NA panel blocks bills on money laundering laws

Faizullah says committee aware of FATF concerns but govt showing no urgency

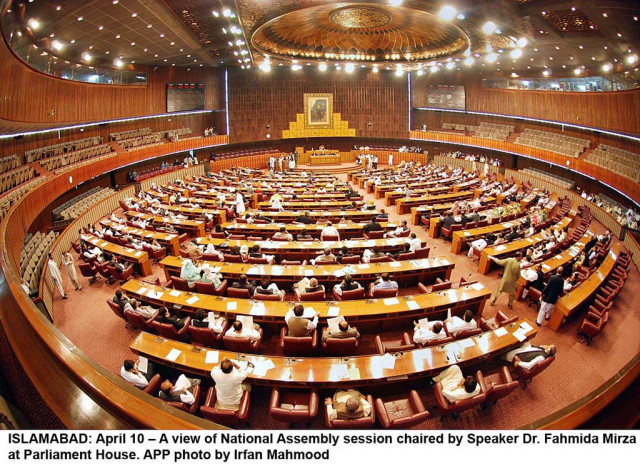

National Assembly of Pakistan. PHOTO: APP

The committee, in a meeting chaired by Faizullah, expressed apprehensions that such draconian powers might be used against political enemies by the government as it deferred a vote on two bills until the committee's concerns were addressed.

The Finance Ministry had tabled the Foreign Exchange Regulations (Amendment) Bill 2019 and Anti Money Laundering (Amendment) Bill 2019 aimed at addressing legal deficiencies pointed out by Financial Action Task Force.

These two bills were moved to amend the Foreign Exchange Regulation Act (FERA), 1947 and the Anti-Money Laundering Act (AML), 2010. "There are no restrictions in the proposed draft that may stop the investigation officers from misusing these powers, Faizullah, the committee chairman, said.

NAB finds 'proof of massive money laundering' against Sharif family

He said that the committee was aware of the concerns expressed by the Financial Action Task Force (FATF) but the government was not showing any urgency and seriousness to get these bills passed. The committee will not pass the bills until the government addresses its concerns," he added.

Adviser to Prime Minister on Finance Dr Abdul Hafeez Shaikh, Finance Secretary Younus Dagha and State Bank of Pakistan (SBP) Governor Tariq Bajwa would have to appear before the committee to defend their bills, he said.

The federal cabinet has already approved the draft of both the bills, which proposed 10-year sentence for money laundering, against the existing punishment of one to 10 years in jail. An increase in the fine — from Rs1 million to Rs5 million — has also been proposed.

According to an amendment to Section 16 of the AML Act, the investigation officer may arrest a person without seeking warrants from the court or the nearest judicial magistrate, if he has a reason to belief that such person is guilty of money laundering.

FIA claims progress in money laundering case against KKF

Currently, the money laundering is a non-cognisable offence but the government wants to make it a cognisable offence. At present, the investigation officer cannot arrest anybody until he gets his warrants from the court or a judicial magistrate.

According to the proposals, under discussion at the National Assembly panel, instead of Financial Monitoring Unit (FMU), any investigating or prosecuting agency can declare it a cognisable offence and arrest the person.

"The government wants to delegate powers of the courts to investigation officers, which can be used to settle political scores," said Syed Naveed Qamar of the Pakistan Peoples Party (PPP). In its present form, he warned, the government could not get the bill passed from an opposition-controlled Senate.

Qamar's views were endorsed by Sheikh Qaiser of the Pakistan Muslim League-Nawaz (PML-N). "The proposed amendments to the AML would lead to harassment and political victimisation of opponents besides opening an avenue for corruption by the investigation officers," Qaiser said. "The amendment bill is against the basic rights of the citizens."

FIA tells NA panel it wants NAB-like powers

According to another important amendment, the FMU will be bound to promptly share information on money laundering with foreign jurisdictions instead of waiting for "due administrative process". Similarly, the banks will be bound to share suspicious transactions report with the FMU "promptly" instead of the existing limit of within seven days.

The government has also proposed to empower the investigation officers to attach property involved in money laundering for six months as against the current period of three months. It is proposed that the courts could grant further extension in the attachment period to up to one year.

According to the proposals, the banks would also be bound to file the suspicious transactions report and on failing to do so, the persons concerned will be liable to five years of imprisonment and a fine of Rs500,000.

The FATF's concerns are more about implementation of the existing laws than the weaknesses in the laws, said Hina Rabbani Khar of the PPP. She said that it is not the best international practice to delegate court's powers to investigation officers to arrest people at their will.

In spite of enactment of Anti-Money Laundering Act in 2010, the investigation agencies have not taken one money laundering case to its logical conclusion, said Dr Ayesha Ghaus Pasha of the PML-N.

The latest amendments were required in the AML Act due to the observations made by the Financial Action Task Force and the Asia Pacific Group on money laundering, said Sohail Rajput, additional secretary at the finance ministry.

FERA Amendments

The government has also also proposed that the central bank should be given powers to arrest people on movement of foreign currency within the country beyond a threshold to be determined by the SBP.

At present, the central bank does not have explicit powers under FERA to issue any regulations relating to inland movement of foreign currencies, said Irfan Ali, Executive Director of the SBP. The government has proposed to allow the central bank to set limits for the inland movement of foreign currency, which the standing committee strongly opposed.

The SBP has also proposed an amendment to FERA to enhance the punishment of currency movement within the country and making it a cognisable and non-bailable offense. It has proposed increase in the punishment for currency smuggling from two years to five years. Besides restrictions on the physical movement of foreign currency within the country, the SBP can also stop clearing of dollars through the banking system, said Irfan Ali.

Pakistan is becoming an overregulated economy while the world is relaxing restrictions on doing business, said Ahsan Iqbal, former planning minister of the PML-N. The committee members also raised concerns over unannounced restrictions imposed by the central bank on clearance of letter of credits due to depleting foreign exchange reserves.

The central bank has also proposed that the tribunals will be empowered to take action against illegal foreign exchange operators in expeditious and time-bound manner. The FIA may also be given powers to take prompt action.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ