Weekly Review: KSE-100 gains foothold above 18,000-point barrier

Strong corporate earnings and foreign inflows propel market to record high.

Strong corporate earnings and foreign inflows propel market to record high.

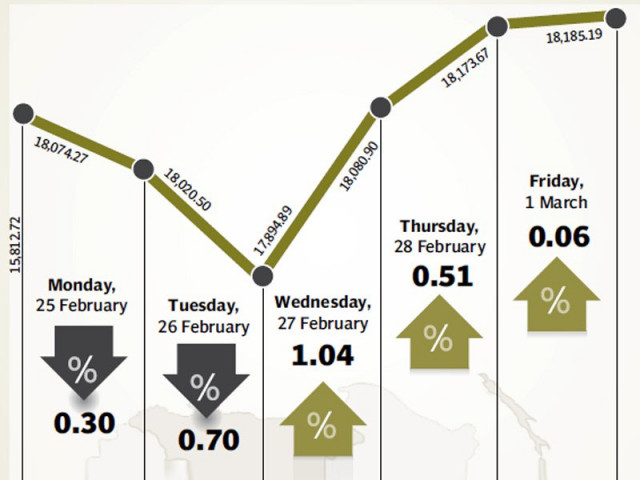

The stock market continued its upward march, as strong corporate earnings and sustained foreign inflows pushed the benchmark KSE-100 index to a new peak, climbing 111 points (0.6%) during the week ended March 1.

Fears of a correction at the 18,000-point mark initially proved true as the index slumped below the barrier in the initial two days of the week. However, bulls made a comeback and the index recovered strongly to close the week in the black.

With the earnings season coming to a close, announcements by Hub Power Company, National Bank of Pakistan and United Bank Limited were the highlights of the week as all three surprised investors with good results and payouts.

Hub Power Company posted a 50% growth in its bottom line for the first half of the current fiscal year and backed that up with a payout of Rs3.5 per share. Investors had initially feared that the company would discontinue its high payout policy under the new management of the Dawood Group.

The announcement allayed those fears and the company’s stock outperformed the market by 4.1% during the week.

National Bank of Pakistan also surprised investors with a payout of Rs7 per share and a stock dividend of 15% to go along with it. UBL also reported a 30% growth in its bottom line with a dividend of Rs3.5 per share.

Foreigners were also active participants in the market in the final two days of the week and were net buyers of $10.5 million worth of equity during the week.

There was good news for the oil and fertiliser sectors as the Economic Coordination Committee approved a hike in marketing margin for oil marketing companies. The government also increased prices of petroleum products by 3-4% (withdrawn on Saturday) to account for rising international oil prices and depreciation of the rupee.

Furthermore, the ECC also approved supply of 35 million cubic feet per day (mmcfd) of gas to Engro’s Enven plant, which resulted in the company’s share price jumping 13%. However, there was negative news for the sector as well as fertiliser sales dropped 8% in January compared to the same month a year earlier.

Average daily volumes improved slightly by 5.1% to 324 million shares. Improved activity in blue chips took average daily values to Rs8.99 billion, up 6.1% over the previous week. Market capitalisation of the KSE increased 0.3% to Rs4.51 trillion by the end of the week.

With the earnings season drawing to a close, investor focus will now shift to the political situation as the government is due to finish its tenure in the next two weeks. Political noise over the appointment of caretaker government can drive the market in coming weeks.

Winners of the week

Dawood Hercules

Dawood Hercules Corporation produces urea fertilisers. The company also produces anhydrous ammonia for manufacturers of soda ash, fructose, and other chemicals.

Engro Corporation

Engro Corporation produces fertilisers, polyvinyl chloride resin, and industrial automation products, develops electricity generating plants, produces dairy foods, and operates a liquefied petroleum gas and liquid chemical terminal.

National Refinery

National Refinery manufactures and distributes lube base oils and petroleum fuels. The company markets its products to customers throughout Pakistan.

Losers of the week

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. It manages call centres and offices in Pakistan and elsewhere throughout the world.

NIB Bank

NIB Bank Limited is a commercial bank operating in Pakistan.

Soneri Bank

Soneri Bank Limited provides banking services.

Published in The Express Tribune, March 3rd, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ