Current account surplus hits $349m

Gets critical support from 24% spike in remittances, 11% rise in exports

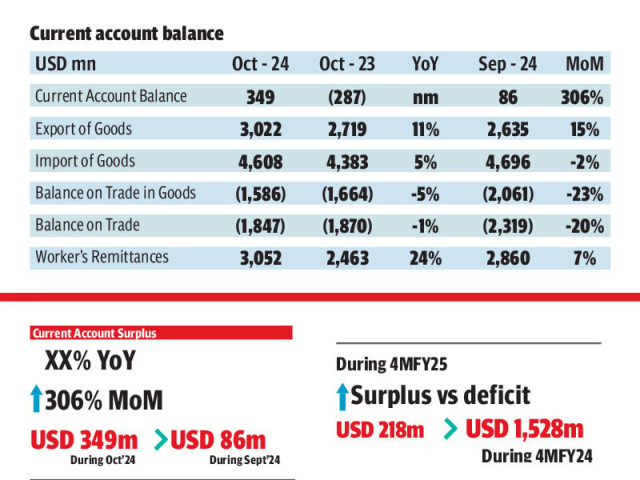

Pakistan posted a current account surplus of $349 million in October 2024, the third consecutive monthly surplus, in the wake of strong inflows of workers' remittances and improvement in export earnings.

According to the State Bank of Pakistan's (SBP) data on Monday, the notable surplus in October led to a cumulative current account surplus of $218 million for the first four months (Jul-Oct) of the current fiscal year compared to a deficit of $1.53 billion in the same period of last year.

The surplus is expected to help the Pakistani currency remain stable against the US dollar and other global currencies, bolster the foreign exchange reserves and boost the country's capacity to smoothly pay for the rising imports and repay the maturing foreign debt.

The surplus, however, was achieved at the cost of economic growth, limiting it to 2.5% for FY24. The suppression of imports to cool down the then overheated economy (high inflation and large current account deficits) continued to keep industrial output compromised, badly hurting new employment opportunities in the country.

On the other hand, the restricted imports helped boost the country's foreign exchange reserves to two months of import cover compared to less than one month in June 2023, which staved off the risk of default on foreign debt obligations.

The balancing act and the boost in reserves encouraged the global credit rating agencies including Moody's and Fitch to upgrade Pakistan's rating by one notch within the 'C' category during July-August 2024.

According to the central bank data, the current account had recorded a deficit of $287 million in October last year. On a month-on-month basis, the surplus surged by over 300% to $349 million in October 2024 compared to $86 million in the prior month of September.

Inflows of workers' remittances spiked 24% to a four-month high at $3.10 billion in October compared to $2.53 billion in the same month of last year.

The export of goods increased 11% to $3.02 billion in the month under review compared to $2.72 billion in the corresponding month of the previous year. Export of services improved 13% to $689 million compared to last year.

On the other hand, the import of goods increased 5% to $4.60 billion in October 2024 compared to $4.38 billion in the prior year. Import of services rose 17% to $950 million compared to $814 million last year.

The SBP has projected the full fiscal year current account deficit in the range of 0-1% of GDP (a maximum of around $4 billion), anticipating higher imports and economic activities later in the year.

The forecast came amid a slowdown in inflation that receded into single digit at 7.2% in October compared to the multi-decade high of 38% in May 2023 and a substantial reduction in interest rate on credit supply to the private sector.

Talking to The Express Tribune, AKD Securities Director Research Muhammad Awais Ashraf said the government is expected to keep the current account balance at the breakeven level (a modest surplus or a deficit) throughout the current fiscal year "to overcome the projected shortfall of $2.5 billion in foreign financing."

He said authorities have estimated the current account deficit for the ongoing fiscal year at a maximum of $4 billion ahead of the uptick in imports to support economic activities. "The government, however, will try to restrict it (C/A deficit) to $1.5 billion to save $2.5 billion to fill the foreign financing gap." The government may maintain imports near $5 billion a month in the remaining eight months of the current fiscal year compared to slightly above $4.5 billion in the first four months of FY25. Accordingly, economic growth will remain moderate within the SBP's projected range of 2.5-3.5% compared to 2.5% in FY24.

He said the robust inflows of workers' remittances at around $3 billion a month would continue to help keep the current account at breakeven level and they would remain a rich source of improving the balance of international payments and the foreign currency reserves.

To recall, Finance Minister Muhammad Aurangzeb has recently projected FY25 remittances at $34 billion compared to $30.25 billion in FY24, a year-on-year growth of 12%.

Ashraf recalled that the government has limited imports equivalent to the sum of inward remittances and export earnings, which resulted in a current account surplus in the past three consecutive months. The government is expected to maintain the strategy in future as well.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ