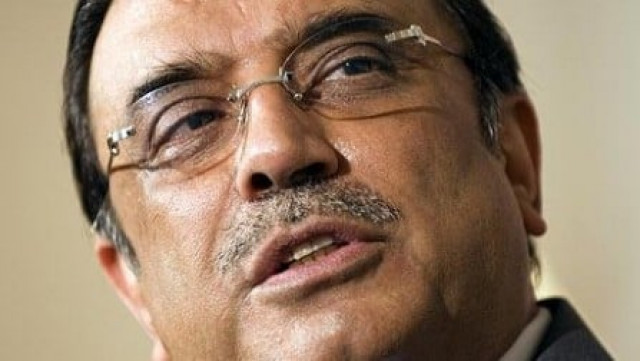

Demutualisation: Government committed to capital markets, says Zardari

SECP chief hints at floating government debt on stock market to raise additional funds for the government.

President Asif Ali Zardari has said that completion of the process of demutualisation of the stock exchanges in the country was a landmark achievement and a historic reformation of the country’s capital market with the initiative helping promote sustainable growth and spurring economic activity in the country.

The President in a meeting with a delegation comprising of representatives of Securities and Exchange Commission of Pakistan (SECP), Stock Exchanges of the country and leading security companies of the country at Chief Minister’s House Karachi complimented them for their support to such a landmark achievement.

Spokesperson to the President Senator Farhatullah Babar while giving details of the meeting provided context to Wednesday's meeting. He said that the Demutualization Bill was approved in a joint sitting of the Parliament on March 27, 2012 and was signed into law by the President on May 7, 2012. Babar said that the Pakistani stock exchanges were operating as non-profit companies with a mutualised structures where members had the ownership as well as trading rights. This pattern though created conflict of interest as members controlled the affairs of the stock exchange, resulting in lack of transparency in addition to compromising investors’ interests. The corporatisation and demutualisation of stock exchanges though converted the exchanges’ structure from non-profit, mutually owned organisation to for-profit entities owned by shareholders.

The President said that the government accords due importance and has always supported the capital market, adding that the passage of the Bill in the joint session of the Parliament clearly reflected the importance given to the stock exchanges by lawmakers.

Zardari said that capital markets channel savings into investments which in turn leads to increased employment and output. This way, he said, in developing countries like Pakistan, capital markets can play a great role in capital formation. Detailing his vision, the President said that Pakistan needs to make its stock exchanges a major source of capital formation.

The President noted the steady progress made by capital market and restoration of the investors confidence and emphasised that more needs to be done to make the market more liquid and efficient to attract investors.

Zardari reiterated that the government believes in providing a level playing field to the private sector, pointing towards far-reaching financial and structural reforms which have been introduced by the government, and that now it was for the private sector to avail step forward and raise capital through fresh debt and equity listings. He said that the debt market needs special attention.

The spokesperson said that Chairman SECP during the meeting suggested that capital markets should be utilised for government borrowings. Agreeing to his suggestion, the President remarked that the listing of government debt on the stock market will help raise additional funds in a timely and documented manner. He urged the Ministry of Finance to consider the suggestion and take necessary measures for implementing this initiative.

The President also expressed his support to the promulgation of other laws mentioned by the Chairman SECP which included The Securities Bill, The SECP Bill, Futures Trading Act and The Corporate Rehabilitation Act. Zardari urged the concerned standing committees of both the Houses to expedite finalisation of these laws.

While recounting the government’s commitment to encourage a culture of corporatisation, the President also emphasised upon the need for further reforms and to support enhanced entrepreneurship and corporatisation in the country and called upon the Federal Board of Revenue to encourage corporatisation through tax incentives.

The President pointed out that the country was offering attractive incentives to the investors by putting in place investment friendly regime. And that now the need was to attract foreign investment both channelised through the capital markets as well as directly into the system.

The delegation included chairman SECP Muhammad Ali, chairman Karachi Stock Exchange Muneer Kamal, chairman Lahore Stock Exchange Dr Salman Shah, chairman Islamabad Stock Exchange Muhammad Rashid Zahi, Managing Directors of the Stock Exchanges, Haji Abdul Ghani, Dr Yasir Mehmood, Syed Mukhtar Hussain Jafery, Akeel Karim Dhaidi, Arif Habib, Zafar Moti, Ameen Esa Tai, Yaseen Lakhani and others.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ