Weekly review: Friday’s profit-taking drags bourse down from historic highs

Macroeconomic indicators, positive and negative sector-specific news keeps market volatile.

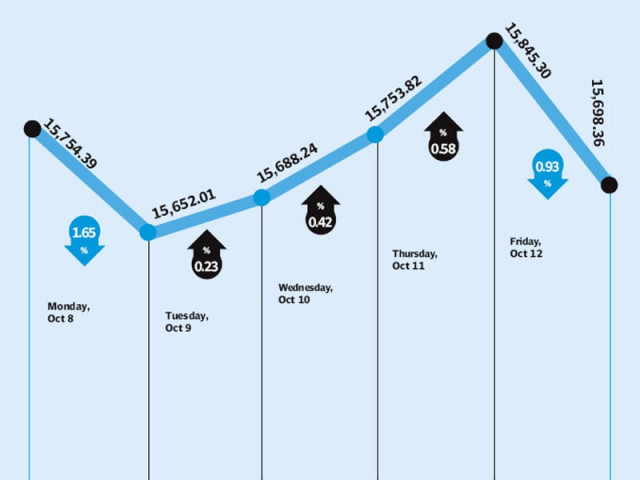

The bourse remained volatile this week, wobbling near the 16,000 psychological level, however, profit-taking in the final trading session of week pulled the bourse down.

The benchmark KSE-100 index closed down 0.4% during the week at 15,694.21 points.

The market was negatively impacted by a lower than anticipated 50 basis points cut in the interest rates, announced last Friday by the State Bank of Pakistan, amidst slower global growth projections by the International Monetary Fund, according to AKD Research report.

Trading activity also remained thin with average daily volumes dropping to 117 million shares, down 12.7% week-on-week.

Macroeconomic indicators that provided the momentum to the market were the cut in National Saving Schemes (NSS) rates, new blocks up for bidding under the new Petroleum Policy 2012, release of cement, auto sales data for September and trade deficit figures, according to Naveed Tehsin, analyst at JS Global Capital.

The government slashed profit rates by 46-80 basis points on NSS with effect from Friday.

Under the newly-approved petroleum policy, the government decided to offer 50 oil and gas blocks for exploration and production bidding alongside the introduction of a new low-British thermal unit gas policy and the increase in gas prices for the oil and gas sector.

The news that cement dispatches for September 2012 were recorded at 2.61 million tons, up 14.2% year-on-year, attracted positive sentiments, according to All Pakistan Cement Manufacturers Association.

On the other hand, auto sector faced a setback as sales of locally assembled cars were down 31% year-on-year and 6% month-on-month for September 2012, data from Pakistan Automotive Manufacturers Association shows. Due to the news, the automobile sector underperformed the market by 2.4% during the week.

The trade deficit shrank by almost 10% to $4.7 billion from July to September 2012 (first quarter) against $5.2 billion in the corresponding period of the preceding fiscal year.

In sector-specific and corporate news, Pakistan Telecommunication Company remained in the limelight over the implementation of the international clearing house and on account of pre-result rally amid better earnings anticipation.

The banking sector rebounded during the week over anticipations that margins will not squeeze due to lower rate cut.

Fertiliser sector was battered as earlier the Sui Northern Gas Pipelines (SNGPL) said that it will be unable to provide further gas to fertiliser producers on its network due to low gas pressure. The SNGPL network includes Pakarab Fertilizer, Engro Enven, Agritech Limited and Dawood Hercules Fertlizer plants. Foreigners showed interest in the market, with net buying worth $9.4 million in the week.

Outlook

Going forward with major September quarter result announcements due next week, activity will primarily be determined by it, said Samar Iqbal, equity dealer at Topline Securities.

However with the recomposed index to free float from October 15 the market will stop following the trend and depend less on the index-heavyweight sectors – the oil and gas sector.

Winners

Pace Pakistan

Pace (Pakistan) Limited is a real estate development company focused on building, acquiring, managing and selling condominiums, departmental stores, shopping plazas, super markets, utility stores, housing societies and carrying out commercial, industrial and related activities.

Engro Corporation

Engro Corporation manufactures and markets fertilisers and plastics, generates electricity, and processes food. The company produces nitrogenous, phosphatic and blended fertilisers, polyvinyl chloride resin, and industrial automation products, develops electricity generating plants, produces dairy foods, and operates a liquefied petroleum gas and liquid chemical terminal.

Dawood Hercules

The principal activity of the company is production, purchase and sale of fertiliser. The company has an annual production capacity of 345,000 tons and markets its urea under the brand name Bubber Sher.

Losers

Colgate Palmolive

Colgate-Palmolive is primarily engaged in the manufacture and sale of detergents, personal care and other related products. The company’s products are categorised as oral care, personal care, surface care and fabric care.

Packages Limited

Packages Limited, together with its subsidiaries, engages in the manufacture and sale of paper, paperboard, packaging materials, and tissue products in Pakistan, Sri Lanka, and internationally.

Jubilee General Insurance

Jubilee General Insurance Company is an insurance provider. The group offers a number of lines of coverage, including health, fire, marine and miscellaneous.

Published in The Express Tribune, October 14th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ