Textile sector warns of export crisis

September exports down 11.7%; textile council urges predictable energy pricing

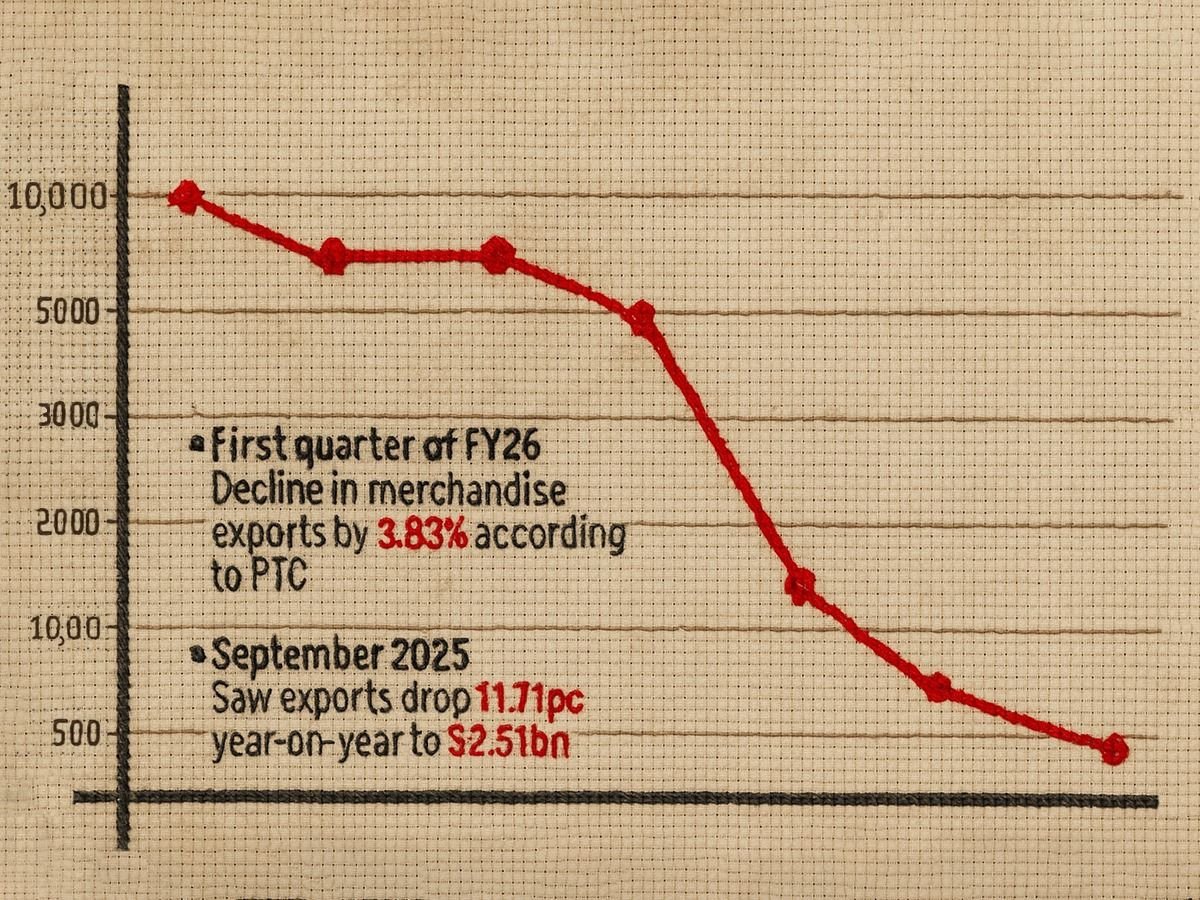

Pakistan's largest export sector is in deep crisis, as the Pakistan Textile Council (PTC) and other leaders sounded an alarm over a sharp decline in exports, factory closures, and mounting costs that threaten the country's economic stability. Exports fell nearly 12% year-on-year in September, dragging first-quarter FY26 proceeds down by 3.83% to $7.61 billion, while a widening trade deficit and surging imports add further pressure on external accounts.

Industry stakeholders, including PTC Chairman Fawad Anwar, KCCI's former president Javed Bilwani, and industrialist Zubair Motiwala, warned that without urgent reforms on energy pricing, taxation, and facilitation schemes, Pakistan risks losing its competitive edge to regional rivals like Bangladesh, India, and Vietnam. The abrupt end of the Export Facilitation Scheme (EFS), coupled with record-high energy tariffs and deteriorating infrastructure, was cited as a major blow to the already struggling textile sector.

In a statement, the Pakistan Textile Council (PTC) expressed deep concern over a decline in merchandise exports by 3.83% in the first quarter of FY26, raising red flags for the country's economic outlook. According to the Pakistan Bureau of Statistics (PBS), total export proceeds stood at $7.61 billion during July and September, down from $7.91 billion in the same period last year. September alone saw exports drop 11.71% year-on-year to $2.51 billion, marking the fifth month of contraction in the last six.

Design credit: Mohsin Alam

This continued decline in exports comes at a time when Pakistan is also facing a widening trade deficit, which rose to $9.37 billion in the first quarter, up from $7.05 billion last year. Imports surged by 13.49%, compounding the pressure on external accounts. The textile sector, Pakistan's largest export engine, is bearing the brunt of both subdued global demand and rising domestic costs.

Closures underscore cost crisis

Against this backdrop, a series of industrial closures and multinational exits highlight the depth of Pakistan's competitiveness crisis. Gul Ahmed Textile Mills Limited recently announced the closure of its export apparel segment, citing sustained losses from high input costs, shifting taxation, and stiff regional competition. The apparel segment is highly labour-intensive, employing thousands, and its closure is a stark warning of the pressures driving even market leaders to scale back.

Speaking to The Express Tribune former president of KCCI said, "More textile units across Pakistan are on the verge of closure as industries continue to operate at a loss." He criticised the government for sidelining key stakeholders in policymaking and talking to either minor stakeholders or totally irrelevant people.

Despite KCCI's contribution of 54% to exports and 66% to the national tax base, we are not heard in any policymaking process, he said.

Highlighting the multiple crises confronting the textile sector, he pointed to severe infrastructure challenges, chronic water shortages, poor law and order, and some of the highest electricity tariffs in the world - higher even than Europe and the US, which are Pakistan's major export destinations. "If production costs here exceed the cost at export destinations, how can exports remain viable?" he asked.

Bilwani further stressed that the abrupt end of the EFS had dealt a major blow to the industry. He argued that instead of scrapping the scheme altogether, the government should have plugged loopholes and strengthened regulations.

Echoing Bilwani's concerns, leading industrialist Zubair Motiwala said the collapse of exports is tied directly to the withdrawal of EFS. "The only real solution is the restoration of EFS. If there was a legal issue, it should have been corrected, not abolished," he said. He added that the recent closure of Gul Ahmed's export apparel unit was a direct result of rising costs compounded by the absence of export facilitation measures.

The crisis is not confined to textiles. In recent months, global players such as Procter and Gamble, Microsoft, Shell, Total Energies, Pfizer, Sanofi, and Careem have either exited or significantly reduced operations in Pakistan.

The PTC has repeatedly urged the government to take urgent corrective steps to restore competitiveness: 1) Regionally competitive and predictable energy (RLNG & Electricity) pricing for export industries; 2) Tax reforms, including automated 72-hour refunds and zero-rating of input under the Export Facilitation Scheme; 3) Financing facilitation, including strengthening EXIM Bank and expanding Export Finance and Long-Term Financing Facilities (LTFF); 4) Policy stability, monitored transparently with monthly KPIs.

"If urgent corrective measures are not taken, Pakistan risks further closures of export-oriented units and reduced foreign investment," warned the PTC chairman. "This will not only mean job losses and industrial shutdowns, but also a sharp decline in Pakistan's foreign exchange earnings at a time when the country cannot afford such shocks."

COMMENTS (2)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ