Political noise, delay in IMF deal dent stocks

Benchmark KSE-100 index drops by 464 points and closes at 41,330

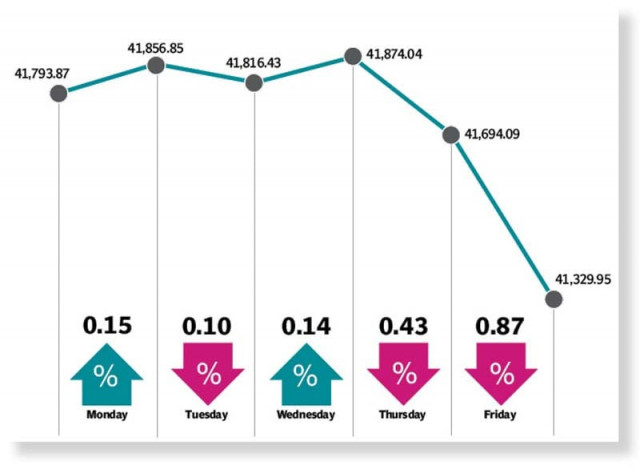

Bears dominated trading at Pakistan Stock Exchange (PSX) during the outgoing week when the KSE-100 index remained range bound, ending three out of five sessions on a flat note as investors stood on sidelines.

The week began with marginal gains, driven by optimism about reaching a staff-level agreement (SLA) with the International Monetary Fund (IMF) following finance minister’s statement that the agreement would be reached on Monday.

Bearish pressure prevailed the very next day when demoralised investors stood on sidelines over government’s failure to clinch the agreement. Furthermore, political chaos in the wake of issuance of non-bailable warrants against Pakistan Tehreek-e-Insaf (PTI) chief Imran Khan dented buying interest.

Prime Minister Shehbaz Sharif’s statement on Wednesday that the SLA would be reached within a few days as the government had accepted the lender’s “toughest” conditions helped the KSE-100 index recover partially during the day.

Bears took control of the market for the next two trading sessions as the looming political uncertainty and the delay in SLA sapped investor interest.

The benchmark KSE-100 index dropped by 464 points, or 1.11% week-on-week, and settled at 41,330 on Friday.

JS Global analyst Wasil Zaman, in his report, noted that after a stable start to the week, the KSE-100 closed negative over prolonged delay in the IMF agreement, which hinged upon formal assurances of financing from friendly countries.

The market closed at 41,330 points, down 1.1% week-on-week, where the exploration and production (E&P) sector was among top performers while banking and food sectors were the key under-performers.

“Foreigners were net sellers ($5 million) with the highest selling in the banking sector ($2.5 million),” he said.

On the news front, the State Bank of Pakistan’s (SBP) reserves remained largely stable at $4.3 billion.

According to the finance minister, documentation for the disbursement of second loan tranche by the Industrial and Commercial Bank of China (ICBC) had been completed and it was expected to be received next week.

Petroleum product prices were increased with petrol now costing Rs272 per litre (up by Rs5) and diesel Rs293 per litre (up by Rs13), which was attributable to depreciation of the rupee.

Among other news, the government managed to raise Rs26 billion in the Pakistan Investment Bond (PIB) auction, but it was short of the target of Rs100 billion, signalling higher returns were being demanded by investors.

Large-scale manufacturing (LSM) data showed a decline of 8% year-on-year in January 2023, reflecting the economic slowdown, whereas remittances from overseas Pakistanis increased 5% month-on-month in February 2023, largely due to the transition to a free-floating exchange rate, the JS analyst added.

Arif Habib Limited, in its report, said that in the outgoing week the stock market started off positively as investors were anticipating some encouraging developments about the IMF programme. “However, the momentum was disturbed due to political noise.”

In terms of sectors, positive contribution to the market came from cement (49 points), glass and ceramics (25 points), and insurance (16 points). Negative contribution came from miscellaneous (197 points), technology (155 points), fertiliser (78 points), banks (43 points), and food and personal care (32 points).

In terms of individual stocks, positive contributors were Oil and Gas Development Company (48 points), DG Khan Cement (22 points), Tariq Glass Industries (13 points), The Searle Company (13 points), and Maple Leaf Cement (12 points).

Negative contributors were Pakistan Services (196 points), Systems Limited (133 points), Pakistan Oilfields (79 points), Engro Corporation (54 points) and Bank AL Habib (50 points), the AHL report added.

Published in The Express Tribune, March 19th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ