Market watch: Karachi bourse rises as interest in oil stocks grows

Benchmark KSE 100-share index gains 117 points to close at 22,347.

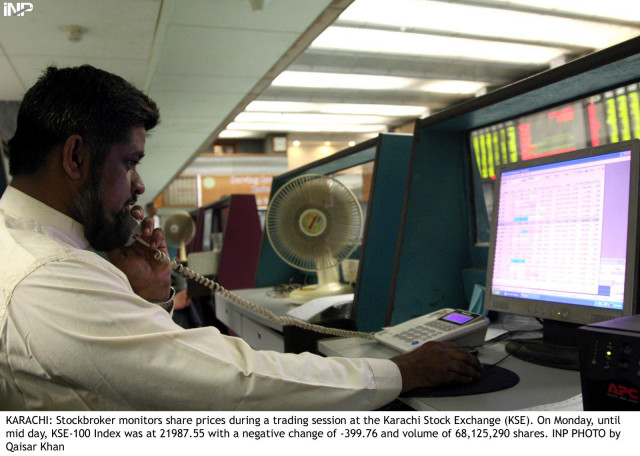

Among oil shares, Oil and Gas Development Company rose 2.9% and Pakistan Oilfields increased 2.3% on talk of foreign interest, said Sibtain Mustafa, an analyst at Elixir Securities. PHOTO: INP/FILE

The benchmark Karachi Stock Exchange (KSE) 100-share index closed at 22,347.29 points, up 0.53%, with trading volumes at 148.65 million shares compared to 167.24 million shares a day earlier.

Among oil shares, Oil and Gas Development Company rose 2.9% and Pakistan Oilfields increased 2.3% on talk of foreign interest, said Sibtain Mustafa, an analyst at Elixir Securities, in his market review.

“Foreign institutional investors (FII) have emerged as net buyers in the previous two trading sessions as $10 million worth of shares have been picked up,” he said.

Although the market was not able to sustain morning gains, it managed to close with an increase of over 110 points as most local institutions, banks and state institutions emerged as sellers on fears of higher inflation and resultant rise in discount rate in the upcoming monetary policy announcement, Mustafa said.

During trading, Pakistan Telecommunication Company rose 2%, National Bank fell 0.6% and Bank Alfalah gained 2.5%.

According to Mustafa, the market will continue to trade in the band of 20,900 and 23,800 points. “We expect the hawkish stance by locals to continue as more clarity emerges on inflation and discount rate,” he said.

Shares of 331 companies were traded on Wednesday. At the end of the day, 155 stocks closed higher, 149 declined and 27 remained unchanged. The value of shares traded during the day was Rs6.4 billion.

Pakistan Telecommunication Company was the volume leader with 16.68 million shares gaining Rs0.53 to close at Rs26.98. It was followed by Lafarge Pakistan Cement with 14.5 million shares losing Rs0.98 to close at Rs7.35 and Fauji Cement with 12.11 million shares losing Rs0.16 to close at Rs12.35.

Published in The Express Tribune, October 24th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ