Budget2015-16

More News

-

The road to nowhere: Five years on, unfinished project scrapped from budget

Millions of rupees were being allocated to the inter-city bus project but no work had been done.

. -

Misplaced priorities: Preventive care finds little space in health budget

77% of the development budget has been allocated to the ongoing schemes.

-

‘Developing a nation’: Education budget split into four heads, development funds go down by Rs0.7b

he claimed that the government is going to spend more on the department - Rs13.2 billion to be exact

-

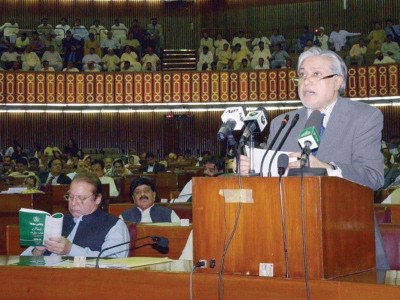

Opposition rejects ‘anti-poor’ budget

Protests from opposition benches began soon after finance minister Murad Ali Shah started his speech

-

Budget 2015-16: Sindh presents Rs739b budget

Sindh follows centre's direction, raises minimum wage from Rs12,000 to Rs13,000

-

Budget 2015-16: Dar’s budget defies economic vision, says KCCI

Chamber criticises increased indirect taxes.

-

Repercussions: Power companies take flak for eating up billions

Water and power secretary seeks Rs84b subsidy from Finance Division.

-

Budget 2015-16: Dairy industry losing sleep over proposals

Import duty on milk powder, whey powder to be decreased.

-

Budget 2015-16: Punjab brings 10 new services under tax net

Sales tax on internet services withdrawn at last moment.

-

Revision: A Super Tax for the super wealthy

Senate standing committee says income threshold should be lowered for high earners

-

Priorities: Environment Dept budget slashed by 73%

According to budget documents, no new scheme has been announced; thus the amount will be spent on ongoing projects

-

Equality: Rs500 million reserved for human rights, minorities

Rs22 million earmarked for scholarships for minority students.

-

Civic spending: Allocation for roads overshadows most civic projects

Pakistan Kissan Ittehad president says this might not help farmers as there are other issues which affect them more

-

Rule of law: Rs2.3 billion allocated for judiciary

Rs94.18 million for nine new schemes.

-

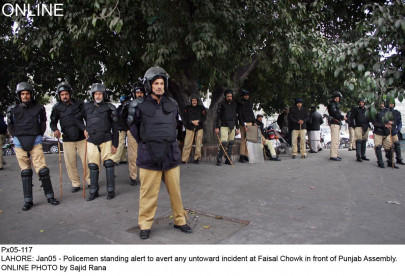

Public safety: Over 100 new projects planned for the Police Department

Largest share of development budget goes to Counter Terrorism Department.

-

History matters: Archaeology Dept gets Rs400 million

Rs88 million reserved for restoration of Shalamar Gardens.

-

Labour welfare: Focus on strengthening on-going projects

A province-wide survey of child labour has been proposed .

-

Allocation for Metro Bus projects slammed

Opposition heckles Dr Ayesha Ghaus with Go Nawaz Go slogan.

-

Education budget: 37 colleges, 3 universities planned

Punjab sets 64 per cent literacy rate target for the year.

-

Rs166 billion to be spent on health

According to budget documents, Rs10.82 billion will be spent on the provision of free medicines

-

All about development: Preparing ground for 8 per cent growth

Largest ever development package announced for the Punjab.

-

Budget, circular debt and dharna

Mr Dar listed Imran Khan’s dharna in August-December among the adverse influences on his performance

-

Budgeting Pakistan

In choosing infrastructure, communication, energy, govt has chosen its 3 planks of reviving the economy

-

The true rate of unemployment

Any layman can understand that with a growth rate of 4.24 per cent, job creation is a far-fetched dream

-

Analysis: Taxing companies looking to expand

Proposal floated to tax undistributed reserves over 100% of paid-up capital.

-

Economic Corridor: Senate body seeks increase in allocation for western route

Committee members from Khyber-Pakhtunkhwa and Balochistan speak against earmarking meagre funds.

-

PTA chief opposes tax on broadband services

Says it will hamper telecom sector growth.

-

Development funds utilisation: Three departments, three varying figures

E&SE department says over Rs11b used so far, but finance shows Rs9.3b; P&D claims around Rs13b utilised

-

Budget 2015-16: Opposition slams hike in sales tax rate

Term budget ‘not people-friendly’, based on temporary solutions

-

Budget reaction: Minus a few qualms, OICCI largely satisfied

Says most incentives will assist growth; taxation remains neglected area.

-

Businessmen take tax holiday incentive with a pinch of salt

Going back on promises in the past leaves industrialists less hopeful.

-

Chicken cost: Poultry industry flaps wings over latest taxes

Say fresh duties to deter sales and increase prices by 25%.

-

Ishaq Dar: Mr 0.6%

Govt looks to impose tax on every transaction done through banking channels

-

Unhelpful: APMDA feels budget measures are redundant

He suggested the government to bring down the rate of tax of non-filers to the rate of income tax returns filers

-

KATI hails decision to withdraw FBR’s powers

Association chief says the tax board has created distortions.

-

Stakeholders criticise tax on internet usage

ICT3 chief says imposition will lower mobile broadband uptake.

-

How governments spend their money

Budget-makers don’t look at the state of the nation and its harsh realities

-

Budget 2015-16: Numbers don’t lie, people do

Brushing aside key economic problems, Dar takes credit for steps not taken by govt.

-

Cost of doing business: Budget fails to impress traders

Says govt ignored demand for cut in general sales tax

-

Reaction: Budget draws mixed reviews, taxes lauded and blasted

ICCI opposes increased tax rates, PBIF hails budget measures.

-

Water projects: Country likely to spend less-than-allocated funds

May utilise 88% of the earmarked Rs43.55b despite water scarcity fears.

-

10-year tax holiday if you set up transmission lines

Benefit extended to projects that come online within three years

-

More funds to higher education

A paltry sum has been apportioned to education ministry, which is responsible for lives and fortunes of students

-

Budget 2015-16 is pro-poor with rich kept in mind: Dar

Finance minister explains salient features of the new budget and clarifies misconceptions surrounding it

-

7.5% ad hoc allowance for govt servants

This is the 6th year in a row that government servants will get budgetary relief in the shape of ad hoc allowances

-

Rs700b set aside for development projects

China-Pakistan Economic Corridor project allocations get cut, but still take up lion’s share of federal PSDP.

-

Rs238b in new taxes imposed to achieve revenue target

Prices of packaged dairy, cigarettes, mobile phones, petroleum, meat and poultry likely to rise.

-

Defence spending goes up to Rs781 billion after 11% hike

Army will get 47%, air force 20% and navy 10%

-

Big on aims, short of ideas

5.5% growth rate targeted for next year

-

Flying higher: Tax exemptions for airlines, airports

Aim is to take aviation’s share in GDP to global average.