Stocks rattled owing to political uncertainty

Index dropped 3.95% week-on-week to settle at 39,669 points

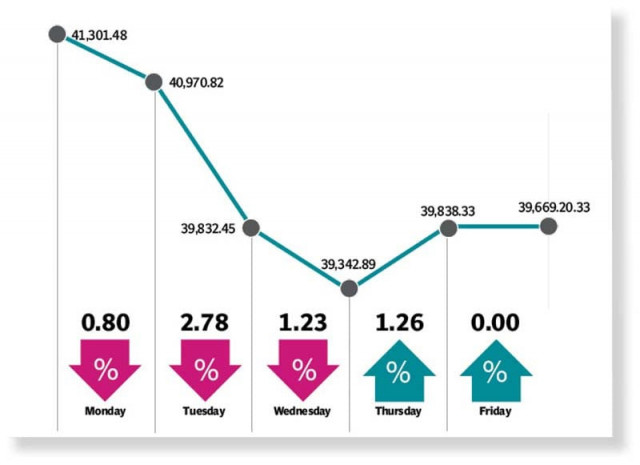

A tumultuous week finally came to an end at the Pakistan Stock Exchange (PSX) with the benchmark KSE-100 index touching a 26-month low at 39,343 points.

The index dropped 3.95% week-on-week to settle at 39,669 points as investor confidence received a battering in the wake of economic and political instability.

At the beginning of trading week on Monday, the market continued the previous week’s negative momentum with another bearish session, dropping over 300 points and slipping below the 41,000 mark owing to a gloomy macroeconomic outlook and an intense political chaos.

On Tuesday, there was a “bloodbath” as the KSE-100 index plunged by 1,138.37 points following Pakistan Tehreek-e-Insaf (PTI) chief Imran Khan’s announcement of the upcoming dissolution of Punjab and Khyber-Pakhtunkhwa assemblies.

The market received further hammering following a no-trust motion against the Punjab chief minister to avert the dissolution of provincial assembly.

The sell-off persisted on Wednesday as rumours circulated about the imposition of governor’s rule in Punjab.

Finally, some recovery emerged as investors opted to buy stocks at attractive valuations in the energy sector. In addition, the Finance Division’s notification about constitution of a 13-member committee to resolve the gas sector’s circular debt crisis boosted investor confidence.

However, the very next day, the index couldn’t sustain the positive momentum and shed nearly 170 points as it responded to S&P Global’s lowering of Pakistan’s long-term sovereign credit rating by one notch to “CCC+” from “B”.

The KSE-100 index closed the week down by 1,632 points, or 3.95%, at 39,669 compared to the previous week.

“Bears stormed the bourse during the week and it closed at 39,669 points, down 4% week-on-week,” said JS Global analyst Muhammad Waqas Ghani.

The index plunged by around 1,958 points during the first three sessions. The market was under a lot of stress primarily because of political unrest and the stalemate in negotiations with the IMF in the face of deteriorating economic indicators, he said.

“Average traded volumes per day increased by 11% to 180 million shares, which was a direct result of selling pressure.”

On the news front, Pakistan’s current account deficit for November 2022 decreased to $276 million (-51% month-on-month), a level last witnessed at the start of CY21.

“The deficit shrank as a contraction in imports more than offset the fall in exports and remittances.”

In other news, the World Bank approved a long-awaited $1.7 billion financing for the flood-affected areas. Moreover, S&P lowered its long-term credit rating for Pakistan from “B-“ to “CCC+” and short-term rating from “B” to “C”, citing weak economic conditions, the JS analyst said.

Arif Habib Limited, in its report, said that in the outgoing week the market remained bearish, hitting a 26-month low at 39,343 points on Wednesday.

The main reason for the decline was uncertainty on the political front as the PTI announced the dissolution of Punjab assembly, followed by a no-confidence move against the chief minister, it said.

On the economic front, SBP’s foreign exchange reserves decreased by $584 million to $6.1 billion, the lowest level since April 2014.

Furthermore, foreign direct investment went down by 48% year-on-year and 14% month-on-month to $82 million in November 2022.

The rupee depreciated by Rs0.7, or 0.13% week-on-week, against the US dollar, closing at 225.64.

In terms of sectors, positive contribution to the KSE-100 index came from miscellaneous (20 points) and tobacco (5 points).

Negative contribution came from technology and communications (379 points), fertiliser (283 points), banks (235 points), cement (161 points) and food and personal care products (101 points).

Stock-wise, positive contributors were Pakistan Petroleum (28 points), Pakistan Services (26 points), Lotte Chemical (24 points), Adamjee Insurance (9 points) and Oil and Gas Development Company (8 points).

Negative contribution came from TRG Pakistan (231 points), Engro Corporation (145 points), Systems Limited (124 points), Mari Petroleum (77 points) and MCB Bank (63 points).

Selling by foreigners continued during the week under review, which came in at $3.3 million compared to net selling of $9.6 million last week, the AHL report added.

Published in The Express Tribune, December 25th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ