Weekly review: Foreign buying pushes KSE-100 up by 4%

Net foreign inflows stood at $33 million, up 159% from previous week.

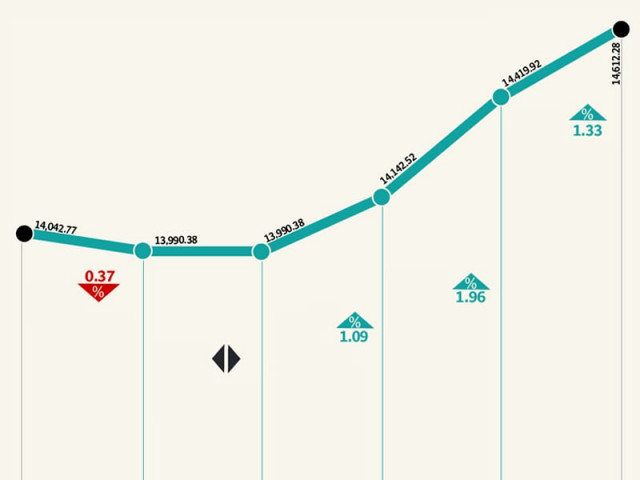

The stock market received a shot in the arm in the form of heavy foreign buying which resulted in the benchmark KSE-100 index climbing 570 points (4.1%) during the week ended May 4.

After crossing the 14,000-point barrier in the previous week, the KSE-100 index solidified its position above the psychological barrier as heavy foreign buying in the final three trading sessions of the week pushed the index to 14,612 points – a level last seen on May 5, 2008.

Foreign buying stood at $33 million during the week, jumping 159% over the previous week, as Pakistan was the recipient of 6% of total foreign inflows in the Asia-Pacific region (excluding Japan). The bourse, which has been devoid of any major foreign activity in recent times, reacted positively as a result.

The market’s gains came despite the fragile political situation of the country and weak macro-economic numbers, which would otherwise have a negative impact on it. Individual performances were also witnessed which aided the market’s growth.

On the political front, the opposition parties announced that they would launch protests across the country demanding the resignation of the prime minister, after he was convicted in a contempt of court case. The prime minister, however, remained defiant and has refused to relinquish his post.

Macro-economic data was another concern, as inflation for April 2012 stood at 11.3%, as compared to 10.8% in the previous month. The rise in the inflation number is likely to dent any chances of a discount rate cut. However, the number still remains below the 12% target for financial year 2011-12.

Furthermore, the rupee continued to slide against the US dollar and dropped to an all-time low of Rs91.07 per dollar. At the same time, the country’s foreign exchange reserves grew nominally and stood at $16.43 billion as compared to $16.42 billion in the previous week.

Stock-specific activity was also witnessed at the bourse, with Engro Foods leading the way with gains of 20.3% during the week. The company’s impressive earnings growth in the first quarter provided stimulus to the stock, which now trades at Rs66.91 on the KSE. The share traded in the region of Rs20 at the start of 2012.

Pakistan Telecommunication Company also climbed 20.1% during the week, on news of a pricing arrangement between Long Distance International operators, according to a report by JS Research.

The fertiliser sector also performed well, with Fatima Fertilizer and Engro Corporation climbing by 12.4% and 7.5% respectively.

Volumes grew marginally by 1.2% and stood at an average of 259.9 million shares per day during the week. Average daily value also climbed by 0.5% and stood at Rs7.27 billion per day. The market capitalisation increased 4% to Rs3.73 trillion by the end of the week.

Monday, April 30th

The stock market plummeted on its opening day, but recovered some losses as the day progressed. The law and order situation in Karachi – coupled with the political situation in the country – kept the trading session dull.

Tuesday, May 1st

The stock market was closed owing to the Labour Day holiday.

Wednesday, May 2nd

The stock market kicked-off May on a strong note, with the index rising healthily on the opening day of trading for the month.

Thursday, May 3rd

The bulls continued their charge; as investors rallied aggressively across the board, riding a wave of positivity generated by the recently-signed Capital Gains Tax (CGT) ordinance.

Friday, May 4th

The stock exchange rounded off the first week of May with a sustained bull rally that saw the index close at levels last witnessed four years ago. During the day, the value of shares traded also surged past the Rs10 billion mark to a 15-month high. Foreign flows have soared during the week, clocking in at a healthy $13 million for the first three days of trading for the month, while another $19.57 million worth of securities were bought by foreigners on Friday.

Published in The Express Tribune, May 6th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ