Remittances soar to 3-month high

Surge by 26% to reach $2.39b in January 2024, signalling confidence in economy

The inflows of workers’ remittances sent home by overseas Pakistanis reached a three-month high at $2.39 billion in January 2024, instilling confidence in the domestic economy following the disbursement of the second loan tranche of $700 million from the International Monetary Fund (IMF) during the same month.

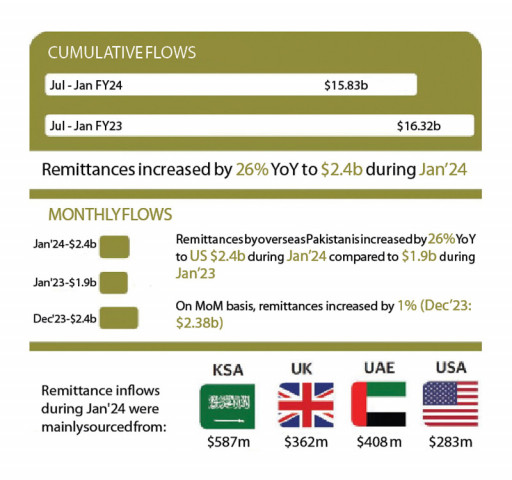

According to the State Bank of Pakistan (SBP), remittances surged by 26% to $2.39 billion in January compared to $1.90 billion in the corresponding month of the previous year. This marked a nearly 1% increase from the $2.38 billion received in December 2023.

However, cumulatively in the first seven months (Jul-Jan) of the current fiscal year 2023-24, remittances remained 3% lower at $15.83 billion compared to $16.32 billion in the same period of the previous year.

SBP Governor Jameel Ahmed had anticipated late last month in January that remittances would grow in the second half (Jan-Jun) of the fiscal year 2023-24, following the announcement of incentives aimed at attracting higher remittances. Additionally, the outlook for the global economy has improved in recent months, supporting non-resident Pakistanis in earning and sending more money back home.

He projected that remittance receipts would increase to $28 billion for the full fiscal year 2023-24, compared to $27 billion in the previous fiscal year 2022-23.

Central bank data suggests that remittance inflows have been comparatively higher in each of the last four months (Oct-Jan) compared to the same months in the previous year.

Speaking to The Express Tribune, Arif Habib Limited, Head of Research, Tahir Abbas said that remittances are expected to remain high with two Eid festivals falling within the last five months of fiscal year 2023-24.

“Historical data suggests that remittances peak around the Eid festivals,” he stated.

According to central bank data, remittances reached their highest levels of $2.53 billion in fiscal year 2022-23 and $3.12 billion in fiscal year 2021-22 during the months coinciding with the festivals.

Abbas said that his research house has estimated that full-year remittances for fiscal year 2023-24 would range between $28.5 billion and $29 billion, close to the IMF projection of $29.4 billion for the year.

He stressed the need to address the recent political turmoil in the country through dialogue to maintain stability in remittances and economic activities. Additionally, the government’s new economic roadmap would provide direction to overseas Pakistanis regarding remittance flows.

Read Rupee surges on remittance boost

Government efforts towards securing a new IMF loan programme at the completion of the current one of $3 billion in March 2024 will also be a significant development which the world will observe before taking financial decisions for Pakistan.

Market discussions indicate that the latest receipt of the IMF loan tranche has instilled new confidence in local businesses, financial and capital markets, and Pakistan’s foreign Eurobonds in global markets. Pakistani expatriates have demonstrated confidence in the country by sending higher remittances to their families and friends back home.

Abbas recalled that remittances began improving after the outgoing caretaker government cracked down on foreign currency smugglers in early September 2023. This crackdown significantly curbed illegal outflows, resulting in an increased supply of US dollars in the domestic economy. As a result, the Pakistani currency has appreciated by almost 10% in the past five months to $279.33/$ in the interbank market as of Monday.

The restoration of stability in the rupee-dollar exchange rate and the crackdown on illicit hawala-hundi operators have encouraged more overseas Pakistanis to send funds through official channels such as banks and registered exchange companies.

Region-wise remittance inflows

Remittances from Saudi Arabia increased by 43% to $587 million in January 2024 compared to $409 million in the same month of the previous year.

Remittances from the UAE rose by 51% to $408 million in January compared to $270 million in the corresponding month of the previous year.

Pakistanis sent 9% higher remittances from the UK, amounting to $362 million compared to $331 million.

Remittances from EU countries increased by 20% to $290 million compared to $242 million. The diaspora sent $283 million from the US, marking a growth of 32% compared to $214 million. Remittances from other countries totalled $467 million in January, exhibiting an 8% increase from $433 million in the same month of the previous year.

Published in The Express Tribune, February 13th, 2024.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ