Economic Survey shows GDP, investment targets missed, inflation remains under control

Government managed to consolidate economic recovery by avoiding a ‘sugar rush’

Islamabad: The Economic Survey of Pakistan has shown that the government managed to consolidate economic recovery by avoiding a “sugar rush” and stabilizing the external sector but it again could not meet the most critical targets of giving credible economic growth figures and increasing investment.

At the launching of Economic Survey of Pakistan for fiscal year 2024-25, Finance Minister Muhammad Aurangzeb on Monday also proposed a new formula for distribution of resources between the center and the provinces under the National Finance Commission.

He suggested delinking the population from the NFC, which constitutes 82% of the distribution of resources among the four provinces.

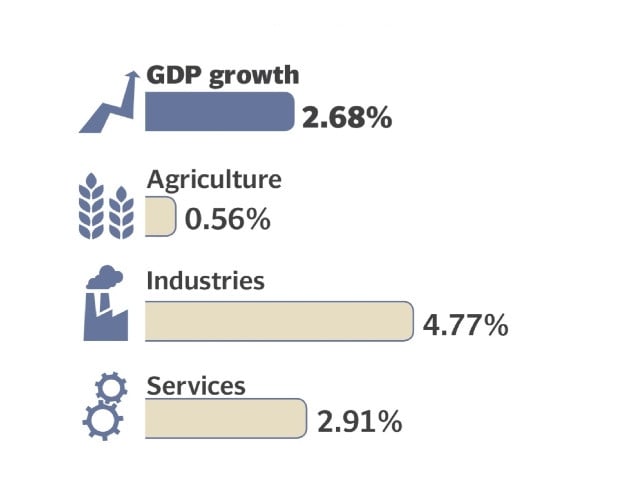

The economic growth rate is 2.7%, which is a right way to go for sustainable growth to avoid boom and bust cycles, said the Finance Minister while referring to historical patterns of achieving higher growth rates and then collapsing next year.

However, the claimed growth rate is below the target of 3.6% and is also disputed by the independent economists.

The Finance Minister further said that the inflation has been “a fantastic story”, which slowed down to 4.6% this year and is in the right direction.

The recovery that began last year has been consolidated this year and the next year will be the year of economic turnaround, said the Finance Minister.

But he struggled to defend the 2.7% claimed economic growth figure for the outgoing fiscal year and offered to set up a committee of experts to review the opposite point of view.

“The data has been provided by the government and we will stick to it”, said the Finance Minister while responding to questions about discrepancies in the data used to work out the 2.7% economic growth number. The Finance Minister said that he was open to review the numbers being highlighted to point out discrepancies.

Data integrity is absolutely critical and there is always a room for improvement, said the Finance Minister. He said that the government can constitute a steering committee having members from the private sector to review the data.

The independent statisticians and economists have challenged the government’s claim that the economy grew by 2.7% in this fiscal year. To achieve this figure, the economy has to grow by 5.3% in the April-June period with large scale manufacturing ought to be growing over 8%. The government throughout the fiscal year stated that the electricity generation was on decline but the economic survey showed that there was a 39.3% increase in gross value addition in the electricity sector. Likewise, the construction sector, which is also affected by the taxation policies and low demand, was shown as growing by 6.6%.

The government throughout the fiscal year stated that the electricity generation was on decline but the economic survey showed that there was a 39.3% increase in gross value addition in the electricity sector. Likewise, the construction sector, which is also affected by the taxation policies and low demand, was shown as growing by 6.6%.

Also, all the major crops saw a dip in their output. The output of wheat declined 9%, rice 1.4% and cotton 31%.

Regarding queries about low growth coupled with high poverty and unemployment, the Finance Minister said that the government will not get into a sugar rush and will absolutely stay on the course of the economic reforms agenda.

To another question, the Finance Minister said that there was a need to control the population growth, as the current rate of 2.6% was unsustainable. One of the measures to control population is “delinking population from the National Finance Commission, " said the Finance Minister in a policy statement that will set the tone for the August NFC talks.

While commenting on the plight of the agriculture sector, the Minister said that had the agriculture sector growth remained at the last year’s level, the overall economic growth rate could have been close to 3.6%.

The government missed its investment-to-GDP target of 14.2%. It remained at 13.8% that too by assuming the entire Rs1.1 trillion public sector development programme will be fully spent. The private sector investment target was missed by a wide margin and it was glued at 9.1% of the GDP despite efforts to bring investment from abroad under the umbrella of the Special Investment Facilitation Council.

The SIFC will play a role in bringing investment in the energy, information technology and mining sectors, which will be a game changer for the economy, the Finance Minister said.

The government met the inflation target of 12% and it remained below 5% in this fiscal year, marking its important achievement.

But the government missed the tax target by a huge margin of over Rs1 trillion. The Finance Minister said that the FBR transformation plan will take two to three years for full implementation. The minister said that there has been widening of the tax base with both individual return filers and registered retailers numbers going up compared to the last year.

He said that the energy ministry has done a good job to improve recoveries of the bills but he said that the overall state-owned enterprises losses were still nearly Rs1 trillion, which can be avoided.

To a question about reducing expenses, the Secretary Finance Imdad Ullah Bosal said that Pakistan has achieved the fiscal consolidation under the IMF programme and there is no more space available for reducing the expenditures. For the next fiscal year too, the maximum possible reduction in the expenditures has been proposed, said Bosal.

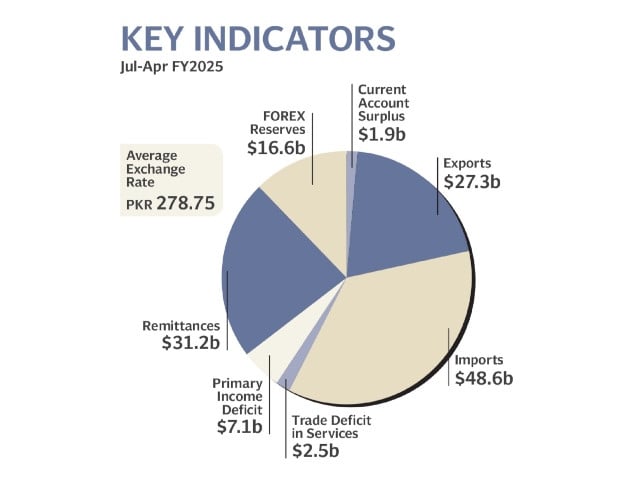

Our dilemma remains the twin deficit but this year, the current account will remain in surplus and the foreign exchange reserves have increased to $11.5 billion, said the Finance Minister. He said that the Pakistan Remittances Initiative and the Roshan Digital Accounts should be appreciated for increasing the foreign inflows.

He said that the foreign remittances are expected to hit $38 billion in this fiscal year while the cumulative inflows under the digital accounts have increased to $10 billion.

The per capita income is now claimed to have increased to $1,824 and the size of the economy in dollar terms is $411 billion, according to the survey. On the basis of latest figures of the national accounts aggregates for FY 2024-25, the overall size of the economy stands at Rs114.7 trillion.

Agriculture sector

The survey showed that the output in important crops has decreased by 13.5% due to a decrease in production of wheat from 31.8 million metric tons to 29 million tons. The claim of 29 million tons wheat production was far higher than the Ministry of Finance’s own projections of around 26 million tons expected production this year.

The production of maize decreased 15.4% to 8.24 million tons, rice output fell 1.4% to 9.7 million tons and sugarcane output decreased 4% to 84.24 million tons. Cotton crops sustained a major hit with 31% dip in production. The cotton bales decreased from 10.22 to 7.1 million bales.

Despite reduction in the production of grams by 17%, other crops have posted a provisional growth of 4.8% due to double-digit growth in the production of potato, onion, mango and sesame.

While cotton ginning & miscellaneous components have declined by 19%, livestock, forestry and fishing have posted provisional growth rates of 4.72%, 3.03% and 1.42%.

Industrial growth

The government has claimed that the “industry has shown a growth of 4.77% ”. Despite an increase in the production of coal (2.84%), the mining & quarrying industry contracted by 3.4% because of a decrease in production of natural gas by 7.05%, crude oil output decreased 14.7%.

The large scale manufacturing, has also witnessed a negative growth of 1.53% with mixed trend in the production of various groups e.g.

“Electricity, gas and water supply industry has shown a positive growth of 28.9% primarily due to low base effect of FY 2023-24 i.e. -19.86% as well increase in output of WAPDA & companies”. Construction industry increased by 6.61% due to increase in construction-related expenditures by the private sector and general government, it added.

The growth in the construction sector is based on the claim that the government will spend Rs1.1 trillion on development in this fiscal year, which is untrue. Likewise, the electricity growth claim is based on the assumption that Rs1.2 trillion power subsidies will be utilized in this fiscal year.

Services Sector

The services sector has also shown a growth of 2.91% in 2024-25 with positive contributions from all the constituents. Wholesale and retail trade has witnessed a modest growth of 0.14% because of slower output growth in agriculture and manufacturing. Transport and storage industry has increased by 2.2% because of the increase in output of water, air and road transport.

Information & Communication has grown by 6.5% due to an increase in output of computer programming and consultancy activities (24%). Slower rate of inflation and low base effect has resulted into positive growth rates in Finance & Insurance and Public Administration and Social Security industries at 3.22% and 9.92%, respectively.

Further, both Education and Human health and Social Work industries have posted positive growth of 4.43% and 3.71%, respectively.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ