Stocks post thin gains as bulls, bears lock horns

Benchmark KSE-100 index inches up by 21 points to settle at 40,471

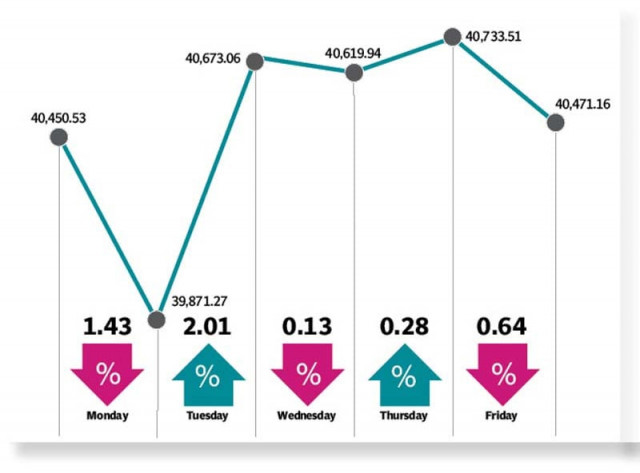

Bulls and bears locked horns at Pakistan Stock Exchange (PSX) throughout the outgoing week as the benchmark KSE-100 index swung between green and red zones, driven by a mix of encouraging and discouraging developments. However, it managed to close week in the green.

A bomb blast in Peshawar’s Police Lines area coupled with political uncertainty sparked fears among investors, resulting in the index dropping below the 40,000-point mark on Monday.

It came despite a positive start owing to hopes about the International Monetary Fund (IMF) loan programme following increase in petroleum product prices.

Bulls returned to the bourse on Tuesday as the index climbed over 800 points primarily because of expectations about the revival of IMF programme soon.

Volatility persisted for two consecutive days and the market closed on a flat note. On Wednesday, trading ended with marginal losses owing to a lack of positive triggers and persistent depreciation of the rupee against the US dollar.

On the other hand, Thursday witnessed slim gains over positive developments regarding talks with the IMF on ninth review of its loan programme.

However, the market failed to maintain the positive momentum on Friday following a discouraging statement from Prime Minister Shehbaz Sharif, saying that IMF delegation was giving a tough time to Pakistan. Resultantly, the index dropped over 260 points.

The benchmark KSE-100 index closed the week up by only 21 points, or 0.05%, at 40,471 compared to the previous week.

“A roller-coaster week was witnessed as bears and bulls both dominated various trading sessions,” said JS Global analyst Amreen Soorani.

Market participants predominantly tracked news flow and updates on the ongoing talks between the IMF and Pakistan’s government on the ninth review. News reports circled around higher tax revenues and appropriate steps for raising energy tariffs to manage the circular debt pileup, she added.

During the week, the Consumer Price Index (CPI) came in above street expectations at 27.5% for January 2023. Moreover, trade data reflected a further contraction in deficit, which was 7% year-on-year lower at $2.6 billion in January.

In addition, the State Bank of Pakistan’s (SBP) foreign exchange reserves dipped further, reaching $3 billion with only three weeks of import cover.

The week also witnessed further devaluation of the rupee, which closed 5% (Rs14) week-on-week lower at Rs276 per US dollar, in addition to the 13% devaluation last week.

Among corporate news, Engro Corporation’s (+3.6% week-on-week) buyback window commenced at the end of the week, which would be open for six months, the JS analyst said.

Arif Habib Limited, in its report, said that the stock market remained range bound during the week. “The unfortunate incident in Peshawar, which caused concerns about the overall security situation, took a toll on the index,” it said.

“However, the commencement of talks between the IMF and the government for ninth review brought back the bulls, which pushed the index up by 826 points in intra-day trading on Tuesday.”

The market closed at 40,471, up by 21 points, or 0.05% week-on-week.

In terms of sectors, positive contribution came from power generation and distribution (101 points), fertiliser (79 points), automobile assemblers (38 points), cement (33 points) and pharmaceuticals (29 points).

Negative contribution came from miscellaneous (245 points), commercial banks (39 points), and technology and communication (35 points).

In terms of individual stocks, positive contributors were Hub Power (98 points), Engro Corporation (88 points), Mari Petroleum (69 points), Engro Fertilisers (48 points) and Lucky Cement (47 points).

Negative contributors were Pakistan Services (249 points), Pakistan Petroleum (72 points), Habib Bank (60 points) and Fauji Fertiliser Company (57 points).

Foreigners’ buying continued as they bought stocks worth $0.9 million compared to net buying of $2.8 million last week.

Average volumes came in at 135 million shares (down by 38% week-on-week) while average value settled at $23 million (down by 32%).

Published in The Express Tribune, February 5th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ