Policy statement: Govt admits violating Debt Limitation Act

External debt and liabilities 1.3 times higher than foreign exchange earnings.

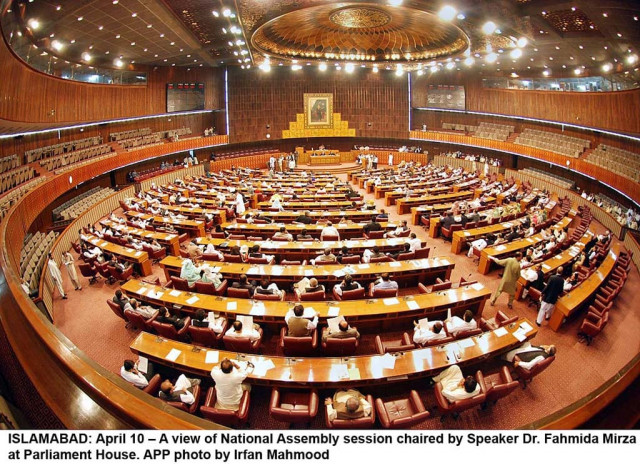

The government on Monday laid the Debt Policy Statement before the National Assembly, admitting that it violated the Fiscal Responsibility and Debt Limitation Act of 2005. PHOTO: APP

The country’s stock of external debt and liabilities is increasing at a rapid pace compared to foreign exchange earnings, which could undermine its debt repayment capacity, reveals the Debt Policy Statement, confirming that the government could not bring the public debt within statutory limits.

The government on Monday laid the Debt Policy Statement before the National Assembly, admitting that it violated the Fiscal Responsibility and Debt Limitation (FRDL) Act of 2005. The statement was prepared by the Debt Policy Coordination Office aimed at reviewing the government’s performance in the light of FRDL Act.

The FRDL law binds the government to keep the public debt below 60% of the total size of national economy and its revenues should be sufficient to finance at least current expenditures – the two most critical conditions that the government did not meet.

The policy statement shows that by the end of fiscal year 2013-14 the external debt and liabilities were 1.3 times higher than foreign exchange earnings. The ratio was slightly higher than the previous fiscal year, indicating indebtedness of the country.

The servicing of external debt and liabilities also increased to 15% of foreign exchange earnings – a ratio that was 14.3% in previous fiscal year 2012-13, showed the policy statement.

The PML-N government has been heavily borrowing to finance its expenditures as it remains unable to mobilise domestic resources. It went on a borrowing spree and resultantly, the weighted average cost of total public debt increased 8.4% in fiscal year 2014 against 7.7% in the previous year.

The government also could not meet the statutory requirement of keeping net quarterly borrowings from the State Bank of Pakistan (SBP) at zero except for one quarter.

Public debt-to-gross domestic product ratio was recorded at 63%, which was 3% higher than the limit imposed under the FRDL Act. The public debt-to-government revenue ratio stood at 440% against the generally acceptable threshold of 350%.

“The government needs to make concerted efforts to increase revenues and rationalise current expenditures to reduce the debt burden and improve the debt-carrying capacity of the country to finance growing development needs,” cautions the Debt Policy Coordination Office.

The government also could not increase revenues and its receipts were not sufficient to finance only the current expenditures. The revenue deficit – total revenues minus current expenses – stood at Rs173 billion or 0.7% of GDP in 2013-14.

There is a need to bring the revenue deficit to zero as envisaged under the FRDL Act, so that borrowing is used to supplement development activities, which will enhance the repayment capacity of the country, advises the Debt Office.

Total public debt was recorded at Rs16.3 trillion at the end of September 2014, registering an increase of Rs239 billion.

The maturity profile of domestic debt improved as the government was able to mobilise more through the Pakistan Investment Bonds. It made net retirement of Rs1.9 trillion through the PIBs, which resulted in an increase in the share of permanent debt to 37% of total domestic debt at the end of 2013-14 compared with 23% in the last fiscal year.

Total stock of PIBs amounted to Rs3.45 trillion by the end of September last year.

However, independent experts criticise the move to issue five to ten-year debt instruments, particularly at a time when interest rates are expected to go down further due to the slowdown in inflation.

The Debt Office observed that the re-profiling of domestic debt has reduced refinancing risks. However, in terms of cost, the country is required to make more interest payments in future as the PIBs carry higher interest rates compared with shorter-tenure treasury bills, it adds.

On the external front, the foreign public debt dropped by $1.4 billion in the first quarter of 2014-15 and was recorded at $50 billion.

“This reduction in the external public debt was mainly contributed by gains of $1.8 billion on account of appreciation of the US dollar against other major currencies,” stated the Debt Office.

However, despite this, the external public debt increased in rupee terms by Rs53 billion and stood at Rs5.1 trillion owing to the depreciation of the rupee against the US dollar by 3.8%.

Published in The Express Tribune, February 3rd, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ