Local startup exits tripled in 2022

The number of exits exceeds that of the last five years combined

In a major milestone for the Pakistani startup ecosystem, the country witnessed a significant increase in exits in 2022, with the number tripling compared to the total number in the last five years, according to MAGNiTT.

MAGNiTT, a platform that tracks venture capital investments across emerging markets, highlighted the increase in exits in the 2023 edition of its annual Emerging Venture Markets Report.

The report analysed and compared VC investments in technology startups headquartered in the Middle East, Africa, Pakistan, and Turkey (MEAPT) region.

Speaking to the Express Tribune, Information Communication Technology (ICT) Analyst at Topline Securities Nasheed Malik said, “This marks a major achievement for Pakistan, as it indicates a strong and thriving startup ecosystem. Pakistani startups have not reached a point where they can exit through initial public offerings (IPOs) at the stock exchange – instead these exits are mergers and acquisitions,” said the analyst.

“The management of these startups expand to their maximum extent and then decide to be acquired by bigger players in order to scale up,” he said.

According to an Invest2Innovate (i2i) Ventures report, in 2022, an increase in merger and acquisition (M&A) activity became a notable trend, with both international companies acquiring local players, local players merging or acquiring other local players, and, in one case, a local player acquiring an international player.

“We believe this type of consolidation activity will continue in 2023, which is a positive signal for the ecosystem as a whole,” said the report.

“One of the most prominent exits in 2022 was Digital Ocean’s purchase of Cloudways for a reported $350 million,” said Mutaher Khan, Co-Founder of Data Darbar. “The acquisition, however, came at a time when the future of exits in the Pakistani startup industry was uncertain, but it served as a powerful indication of the strength and diversity of the market as a whole, where different startups made decisions as per their unique needs.”

Other prominent adventures include NayaPay acquiring WAli fintech, MicroEnsure was acquired by insuretech Waada and Emerce.pk was acquired by e-commerce player Bagallery. According to the i2i report, VentureDive acquired Nexdegree.

FindmyAdventure was acquired by GoZayaan and Call Courier by PostEx. according to Mutahir Khan. DevOps was bought by Tecbrix.

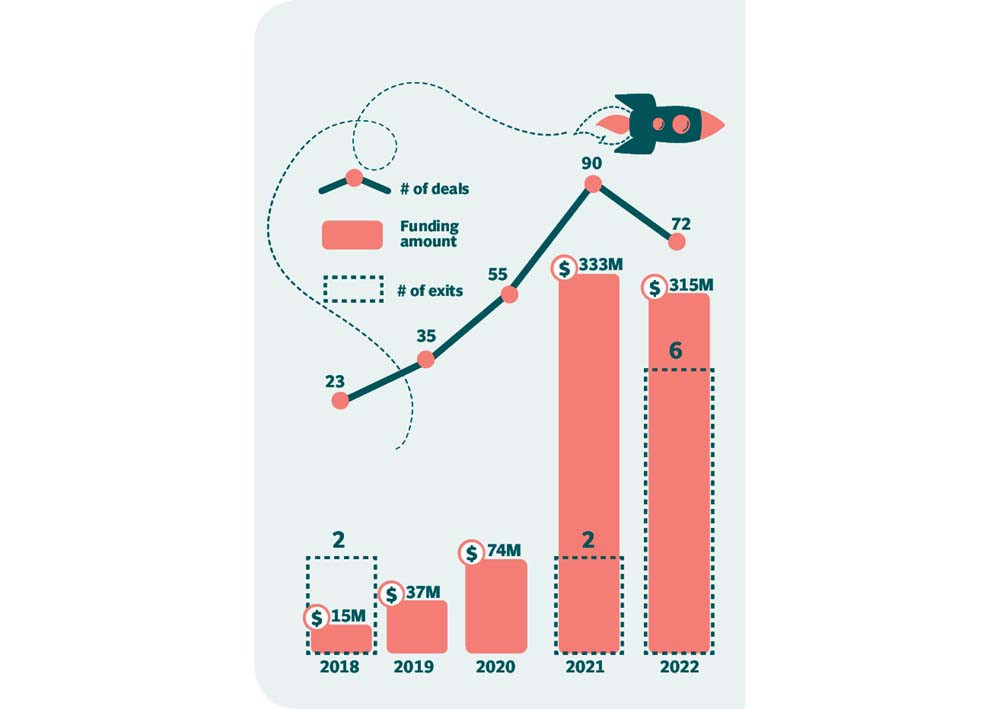

The report highlighted that Pakistan-headquartered startups raised $315 million in funding across 72 deals, with six exits in 2022. More than half the funding Pakistan saw was covered by its top five deals in 2022. Although the number of deals in Pakistan fell by 20% in 2022, funding declined by only 5.4%.

“Record exits create opportunities for consolidation,” said Philip Bahoshy, Founder and CEO of MAGNiTT.

“With Emerging Venture Markets (EVMs) often manifesting the broader macro story playing out from prior periods – the broad correction in startup valuations along with higher interest rates and subsequent fundraising challenges and cash conservation – opportunities for VCs, corporates, international startups, and regional players open up to consolidate their market positions by acquiring attractive, promising companies in EVMs at lower valuations, which could drive significant M&A activity in 2023,” he said.

“We witnessed a record number of exits in 2022, increasing by 36% to an overall record of 144,” Bahoshy explained, adding that while this is usually an indicator of industry maturity, “We can’t tell how many of these are a consequence of the challenging funding landscape or delivering returns for their investors. What is clear is that a normalisation of valuations to pre-pandemic norms is likely to see this exit trend continue into 2023 as opportunities arise for international startups, regional corporates and well-funded companies from the region.”

Aside from M&A activity, Bahoshy predicted that opportunities will still abound for smaller startups at the earlier stages of funding.

“As liquidity becomes harder to come by, especially for larger investments, startups raising SEED rounds or early Series A will likely be in a sweet spot thanks to their more realistic valuations – specifically those with product-market fit and a clear path to monetisation for investors that still have dry powder,” he said.

Topline data from MAGNiTT’s latest report reveals sustained levels of funding – exceeding $7 billion for the second year in a row – and a steady number of transactions in MEAPT, driven by a record first quarter in 2022. Further analysis, however, shows a decline in funding and deals in subsequent quarters – in line with a worldwide pullback in venture investing – reflecting caution by VCs as a result of several macroeconomic developments and a climate of general uncertainty.

Within the EVMs, the MENA region continues to attract significant interest, surpassing its 2021 funding levels and crossing the $3 billion mark in 2022. This increase was largely driven by a 72% jump in funding for Saudi Arabian startups, while Egypt led the number of deals in MENA at 160 transactions.

Published in The Express Tribune, January 15th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ