Finance minister unveils Rs17.6tn budget, targets 4.2% growth

Muhammad Aurangzeb dismisses rumours regarding mini-budget, clarifies no new taxes have been imposed

Finance Minister Muhammad Aurangzeb has unveiled a Rs17.6 trillion federal budget for fiscal year 2025-26, laying stress on the government's focus on economic stability and growth.

In his budget speech in the National Assembly marred by the opposition’s pandemonium on Tuesday, Aurangzeb outlined key economic achievements, saying that remittances have reached $31.2 billion, with projections to rise to $37-38 billion by the end of the current financial year.

The country’s economic growth stands at 2.7%, and inflation has dropped to 4.7%, he claimed.

For the fiscal year 2025-26, the economic growth rate is expected to be 4.2 per cent. The inflation rate and interest rate are expected to be 7.5 per cent. “Our budget deficit is 3.9 per cent, while the primary surplus is 2.4 per cent of GDP,” he said.

The National Economic Council (NEC) has approved Rs4.224 trillion in national development expenditures, including Rs1 trillion for the Federal PSDP, Rs2.869 trillion for Provincial ADPs, and Rs355 billion for investments from SOEs’ own resources.

The estimated revenue of FBR is projected at Rs14.131 trillion, which is 18.7% higher than the current fiscal year. The share of federal revenue allocated to the provinces will be Rs8.206 trillion. The target for federal non-tax revenue is Rs5.147 trillion, while the federal government's net revenue stands at Rs11.072 trillion.

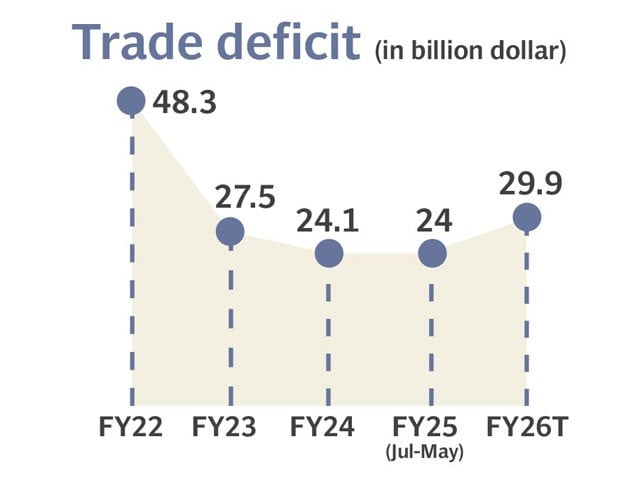

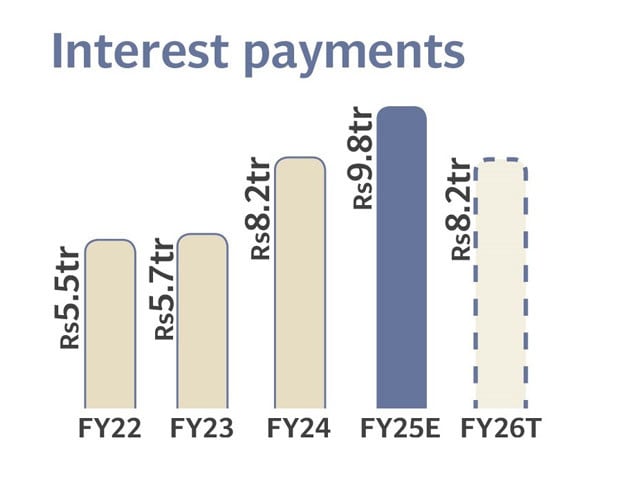

Total federal expenditures are estimated at Rs17.573trillion, including Rs8.207trillion for debt servicing and Rs16.286trillion for current expenditures.

Defence spending will be Rs2.550 trillion, with Rs971 billion allocated for administrative expenses, Rs1.055 trillion for pensions, and Rs1.186 trillion for subsidies in electricity and other sectors.

Overseas Pakistanis are a vital asset, contributing $31.2 billion in remittances over the first 10 months of this fiscal year — 31% more than last year. In the past two years, remittances have grown by $10 billion, strengthening the current account. “We deeply appreciate their support and will continue to enhance facilities to ensure their active role in national development,” Aurangzeb said.

The finance minister also touted improvements in Pakistan's credit rating, with Fitch raising its rating to B- and Moody's signalling positive changes in the economy.

In terms of fiscal policy, the government has made huge strides in tax reforms, aiming to increase the tax-to-GDP ratio, which has historically been low at 10%, according to Aurangzeb.

The budget 2025-26 sets an ambitious target of achieving a 14% tax-to-GDP ratio. According to official estimates, the Federal Board of Revenue (FBR) faces a tax gap of approximately Rs5.5 trillion.

The finance minister shared details of measures to combat fraud and increase tax compliance, including blocking over Rs9 billion in fake tax refunds and using AI to identify fraudulent claims involving Rs13 billion.

The government has launched major digital reforms in the FBR to boost transparency and revenue. Digital Production Tracking, starting with sugar, now covers cement, beverages, and fertilisers. Nationwide B2B documentation and E-Invoicing have been introduced, along with AI-based audit selection for fairer tax assessments.

The POS system integration, E-way Billing, and a Faceless Audit system are underway to reduce discretion and improve compliance. A Centralised Control Unit and a revamped PRAL Board are set to enhance data visibility and tech-driven management.

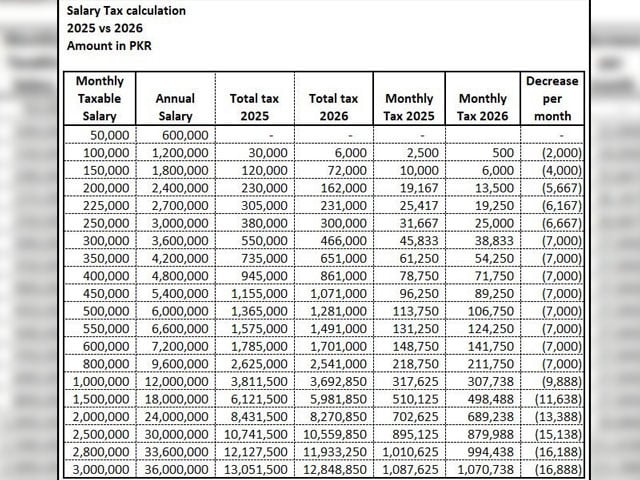

Simplified tax return forms for salaried people will be implemented starting July 1, 2025. Aurangzeb said to ease the pension burden and enhance the system, the government has introduced reforms, including discouraging early retirement, linking pension increases to CPI, limiting family pension to 10 years after a spouse’s death, eliminating multiple pensions, and requiring retirees to choose between pension and salary if re-employed.

Senator Muhammad Aurangzeb, Minister for Finance and Revenue, presenting the Federal Budget for the year 2025-26.#BudgetSession #Budget2025_26 pic.twitter.com/9wkR4YLl1E

— National Assembly 🇵🇰 (@NAofPakistan) June 10, 2025

According to Aurangzeb, weak prosecution has delayed tax-related revenue, but the government's strategy led the FBR to recover Rs78.4 billion through successful litigation. Additionally, an ADR case settlement brought Rs77 billion to the national exchequer. The legal team and judiciary deserve deep appreciation for this achievement.

The finance minister sought to dismiss rumours regarding a mini-budget and clarified that no new taxes have been imposed.

He stated that handing over power distribution companies to professional boards has cut political interference. As a result, these companies reduced losses by Rs140 billion in 9 months, with a goal to eliminate all losses within five years.

The finance minister informed that the price of electricity has been decreased by more than 31 per cent, while for protected consumers, the power tariff has been increased by more than 50 per cent.

The government has also revisited the agreements with Independent Power Producers (IPPs), which will result in savings of over Rs3,000billion.

"By adopting this approach, we have been successful in shutting down two environmentally damaging furnace oil power plants with a capacity of over 3,000 megawatts," he claimed.

He further stated that the government has completed almost all the necessary work for the privatisation of three distribution companies in Faisalabad, Gujranwala, and Islamabad.

The government also aims to finalise transactions for PIA and Roosevelt Hotel in fiscal year 2025-26 while advancing policy and regulatory reforms for the privatisation of GENCOs and DISCOs.

Glimpses from today's Session of the National Assembly.#BudgetSession #Budget2025_26 pic.twitter.com/wnTrgR3XFN

— National Assembly 🇵🇰 (@NAofPakistan) June 10, 2025

Aurangzeb claimed that the IMF had recognised the government's efforts to enforce laws, generating Rs389 billion in revenue.

The World Bank and IMF, under their country partnership framework, will provide $40 billion in resources to Pakistan over the next ten years. Similarly, tackling climate change is a top priority under this framework, he added.

In the electricity sector, legislation for the establishment of a competitive and open market and National Electric Power Regulatory Authority (NEPRA) has been given a final shape, and work on it will begin in the next three months.

The finance minister emphasised ongoing efforts in the oil and gas sector, with new hydrocarbon discoveries set to strengthen energy security. Moreover, the government is working to establish a competitive electricity market, with legislative action for NEPRA expected to begin within three months.

Aurangzeb also spoke about significant progress in Pakistan's debt management, with the debt-to-GDP ratio dropping from 72% to below 70%. The government has launched Sukuk bonds on the Pakistan Stock Exchange and is preparing to issue Panda bonds in China.

Under Pakistan's first Debt Buy Back Programme, Rs1,000 billion worth of debt was bought back, he informed. Under an active refinancing program, a record amount of over Rs850 billion was saved and the average time to maturity of loans was increased by 66%.

He said that by May 2025, SME Ranking and Scoring enabled financial assistance of over Rs311 billion to 95,000 SMEs, raising total SME finance to Rs471 billion and beneficiary businesses to 134,000. The government aims to expand SME finance to Rs1,100 billion and beneficiary businesses to 750,000 by 2028.

The prime minister aims to boost social and economic development by providing housing loans to low-income households, stimulating various sectors and creating jobs for skilled workers. The State Bank of Pakistan will announce project details soon.

He further said agricultural sector loans have risen from Rs1,785 billion in the first 10 months of the previous fiscal year to Rs2,066 billion in the same period this year, with new measures focusing on supporting small farmers.

Pakistan is strengthening its seed sector by establishing the National Seed Development and Regulatory Authority, digitising seed system regulation, and promoting seed research and investment.

The National Seed Policy 2025 and National Agricultural Biotechnology Policy 2025 are nearing approval, while the Plant Breeders' Rights Act is being prioritised to foster innovation.

In terms of long-term economic development, Reko Diq project, feasibility study completed in January 2025, has an estimated lifespan of 37 years and is expected to generate over $75 billion in cash flows.

The $7–7.8 billion project will employ 41,500 people and drive economic growth through local procurement, environmental safeguards, and CSR programs. It will enhance exports via Qasim and Gwadar ports, road and rail links, and other infrastructure, making it a game-changer for Pakistan’s economy.

Read More: Eyeing turnaround with cautious optimism

State Bank reserves are projected to reach $14 billion by the end of 2025. The finance minister also underlined that reforms in various sectors, including pharmaceuticals and IT, are expected to benefit the economy, with significant reductions in customs duties planned over the next four years.

To improve exports, the government’s "Tariff Reforms Package" has been introduced aimed to streamline the tariff structure to boost exports and accelerate economic growth.

Key reforms include eliminating Additional Customs Duties within four years and Regulatory Duties within five years, completing all five schedules under the Customs Act 1969, implementing a four-tier customs duty structure (0%, 5%, 10%, 15%), and capping the maximum customs duty at 15%.

Earlier, in a meeting chaired by Prime Minister Shehbaz Sharif, the federal cabinet approved an increase in the salaries of government employees.

According to reports, the cabinet also approved the budget proposals for the upcoming fiscal year. The finance minister briefed the cabinet on the budget during the meeting. When asked by journalists about maintaining fiscal discipline after the budget, Aurangzeb responded, "Inshallah."

Also Read: Tax exemption costs jump to Rs5.8tr

He proclaimed that BISP provided Rs592 billion in unconditional cash assistance to eligible families, along with educational scholarships for over 10 million children. Under the Nashonuma program, 1.5 million lactating and pregnant mothers and 1.6 million children received nutritious food. Additionally, 250,000 beneficiaries underwent financial literacy training in one year.

The government also intends to expand the coverage of BISP's initiatives. The 'Kafalat Program' will be practically extended to 10 million households. The educational stipends program will be further expanded to benefit approximately 10 million children. For the next fiscal year, a provision of Rs716 billion for BISP is proposed, which is 21% more compared to the previous year.

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ