Tough decisions: 2019 sees Pakistan economy emerge out of deep waters

IMF’s bailout programme, delayed licence fee payments by telecom operators among others provide relief

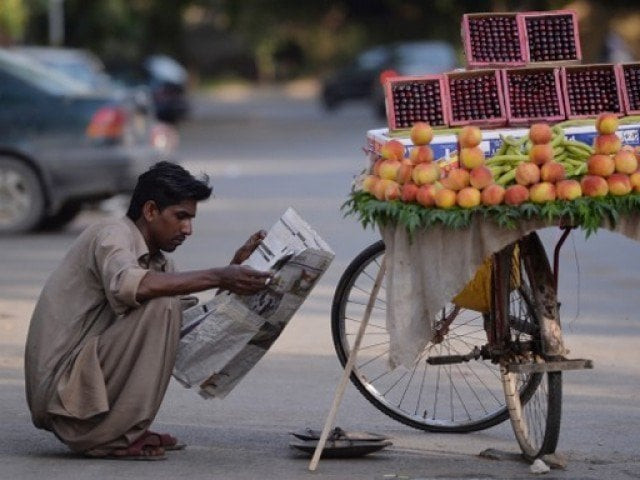

PHOTO: AFP

The year 2019 has brought stability to Pakistan’s flagging economy after Prime Minister Imran Khan entered into the “last International Monetary Fund Programme”.

The year 2019 has brought stability to Pakistan’s flagging economy after Prime Minister Imran Khan entered into the “last International Monetary Fund Programme”.Pakistan has availed three IMF programmes since 2008 to address its structural problems, which still remain unaddressed. The country’s savings and revenues as percentage of total size of its economy remained at around 10% of the gross domestic product (GDP).

The second decade of the 21st century has turned out to be the ‘Lost Decade’ in economic terms with national economic output averaging around 3%, savings-to-GDP ratio around 10%, nearly 60% of the population either poor or vulnerable and debt-to-GDP ratio standing at 88%.

The government of Pakistan Tehreek-e-Insaf (PTI) spent the first half of 2019 in taking a decision on the IMF programme and eventually ended up signing a 39-month deal. With the sixth month into the deal, the IMF revised downwards the much-debated tax collection target. The Express Tribune had called the Rs5.555 trillion tax collection target even before the start of the fiscal year.

The IMF has now lowered its exchange rate assumptions as well as the average inflation rate for this fiscal year.

Prime Minister Imran was provided with an alternative solution to deal with the country’s financial crunch instead of opting for the IMF bailout package but he chose to avoid going down the risky path, former finance minister Asad Umar had revealed in April.

In fiscal year 2018-19, the PTI government added Rs465 billion to the circular debt, according to the IMF report.

The IMF stated in its latest review report that the circular debt could not be brought to zero by December 2020 but by 2022-23, and projected the flow of circular debt at Rs75 billion.

Adviser to the Prime Minister on Institutional Reforms Dr Ishrat Husain had been given three months by the federal cabinet in August 2018 to suggest changes, which he did in bits and pieces.

At the start of 2019, the PTI government did not increase power tariffs but ended the year with four revisions with the fifth one on the cards. The IMF has already revised upwards the debt servicing budget to Rs3.15 trillion from Rs2.98 trillion for this fiscal year.

The government has so far imposed Rs1.3 trillion additional taxes on the taxpayers and energy consumers.

One of the major successes of the government was containing the widening current account deficit. The improvement came by stopping and reducing certain imports and the contribution of increase in exports in the first five months of this fiscal year was up to $500 million.

The government claimed to have achieved a significant jump in foreign direct investment as the money came in on account of one-off delayed licence fee payments by the telecom operators.

In June 2019, the budget deficit stood at 8.9% of the GDP or close to Rs3.5 trillion. PM Imran also borrowed $16 billion from foreign sources in fiscal year 2018-19.

The government’s debt was equivalent to 88% of the GDP at the end of fiscal year 2019. The ratio was “higher than the median estimate for B-rated sovereigns of 55% of GDP for 2017”.

The country’s economic growth rate slowed down to 3.3% — the lowest in nine years — in the first year of PM Imran’s government, which missed its targets set for all major sectors of the economy.

In 2019, Imran gave his first tax amnesty scheme and amended the National Accountability Ordinance (NAO) 2000 to shield businessmen from the accountability watchdog. The other purpose was to provide a solace to the bureaucracy that was unwilling to work due to growing intervention of NAB in every important decision. But the bureaucracy still has reservations, as the final ordinance did not carry some of their recommendations.

Pakistan has also signed a revised Free Trade Agreement with China, which many fear would further widen the trade deficit with Beijing.

In 2019, the PTI government first revised downwards the active privatisation list to only eight from 64 companies and later increased it to 19.

As the Pakistan International Airlines (PIA) and the Pakistan Steel Mills (PSM) are still running in losses, the cumulative debt of all state entities increased to a record Rs2.1 trillion by the end of last fiscal year – a net addition of Rs656 billion or 47% in one year.

In between, Pakistan finally jumped 28 spots on the Word Bank’s Ease of Doing Business Index, making the country’s environment conducive for foreign investment.

Hopes for export to revive rekindled but no major benefits could be accrued due to lack of exportable surplus and constant increase in cost of doing business.

The government again faced serious issues in broadening the tax base. For the tax year 2018, there were about 2.7 million taxpayers on the Active Taxpayers List that remained below two million in 2019.

The FBR formally sought permission of the prime minister to launch disciplinary proceedings afresh against a dozen senior taxmen on charges of corruption and inefficiency. However, no decisive action has been taken so far.

In April, the PTI government decided to amend laws to ensure that price control mechanisms proactively focused on cartelisation, hoarding and undue profiteering, according to a statement issued by the finance ministry.

Despite according high priority, the government recovered less than $10 million out of $7.5 billion referred by the Organization for Economic Cooperation and Development (OECD).

In October, the Financial Action Task Force (FATF) announced retaining Pakistan on its grey list for four more months after which Islamabad might face action, including being blacklisted, if it fails to make any significant progress on the inter-governmental body’s 27-point action plan. The final report that Pakistan sent to the global body also lacked enough substance to completely convince the IMF otherwise.

Although the government did not officially release any new data on poverty and unemployment, the independent economists have claimed significant jump in poverty and unemployment.

In 2020, the government has planned to introduce a mini-budget and increase electricity prices to recover cost of idle capacity payments and servicing of circular debt.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ