Sales Tax

More News

-

Sindh hikes sales tax to 15%

Move likely to exacerbate inflation as indirect tax disproportionately affects low-income groups

-

55% of capacity of major sectors couldn’t be traced

It leads to evasion of income tax, sales tax and federal excise duty

-

Ex-Fata industries exempted from tax till June 30

Supreme Court grants total sales tax amnesty to steel and ghee industries in former tribal areas until June 30, 2024

-

Harmonisation of sales tax laws – a ray of hope

Rules put emphasis on location where service provider resides or place from where services are rendered

-

Traders threaten to go on strike after addition of sales tax on energy bills

'The small businessmen of Pakistan cannot afford to pay the bills'

-

Govt eyes Rs740b in additional taxes

Rs300b to be collected through petroleum levy

-

Govt to provide tax relief on edible oil

FBR decides to impose an additional sales tax of 5% to 17% on electricity and gas on customers not registered in ATL

-

Salt association seeks end to sales tax

Official says sector has potential to earn $1b through exports

-

Senate panel opposes sales tax at retail stage

Also rejects budget proposal to arrest taxpayers on suspicion without warrants

-

KCCI demands date extension

KCCI president requested the FBR to extend date in larger interest of the revenue board and business community

-

Govt not to restore zero-rated sales tax regime

Dawood says Pakistan and Afghanistan have agreed to bilateral FTA

-

Importers urge removal of sales tax on sugar

Say if tax remains applicable, sugar price will continue to be on higher side

-

FBR investigates Re1 RPO

Authority will probe whether refund payment order of Re1 is scam or glitch

-

Exports to stay low due to liquidity woes

Businessmen term zero-rating indispensable to remove hardships

-

Pakistani exporters decry 17% sales tax on local sales

Demand restoration of zero-rated facility

-

For dairy sector: Govt mulls zero-rated facility

Committee set up to review budget proposal as taxes cause losses to firms

-

Adviser to PM Imran on Commerce for improving direct tax receipts

Abdul Razzak Dawood says it will help reduce indirect taxes like sales tax

-

RCCI urges PTI govt to slash sales tax

PTI govt urged to come up with comprehensive, long term policy

-

In Pakistan, large retail store chains win taxation relief

FBR accepts demand of halving withholding tax rates; cuts minimum income tax rate for traders

-

Number of sales tax return filers rises only 8%

Marginal increase indicates govt’s reforms initiative is not bearing fruit

-

Cotton crisis – investment in R&D needed

Policy of sugarcane support prices contributes to lower cotton output

-

Tough decisions: 2019 sees Pakistan economy emerge out of deep waters

IMF’s bailout programme, delayed licence fee payments by telecom operators among others provide relief

-

Japan proceeds with twice-delayed sales tax hike as growth sputters

Government applies measures to mitigate pain on consumption

-

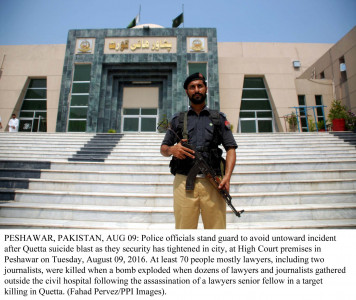

IHC seeks FBR’s reply over sales tax on lawyers

Chief Justice Athar Minallah says indirect tax will put additional burden on litigants

-

Discrepancy of up to Rs24b found in tax receipts

Figure reported by FBR is different from cash deposited in treasury

-

Win-win solution to zero-rated issue sought

NA panel asks PM aide to find solution that benefits both govt and industry

-

Top court upholds Sindh’s right to collect sales tax

Constitution clearly states ‘sales tax on services’ is within the exclusive domain of the provinces, SC observes

-

GST on sugar may be increased

Imposition of FED on gas, hike in customs duty are also on the cards

-

FBR asks big businesses to declare hidden sales

Chairman urges them to opt for tax amnesty as only 11% are currently registered

-

KPRA inspects wedding halls in Peshawar

Authority urges defaulters to deposit sales tax by January 3

-

India cuts tax rates on some goods after election loss

Reduction is aimed at appealing to traders and middle class

-

PCGA suspends cotton purchase from growers

In protest against the federal cabinet's refusal to restore the old system of sales tax

-

FBR issues notification on sales tax exemption

It comes days after Senate panel warned of seeking explanation for delay

-

Marriage halls to pay 15% sales tax on services

Court dismisses a petition filed by hall and lawn owners’ body

-

Sales tax: Tractor industry urges release of refunds

Tractor industry’s pending sales tax refunds, which amount to over Rs3 billion

-

Computer parts exempted from tax to promote laptop assembly

Measures taken to encourage manufacturing of computers and laptops

-

FBR approves new policy for tax audit selection

Currently, more than 925,000 audit cases remain pending

-

FPCCI recommends cut in sales tax to 15%

Says high tax impacts inflation, promotes smuggling and tax evasion

-

Incomplete risk parameters: LHC suspends FBR’s audit policy on transparency concerns

Haphazard selection of companies for audit creates unmanageable backlog

-

Sales tax: Exports likely to pick up after release of tax refunds

PAF asks govt to clear refund claims of higher value as well

-

MCCI demands release of funds

Says govt has failed to achieve targets for FY17, broaden the tax base

-

Exporters call for payment of duty drawback claim

Their working capital has been stuck with FBR for past many years

-

Fuel shortage feared as tankers stop supply

Karachi to remain largely unaffected as a couple of lobby groups go on strike

-

One-month bar: PHC restrains Rs600m sales tax recovery

The court issued notice to FBR on a petition filed by Pesco

-

Sales tax: ‘Deduction at source unjustified’

Last year, the FBR had withdrawn Rs4 billion from the Sindh government's account

-

Taxation: Offices of five housing schemes sealed

PRA is taking action against all institutions that are not paying sales tax

-

Increased sales tax: How high-end mobile phones could become expensive

Budget proposal could slow down growth of 3G/4G subscribers

-

Increase in sales tax: Industry concerned over FBR’s proposal

PHMA chairman said that FBR is bent on proposing draconian moves that would destroy the value-added sector’s exports

-

Textile, leather goods: FBR proposes hefty increase in sales tax

Also wants to withdraw exemption from 5% withholding tax on power bills

-

Petroleum Sale: Govt issued notice on sales tax

The petitioner’s counsel told the court that the sales tax on petroleum products was unconstitutional