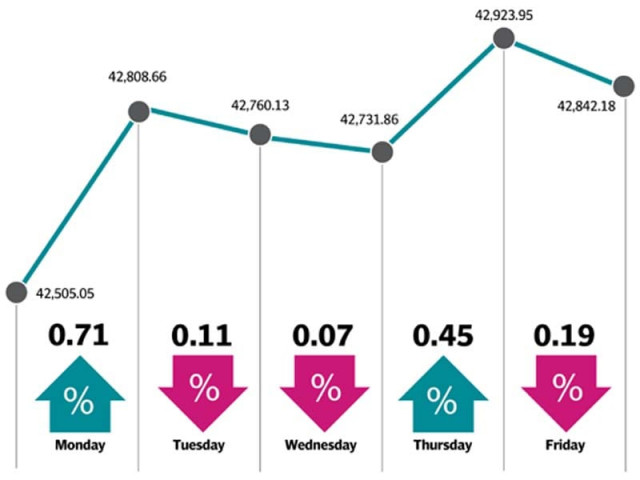

KSE-100 registers minor increase of 337 points

Concern over Pakistan’s economic position keeps investors away

Participation during the week remained on the higher side, despite slowing down in comparison to the previous week.

PHOTO:EXPRESS

With political uncertainty aside, the index returned to its fundamentals with financial results dominating the news flow. However, concerns on the macroeconomic front kept investors interest subdued. Although the Pakistan Tehreek-e-Insaf (PTI) has emerged as the clear winner, the Election Commission of Pakistan’s decision to withhold results in some constituencies also kept investors jittery.

Asad Umar, nominated to be the next finance minister, held a press conference during the week where he shared plans to deal with the current external sector challenge by floating dollar-denominated bonds to raise funds. The central bank’s foreign exchange reserves also witnessed a boost in the week, however, they remain far from being at a comfortable level. These concerns kept the index from maintaining a steady upward direction.

The week kicked off on a positive note, but profit-taking in the following two sessions dragged the index lower. Some gains were made on Thursday as investors scrambled to pick blue chips in late trading, but the index retreated once again on Friday.

According to an Elixir Securities’ report, Bloomberg reported during the week that the National Accountability Bureau (NAB) has started an inquiry into the awarding of an LNG terminal to Engro Corporation. The probe will look into allegations of an “illegal award” of Pakistan’s first LNG terminal to Engro’s Elengy Terminal Pakistan Limited. The negative impact on the stock price was, however, short-lived as it closed up 2.9% for the week. Nishat Chunian, however, lost 0.6% for the week and traded at its lower circuit on Friday after media reported that its chief executive has been summoned by the anti-graft agency next week, the report added.

Market watch: KSE-100 plunges 574 points as profit-booking takes over

Participation during the week remained on the higher side, despite slowing down in comparison to the previous week. Average daily volumes decreased 27% to 208 million, while value traded fell 19% to $78 million.

In terms of sectors, cement added 216 points to the index as market rejoiced on weak coal price outlook. Other sectors that contributed positively to the index were oil and gas marketing companies (up 60 points), auto assemblers (57 points), fertilisers (38 points) and oil and gas exploration companies (36 points).

Market watch: KSE-100 ends with trimmed gains after over 600-point increase

On the other hand, index-heavy banks took away 69 points from the index on concerns over earnings outlook. Scrip-wise, LUCK (up 103 points), ENGRO (60 points), INDU (48 points), SNGP (47 points) and PPL (33 points) added to the index. On the results front, Allied Bank (ABL), Engro Fertilizers (EFERT) and Aisha Steel (ASL) announced earnings during the week, which failed to garner significant interest as earnings were broadly in line with market expectations.

During the week, foreigners sold a considerable $38.6 million worth of shares compared to net selling of $14.6 million during the same period last week. Selling was witnessed in exploration and production ($13.8 million) and commercial banks ($10.6 million). On the local front, insurance companies, individual investors and mutual funds were net buyers amounting to $16.7 million, $10.8 million and $10.4 million, respectively.

Market watch: KSE-100 plunges 758 points as election day approaches

Among major highlights of the week were; National Electric Power Regulatory Authority (Nepra) imposed Rs5 million fine on Genco-II for power breakdown, Oil and Gas Regulatory Authority (Ogra) awarded licence for refinery in Khyber-Pakhtunkhwa, Beijing expressed interested in joining Tapi pipeline project, the Federal Board of Revenue (FBR) to add Rs97 billion amnesty amount in FY18 revenue collection and Asad Umar said Pakistan needs infusion of $12 billion in loans immediately.

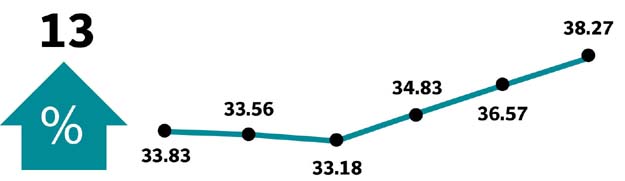

Winners of the week

Unity Foods

Unity Foods Ltd is an agri-business company, with principal activities that covers the entire value chain from procurement to crushing of multiple oil seeds.

Indus Motor Company

Indus Motor Company Limited was created through a joint venture agreement between the House of Habib, the Toyota Motor Corporation and the Toyota Tsusho Corporation, in order to assemble, manufacture and market Toyota vehicles. The company is also the sole distributor of Toyota vehicles in Pakistan.

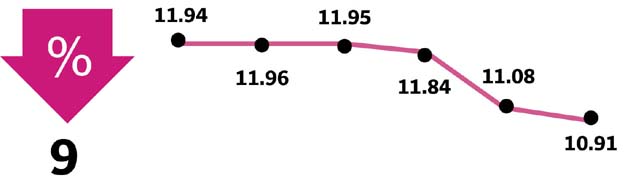

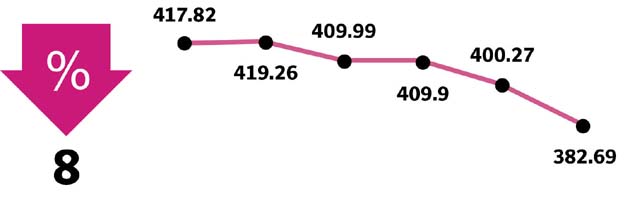

Losers of the week

Pakistan Telecommunication Company

Pakistan Telecommunication Company Limited provides fixed line domestic and international telephone services, telex, telegraph, fax and leased circuit services in Pakistan. The company owns all public exchanges, the nationwide network of local telephone lines, principal long distance transmission facilities and international telephone gateways in Pakistan.

National Refinery

National Refinery Ltd manufactures and distributes lube base oils and petroleum fuels. The company markets its products to customers throughout Pakistan.

Published in The Express Tribune, August 12th, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ