to produce power from LNG.

“Work on dam projects such as Diamer and Dasu and others is also underway.”

Dar makes case for strong economic growth

Finance Minister Ishaq Dar cites an Express Tribune story to prove case for strong economic growth.

Read: Shift in focus: Rise of Pakistan just a matter of time, says David M Darst

“According to an analysis by Goldman Sachs, Pakistan, currently ranks 44th in world economies and will become the 18th largest economy by 2050,” Dar added.

“Standard and Poor as well as Moody's have termed Pakistan's outlook positive.”

“Efforts afoot to restrict fiscal deficit to 5% while during the 2015-16 period this will be restricted to 4.3%,” the finance minister said.

Rs700 billion allocated for Public Sector Development Programme

Amid last-minute changes to accommodate the prime minister, the federal government has allocated Rs700 billion for Public Sector Development Programme for the new fiscal year –up by 29% or Rs158 billion over outgoing fiscal year’s revised budget.

'Will achieve the target of 5% by June 30, 2015'

Finance Minister Ishaq Dar presents federal budget for the year 2015-16.

“Government had vowed to wrong economic pundits and our economic ship is safe now,” he said.

“We have to save Pakistan from defaulting,” the finance minister said, adding the country has to achieve macro-economic stability.

“We will achieve the target of 5% by June 30, 2015,” he upheld.

“We’ve put a dwindling economy on the path of progress,” Dar further said.

“GDP remained at 4.24 % and depicts persistent growth,” he added.

Further, the finance minister said, “Prices of commodities and oil were controlled.”

“Unusual and prolonged winter season resulted in the damage of rice production and large-scale manufacturing and production saw a decline,” he added.

Read the full text of Dar's speech here

PM Nawaz arrives at Parliament

Prime Minister Nawaz Sharif has arrived at the Parliament.

Budget to be announced shortly.

Key budget 2015-16 sections

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ