WATCH: Journo’s question leaves FM searching for answers

Journalists stage protest against imposition of taxes on salaried employees before Aurangzeb’s post-budget presser

Journalists staged a protest against the imposition of heavy taxes on salaried employees before Finance Minister Muhammad Aurangzeb's press conference on Thursday.

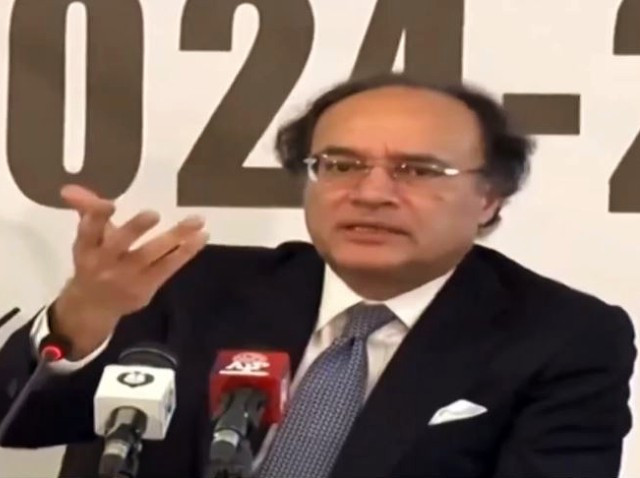

The finance minister was set to address a post-budget press conference in Islamabad when journalists stood up in protest.

The journalists recorded a token protest just before the start of the press conference. They voiced concerns that while salaries in the private sector are not increasing, hefty taxes have been imposed on private sector employees.

Responding to a journalist's question about the increase in taxes on salaried people announced a day earlier, Finance Minister Aurangzeb struggled to give a coherent answer.

The Express Tribune earlier reported that the federal government increased the tax rate for both salaried and non-salaried taxpayers in the federal budget for the next financial year, placing a cumulative burden of Rs75 billion on the salaried person, Rs150 billion on the non-salaried individuals.

The budget proposed a maximum tax rate of 35% for the salaried persons, and 45% for non-salaried individuals. The minimum threshold of Rs50,000 monthly income had been maintained for both the categories, while the number of tax slabs would also remain at 6.

The salaried people in the first tax slab with the income of up to 600,000 per annum or Rs50,000 per month had been exempted from income tax. In the second tax slab, the income tax for those earning between 600,000 and 1.2 million per annum would be 5%.

This 5% tax, according to the Finance Bill, would be charged on the amount after deducting Rs600,000 from the total annual income. Hence, in this category, the monthly income tax would increase from Rs1,250 per month during the current fiscal year to Rs2,500 per month in the next fiscal year.

Under the third slab, which covered individuals, having the annual income of Rs1.2 million to Rs2.2 million, a fixed tax of Rs30,000 would be levied along with 15% income tax. The tax payment in this category would increase from the current Rs11,667 to Rs15,000 per month.

In the fourth tax slab, which covered individuals having the annual income of Rs2.2 million to Rs3.2 million, the fixed tax would be Rs180,000, besides 25% tax on the remaining amount after deducting Rs2.2 million. Overall, the per-month tax in this slab would increase from Rs28,770 to Rs35,834.

In the fourth tax slab, which covered individuals having the annual income of Rs3.2 million to Rs4.1 million, the fixed tax would be Rs430,000, besides 30% tax on the remaining amount after deducting Rs3.2 million. Overall, the per-month tax in this slab would increase from Rs47,408 to Rs53,333.

While for the sixth tax slab, the top-most category comprising individuals having the annual salary income of more than Rs4.1 million, the fixed tax of Rs700,000 would be levied in addition to 35% income tax on the remaining amount after deducting Rs4.1 million from the total salary.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ