How is stagflation, import reliance challenging stability?

This is an unprecedented situation in the history of Pakistan

The economy has been embroiled in a judicial-political tussle since July 2022, leading to political turmoil and turbulence.

To make matters worse, the Extended Fund Facility (EFF) provided by the International Monetary Fund (IMF) has been stalled since September 2022.

In light of these circumstances, the government had to slow down the economy in order to address the decline in foreign exchange reserves caused by the balance of payments (BOP) constraint.

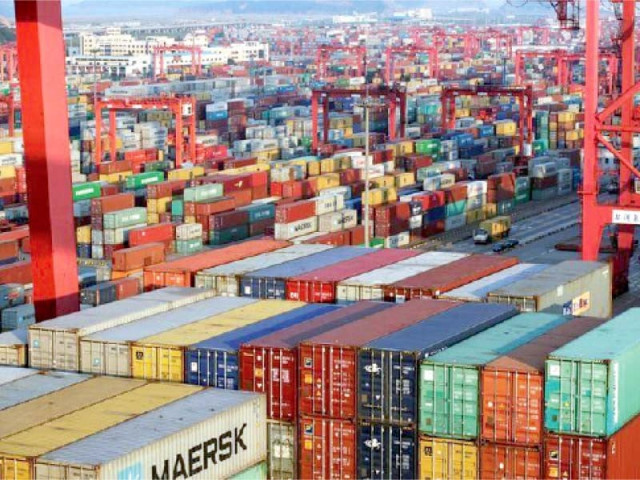

Imports reached approximately $45 billion, experiencing a deceleration of around 23% during the first 10 months of fiscal year 2023, while exports remained at approximately $23 billion, decelerating by around 14%.

Despite a global economic slowdown, the impact on the economy has been relatively mild. However, the combination of the BOP constraint and a scarcity of international finance has significantly exacerbated the economic situation.

Media commentators and analysts have been consistently predicting that Pakistan was on the brink of default since May 2022. Nevertheless, despite challenging circumstances, the government successfully averted a default, which is a positive development.

The government implemented several measures to manage the economy in the current circumstances. Import controls and restrictions were implemented to safeguard valuable foreign exchange reserves.

For a few months, the rupee-dollar exchange rate was maintained at around 225, with the expectation that the economy would attract foreign currency inflows. However, this did not materialise, and the rupee was subsequently allowed to float, following the guidelines of the IMF.

As a result, the rupee-dollar exchange rate is now approximately 285, which has significantly contributed to an increase in prices.

The implementation of import restrictions, coupled with a high policy rate, sent a signal to industrial capitalists indicating a decline in demand. Consequently, temporary production halts have been reported, and the growth of large-scale manufacturing turned negative during the first nine months of FY 2023.

Moreover, industrial capitalists anticipate a further decrease in demand in the upcoming months and have consequently reduced production and laid off workers.

When there is a decrease in product demand, industrialists scale back their output, resulting in reduced capacity utilisation. However, they do not lower product prices as they need to cover operational and maintenance costs and aim to avoid losses.

The prices of agricultural products are linked to the exchange rate between the rupee and the dollar. In the event of rupee devaluation, there is a potential for increased exports of agricultural products.

Merchants and dealers involved in the agricultural sector become active in exporting available commodities, leading to a temporary surge in exports. However, after a few months, these commodities become scarce, resulting in increased prices in the domestic market.

This indicates that temporary export increases do not have positive implications for the economy. Surplus commodities should be exported through proper planning and execution to avoid such issues.

Otherwise, the exported commodities would need to be imported within a year, and they would be available in the domestic market at higher prices.

This is an unprecedented situation in the history of Pakistan, as the BOP constraint has become increasingly restrictive over the decades.

In the early 2000s, the economy was able to achieve a growth rate of approximately 4.5% without encountering BOP difficulties. However, by 2018, the growth rate that could be sustained without hitting the ceiling had decreased to around 3.8%.

This trend highlights the economy’s growing dependence on imports, resulting in a reduction in the domestic content of raw materials and intermediate inputs.

In short, the economy relies heavily on imports, with exports also depending on imported inputs. This indicates a structural weakness in the economy. Implementing structural changes in the economy takes years to yield positive results. It remains to be seen how policymakers will respond to this challenge in the years to come.

The writer has worked as an Assistant Professor of Economics at SDSB, Lahore University of Management Sciences (LUMS)

Published in The Express Tribune, May 22nd, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ