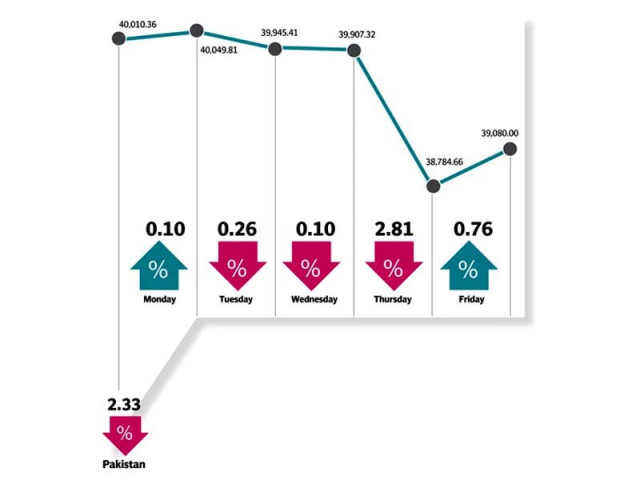

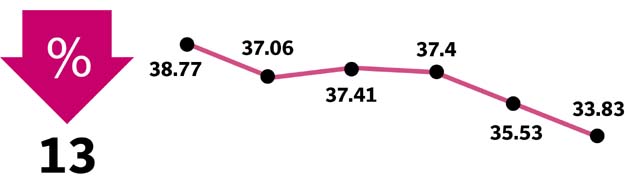

Weekly review: KSE-100 endures turbulent week, declines 2.3%

Political noise takes toll on investors; rupee weakening provides respite on Friday

The 2.3% fall was led by the resurgence of domestic political noise as the long-awaited judicial inquiry report on the ‘Model Town’ incident was made public. This was followed by a strong reaction from opposition parties, which led the investors to believe that there may likely be a repeat of 2014-esque sit-ins.

Also, Pakistan Peoples Party and Pakistan Tehreek-e-Insaaf declared their support for Pakistan Awami Tehreek, which has called for country wide protests demanding resignation of Punjab Chief Minister Shahbaz Sharif. In addition, oil prices took a mid-week dip as well as US gasoline inventories came in higher than expected, while the Pakistan Stock Exchange’s new proposals for circuit breakers also rattled retail investors.

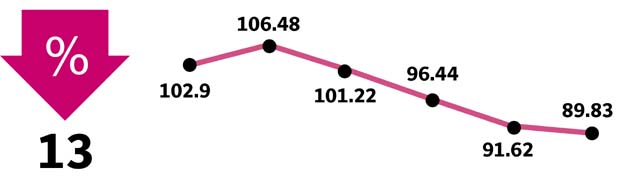

Weekly review: MSCI announcement the catalyst as KSE-100 Index drops 1.4%

Trading kicked off on a positive note on Monday as euphoria over issuance of Eurobond and Sukuk amounting to $2.5 billion led the index higher. However, sentiments were dented as politics cast a shadow over the positive development and investors chose to remain on the sidelines and monitor the situation closely. The following two sessions remained lacklustre, a trend which came to an end on Thursday as the KSE-100 plunged over 1,100 points.

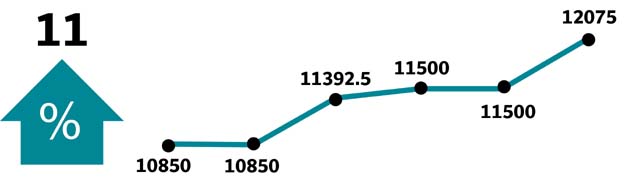

The benchmark KSE-100 index made a 16-month low to 38,785 points (levels last observed in Jul’16), according to AHL Research. On the last trading day of the week, stocks took a dramatic turn and bounced back to make an intra-day high of 550 points. This development came amid the rupee movement against the greenback in the interbank market as the PKR-USD parity had reportedly breached the PKR 109.5 level (implying a 3% intra-day depreciation). However, the hype remained short lived as the PKR closed at 107 on closing basis. Trading volumes jumped 26% during the week to 141 million shares while traded value increased to $54 million; up 14%.

Almost all major heavyweights such as oil & gas marketing (down 7.5% week-on-week), cements (down 2.8%), power generation (down 4.4%) and fertilisers (down 3%) witnessed heavy battering. Some respite to the index was offered by the E&P sector mainly on the back of elevated international crude oil prices and overall realignment of investors towards sectors offering benefits in the case of PKR devaluation against the greenback.

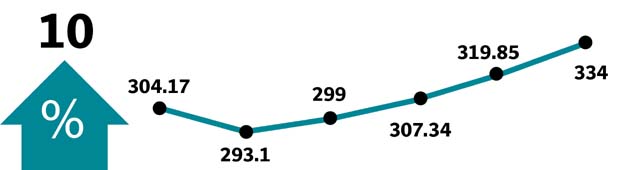

Refineries also declined by 6.8% during the week, while the engineering sector declined by 6.5%. The decline in the engineering sector was possibly due a slight $6/ton rise in HRC prices, which closed the week at $553/ton.

On the other hand, E&Ps gained 1%, tobacco was up 4%, and food surged 7%.

In terms of stocks, HBL (down 4%), KAPCO (14%), SNGP (13%), UBL (4%) and PSO (-%) held 404 points from the index.

KAPCO declined due to weak sentiment as the market comes to terms with the plant’s expiry in FY21. The Sui companies declined due to a proposed tariff revision by OGRA, which could potentially change the company’s return formula detrimentally.

Weekly review: Uncertainty erodes away gains, KSE-100 ends almost flat

Developments in the power sector have brought into question the future of furnace oil, which has negatively impacted the energy chain. Attock Refinery Limited (ATRL) and Pakistan State Oil (PSO) declined 8% and 7% respectively as they stand to lose when furnace oil-based generation goes down. Similarly, Nishat Chunian Power (NCPL) was down 6% while Nishat Power (NPL) was down 5%.

Positive contribution came from PPL (+4%), NESTLE (+11%), PAKT (+6%), NATF (+10%) and DAWH (+2%), which added 188 points to the index.

Foreigners bought $1 million during the week (vs selling of $39.5 million last week). On the local front, insurance sector was net buyers of $6.4 million whereas individuals were net sellers of $9.7 million.

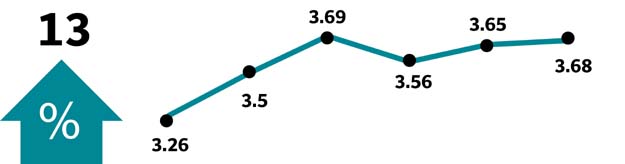

Among major highlights of the week were; Pak Suzuki introduced four new products, CPI for Nov 2017 clocked-in at 4%, Pakistan’s first LNG terminal saved $3 billion and PSO suspended imports on shut-down of furnace oil-based power plants.

Winners of the week

Crescent Jute

Crescent Jute Products Ltd manufactures and markets jute and cotton textiles.

Nestle Pakistan

Nestle Pakistan Limited manufactures, imports, and sells dairy products, confectioneries, culinary products and fruit juices. The group’s products include milk, butter, cream, noodles, coffees, and dietary and infant products.

National Foods

National Foods Limited is a diversified food manufacturer. The group’s products include recipe blends, dehydrated vegetables, pickles, salts, snack foods, desserts, and a number of kinds of health foods.

Losers of the week

Kot Addu Power Company

Kot Addu Power Company Limited owns, operates, and maintains a power station and generating units.

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centers and offices located in Pakistan and elsewhere throughout the world.

Sui Northern Gas

Sui Northern Gas Pipelines Limited purchases, purifies, transmits, distributes, and supplies natural gas, in addition to marketing Liquefied Petroleum Gas.

Published in The Express Tribune, December 10th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ