Budget2015-16

More News

-

Trying to discourage? Smoking cigarettes to burn a bit more cash

Tax increase to encourage illicit trade and smuggling, comments official.

-

Budget 2015-16: Subsidies on energy, commodities slashed by 32%

Doubts remain about government’s ability to keep itself within Rs137.6b target.

-

Market Watch: Pre-budget uncertainty takes down index

Benchmark 100-share index drops 73.25 points.

-

Ambitious plan: Govt increases BISP fund by Rs5 billion

Will launch special schemes for creating employment.

-

Prime Minister House may get cash ‘off the radar’

Sources claimed that the finance ministry had deliberately concealed the amount

-

Jacked up: Provinces to get Rs1.9 trillion

Their share in federal taxes and straight transfers has been hiked by 17.4 per cent.

-

Oil and gas: Government expects to receive Rs382b in its coffers

This is 5.6% lower than last year’s revenue target of Rs405b.

-

Capital markets: Tax hike on banks’ investment gains surprises many

CGT rates also revised upwards; sale of shares to be taxed even after two years.

-

Incentives offered: Agriculture, construction and textile emerge victorious

Suspension of minimum tax on builders and reduction in import duty on construction machinery hailed

-

100% increase in tax on mobile handsets

Decision to be a major setback for the sector.

-

Rs100b rehabilitation fund drawn up for TDPs

Govt says Rs20 billion from that amount can be spent on security

-

The poverty of the economic survey

There is no example of a country growing respectably while an IMF programme is still in place

-

Call for promoting science education

The participants were also shown a display of vacuum technology and its applications in industries

-

Govt slashes Rs4.4b from health budget

The government has allocated Rs22.4 billion for the Ministry of National Health Services

-

HEC gets over 72% of education budget

Education ministry budget cut by Rs1 billion.

-

Budget 2015-16: Capital receives nearly Rs5b for various projects

Islamabad Police to have Rapid Response Force, forensic lab.

-

Budget 2016: more of the same

This year's budget does not do much in terms of cutting back on the privileges of Pakistan’s wealthy elite

-

Budget 2015-16: Text of Ishaq Dar's budget speech

Finance minister lists PTI's four-month long protest in Islamabad, oil prices as contributing factor to missed...

-

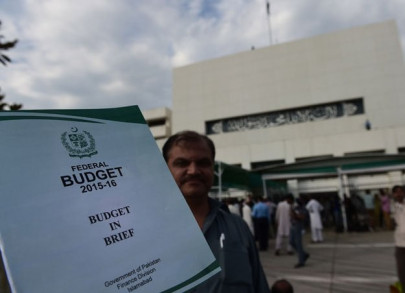

Budget 2015-16: Finance Minister Ishaq Dar unveils Rs4.451 tr budget

New budget is expected to focus on spurring economic growth

-

Budget 2015-16: Govt eyes 5.5% GDP growth next year

The new budget boasts historically low interest rates and high infrastructure spending

-

Economic survey: Riddled with typos and errors

Govt missing targets and making mistakes .

-

Private sector borrowing: Appetite for credit remains subdued

Reads Rs149.3b compared to Rs325.1b in comparative period.

-

Alarming results: Large-scale manufacturing registers dismal growth

Clocks in at 2.5% compared to 4.6% in the same period last year.

-

Industrial sector misses target by a mile, grows 3.62%

Services sector fares better, falls just short of target.

-

Turtle’s pace: No growth in agriculture – literally

Barring cotton and rice, growth in important crops remains weak

-

Economic 2015-15 Survey: Tax exemptions eat up Rs665b in revenues

Dar says govt will remove another one-third of tax breaks in new budget.

-

Rare success story: KSE-100 rises and shines during 10MFY15

Gains 4,077 points making it more attractive than most major stock markets.

-

Uncertain: Misty details hover over energy clouds

Lacklustre reporting of statistics provides no value addition.

-

Bowing down: Country spends 44.5% revenue to service debt

Ate up Rs1.193t; domestic debt comprises major chunk of pie.

-

Through SRO, Punjab slaps 19.5% tax on mobile internet usage

Decision a ‘big negative’ for economy; 80% subscribers’ income not taxable.

-

The government’s report card

Govt has not done enough to encourage entrepreneurial creativity of the nation, which could kick-start economy

-

Talking big numbers: ‘Budget outlay to be over Rs470 billion’

Finance minister hopes to create thousands of public sector jobs

-

Pre-budget meeting: Ruling party’s lawmakers take up cause of farmers

Party urges Nawaz to introduce subsidies to ensure greater competitiveness

-

Economic Survey 2014-15: Losses due to war on terror down by a third to $4.5b

Total cost, direct and indirect, caused by terrorism in the country since 2001 tops $107 billion

-

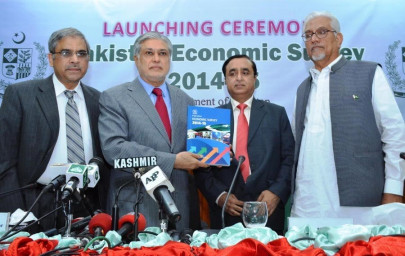

Economic Survey 2014-15: Ishaq Dar touts economic growth amidst missed targets

Government misses major economic targets

-

Budget 2015-16: Science and technology a lost cause for govt

Govt drastically slashes development budget in upcoming PSDP; not a single project approved

-

Budget 2015-16: Incentives for industries, agriculture sectors likely

Iqbal stresses country will notch up 5.5% growth next year.

-

Budget 2015-16: 10% WHT likely on advertisement income

Tax on media houses aimed at generating Rs5b during new fiscal year

-

Accountability: Audit last budget before deciding this year’s, demands PTI

Ali Zaidi accuses Sindh govt of misappropriating last year’s funds.

-

Political economy

Recent rise of globalised and globalising middle classes and groups means that margins look more like mainstream

-

Harmonising state policies with economic pragmatism

With narrow economic base, heavy dependence on foreign assistance, Pakistan has to be prudent in resource mobilisation

-

GDS target likely to be slashed for next year

Collection is expected to be Rs29.9b, which is 35% lower than this year.

-

FPCCI seeks incentives for oilseed growers

Better crops will help lessen reliance on edible oil imports.

-

Budget 2015-16: 12% of approved funds goes to CPEC’s western alignment

NEC allocates Rs171 billion for corridor related projects next year.

-

Budget discussions: PM Nawaz kept key bodies ‘out of the loop’

Proposed FED on internet usage might decrease use of social media.

-

KCCI wants duty on milk decreased

Chief urges government to make commodity cheaper.

-

Budget 2015-16: Budget will exceed Rs470 billion

Muzaffar Said adds no new taxes levied; higher sums doled out for education, health and local govt

-

Budget preview

Pakistan’s fiscal problem will not be fixed until the govt gets serious about cracking down on culture of tax evasion

-

Setback: Govt struggling to keep next budget under Rs4.2t

LHC ruling declaring imposition of electricity surcharges illegal raises power subsidies’ requirement to Rs250 bn

-

Sindh industrialists demand reduction in GIDC

Govt wants to increase GST to 5% at yarn stage, slap 5% tax on cotton sales and another 5% on power consumption.