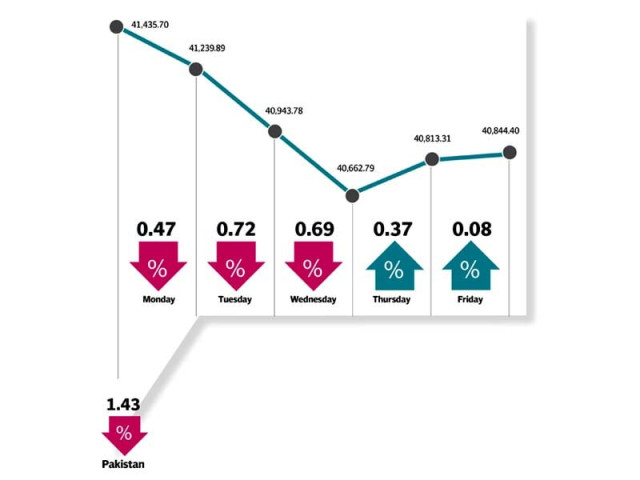

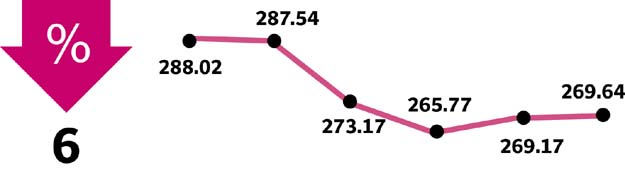

Weekly review: MSCI announcement the catalyst as KSE-100 Index drops 1.4%

Trading activity remains dull; average volumes, value decline 7% & 14% respectively

Most of the euphoria witnessed during the previous week (strong mutual fund buying) fizzled out as political headwinds took charge. Unsettling news over timing of elections, ongoing court cases (involving former prime minister Nawaz Sharif, Finance Minister Ishaq Dar and Imran Khan) made the perfect cocktail to keep investors wary of making fresh investments. Matters on the macroeconomic front also remained unexciting as trade deficit numbers for 4MFY18 painted an alarming picture.

Weekly review: Uncertainty erodes away gains, KSE-100 ends almost flat

Apart from the usual political hiccups, trading in the initial week was led by MSCI’s announcement, where the leading index provider downgraded Engro Corporation (ENGRO) in the MSCI Emerging Markets Index and lowered Pakistan’s weight to 0.08% (from 0.14% previously).

While this was perceived as highly likely, given the 19.3% erosion of the market since the official transition (June 1, 2017), reception of the outcome remained gloomy. Meanwhile, on the commodity front, interest in international oil prices fizzled out amid increasing US stockpiles and Russia admitting uncertainty on further oil cuts.

The market continued its bearish trend from the previous session, and opened negative on Monday. The losing streak continued for the following two sessions. However, in the last two days of trading, market recovered as value buying took place in ENGRO. Also, some clarity emerged with regards to the political process with passing of delimitations and election act this week.

With that said, trading activity slumped significantly as average daily traded volumes declined 7% to 106 million shares while average daily traded value plummeted 14% to $51 million.

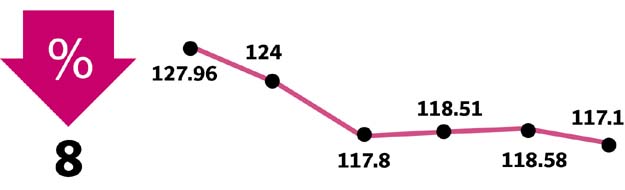

The bulk of the declines were led by textile spinning, refinery and power generation sectors. The latter two came under the limelight as the government reportedly shut down 8,000 MW of power plants amidst reduced seasonal demand and higher generation from other sources. Apart from these almost all index heavyweights including, fertilisers, commercial banks, and oil and gas exploration companies also contributed negatively to the index. On the other hand, tobacco sector was up 8%.

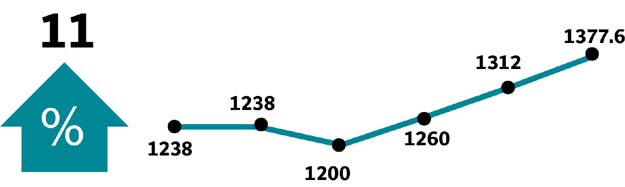

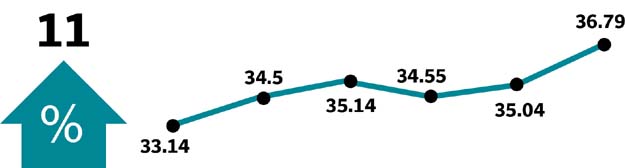

In terms of stocks, PAKT (11% WoW), TRG (11%), PIBTL (4%), COLG (4%) and HMB (3%), added 103 points to the index. On the other hand, ENGRO (-6%), DAWH (-8%), MCB (-3%), PSO (-6%) and OGDC (-2%) detracted 357 points from the index.

Foreign investors registered net buying of $1.13 million this week compared to net selling of $1.78 million in the previous week. Major buying was witnessed in oil & gas marketing and other sectors of $2.73 million and $5.17 million, respectively. While major selling was witnessed in commercial banks ($3.48 million), fertilisers ($1.84 million), telecom ($1.64 million) and cements ($1.53 million).

Keeping the weak outlook into consideration, mutual funds and banks turned into net sellers of $16 million and $4 million worth of equities, respectively.

Market watch: KSE-100 touches new peak with handsome gain

However, the insurance companies, other organisations and individuals closed the week with net buy of $8.09 million, $4.96 million, $2.78 million and $2.32 million, respectively. Among major highlights of the week were; 4MFY18 Foreign Direct Investment (FDI) remained encouraging at $940 million (up 74%), trade deficit widened to $3.04 billion in Oct’17, car data released by PAMA indicated growth at a robust 32% in Oct’17.

Winners of the week

Pakistan Tobacco

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centres and offices located in Pakistan and elsewhere throughout the world.

Ibrahim Fibre

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a Polyester Staple Fibre manufacturing plant. The company manufactures a wide range of polyester staple fibre and it also manufactures a variety of blended as well as pure synthetic yarns. Ibrahim Fibres Ltd also owns an in-house power generation plant.

Losers of the week

Nishat Power

Nishat Power Ltd is an independent power producer that supplies electricity to the national grid in Pakistan.

Dawood Hercules Corporation

Dawood Hercules Corporation Ltd produces urea fertilisers. The company also produces anhydrous ammonia for manufacturers of soda ash, fructose and other chemicals.

Engro Corporation

Engro Corporation Ltd manufactures and markets fertilisers and plastics, generates electricity, and processes food. The company produces nitrogenous, phosphatic and blended fertilisers, polyvinyl chloride resin, and industrial automation products, develops electricity generating plants, produces dairy foods, and operates a liquefied petroleum gas and liquid chemical terminal.

Published in The Express Tribune, November 19th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ