Govt proposes income tax relief for salaried class

Budget 2025-2026 proposes up to 4% income tax cut for lower, middle-income sectors

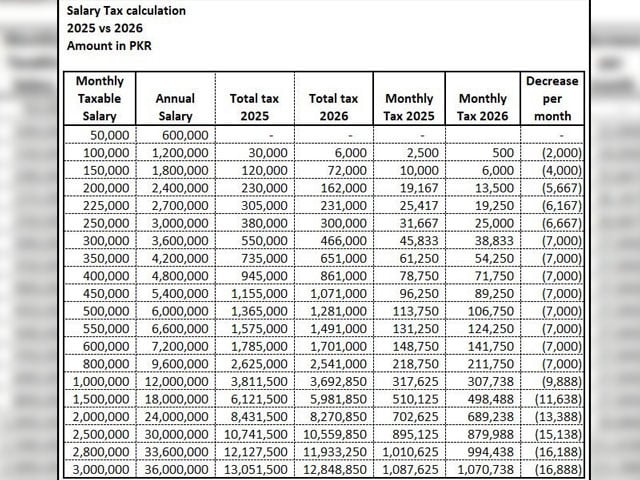

The government has taken a significant step to provide substantial relief to lower and middle-income sectors, proposing up to a four per cent decrease in income tax across various slabs.

Presenting the federal budget for the fiscal year 2025-26, Finance Minister Muhammad Aurangzeb stated that the prime minister had consistently endeavoured to lower taxes on salaried individuals.

"Keeping this objective in mind, we have proposed a decrease in income tax across all slabs," he said. "This measure will not only ease the existing tax structure but also strike a crucial balance between inflationary pressures and individuals' take-home pay by alleviating the tax burden."

Under the new budget, individuals earning between Rs0.6 million (Rs50,000 monthly) and Rs1.2 million per annum (Rs100,000 monthly) are set to receive significant tax relief, as the government has lowered their tax rate from five per cent to one per cent. For those earning up to Rs100,000 per month, the federal budget also proposes a reduction in the total tax amount from Rs30,000 to Rs6,000.

Similarly, individuals earning up to Rs2.2 million per annum will see a four per cent decrease in tax on their salaries, bringing the rate down from 15 per cent to 11 per cent.

Some relief has also been extended to the higher income bracket. Individuals earning up to Rs3.2 million will benefit from a two per cent cut, reducing their tax rate from 25 per cent to 23 per cent for the upcoming fiscal year.

Meanwhile, in a move to mitigate the brain drain phenomenon, which sees professional human resources facing the highest tax burden in the region, the government has proposed a one per cent decrease in the surcharge applied to individuals earning more than Rs10 million per annum.

Earlier, it was revealed that the salaried class paid a staggering Rs331 billion in income tax in the eight months of the current fiscal, which is 1,350% more than the taxes paid by retailers, but still not enough for the government to seek relief from the International Monetary Fund (IMF) for the marginalised segment.

The total income tax contributions by the salaried people during the July–February period of this fiscal year were Rs120 billion, or 56% higher than the Rs211 billion collected during the same period of the last fiscal year.

Last year, the salaried class paid Rs368 billion in taxes. But despite this backbreaking burden on the salaried people, who pay taxes on their gross income without adjusting expenditures, the government did not take up the issue of lessening this burden with the IMF during the recently held talks.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ