Dar snubs doomsayers, sees ‘economic comeback’

Minister assures PSX investors country will not default

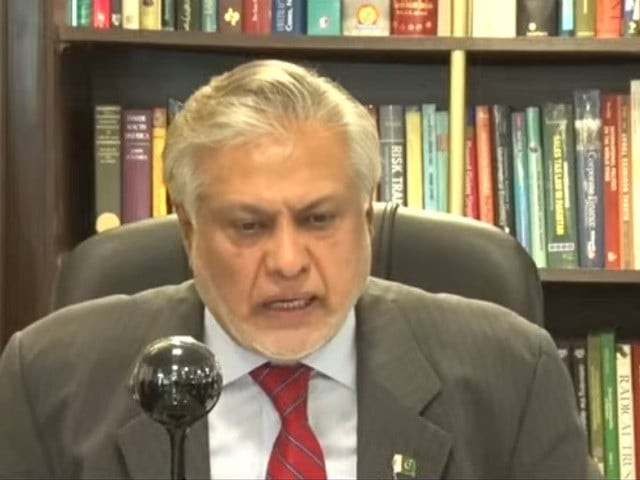

Conceding that Pakistan's economy was stuck between a rock and a hard place, Finance Minister Ishaq Dar on Wednesday expressed his optimism that the country had the potential to stage a “comeback”.

In an over 35-minutes online address to Pakistan Stock Exchange (PSX), the minister reiterated that the country would not default on any international payments including foreign debt.

"We hear every day that Pakistan will default…but how? There is no chance Pakistan will default. Pakistan will survive," he assured the investors at the PSX, which a day earlier had again taken a turn for the worse.

The downward spiral at the bourse came at the heels of Monday's handsome recovery, as concerns over the country’s economic situation and the fate of the International Monetary Fund’s (IMF) loan programme had caused jitters in the market.

Dar admitted that he and his economic team were managing in a tight position.

“We don’t have foreign exchange reserves of $24 billion which we had in 2016.

That is not the [current] government’s fault. That is not my fault. The fault is in the system. And we must ensure Pakistan moves forward,” he maintained.

"Pseudo intellectuals …and people (mostly the rival politicians) with vested interests have been propagating that Pakistan will default,” the minister claimed.

Sharing facts, he said Pakistan's debt-to-GDP ratio stood at 72% at present, while that of the US and Japan was 110% and 257%, respectively.

“There are dozens of developed countries including the UK which have a debt-to-GDP ratio of over 100%, but no one says they would default,” he explained.

Dar said the government had arranged funding worth $31 billion required to repay foreign debt and finance the current account deficit (CAD) in the ongoing fiscal year 2023.

"There is no chance that Pakistan will default. I can prove Pakistan will not default. It has a bright and beautiful future,” he added.

The minister announced that Pakistan would ultimately return to global bonds and Sukuk markets to raise part of the required debt financing in the future once the economic indicators improved.

"We have to show the world our economy is taking off. (So that we)…reach back to the global bond market,” he pledged.

Dar slightly touched upon the grave outstanding issues between the government and IMF. He wound up the subject in a one-line statement by saying: "We will complete the ongoing IMF programme [worth $6.5 billion]."

The minister, however, spent some time expressing his dislike towards the global lending institutions by saying: "We should not remain dependent on multilateral donors going forward. Our ultimate goal is to get rid of them."

He added that these days, the government was running from pillar to post for each of $1 billion from the IMF time and again just because of the “propaganda of default and petty politics”.

Pointing out the causes behind the ongoing foreign exchange reserves crisis, rupee depreciation and fault lines in the economy, the minister, without naming Afghanistan, maintained that it was not only the US dollars, which were being smuggled to the neighbouring country, but wheat and fertilisers as well.

"We have been spending heavy foreign exchange reserves to import wheat and fertilisers and heavily subsidising them for our people, but they are also being smuggled out of Pakistan,” he noted.

He pointed out that the law enforcement agencies were conducting a crackdown against the smugglers and the issue would be resolved soon.

“The nation has come out of such periods of crises in the past including in 2008 and 2013,” he recalled.

In 2013, Pakistan was declared as an unstable macroeconomic state.

Dar recollected that not a single multilateral development financial institution was ready to lend Pakistan even a dollar back then.

"Pakistan had been projected globally that whosoever would win election in the country in 2013 would declare default in six to seven months. But we reemerged only in three years and have huge potential to stage a comeback again,” he claimed.

The minister agreed to reduce the central bank’s key policy rate standing at a 23-year high at 16% at present and strengthen the local currency against the US dollar.

"Pakistan's foreign exchange reserves would be at a much improved level when we close the current fiscal year on June 3, 2023," he assured the PSX investors.

The minister was speaking at a ceremony held to mark the first listing of the developmental Real Estate Investment Trust (REIT) on the PSX.

REITs are investment schemes that collect money from investors and invest it in real estate projects.

Dar directed the authorities concerned, including the Securities and Exchange Commission of Pakistan (SECP), to give emphasis to the proposal that companies aiming to get listed on the PSX should first offer shares at a minimum price to the general public and then auction majority ordinary stocks to corporate and rich individual investors through the 'book-building' process to discover its true price.

At present, companies first auction their stocks through the Dutch bidding process, which usually takes their price up.

Later, general investors are offered stocks at the premium price.

Dar said the ‘book-building’ process gave confidence to the market.

“Anyhow, this is wonderful idea. It can be tested. I leave it to you -- specialists and experts -- to decide [about it],” he added.

The minister asked the business community to play its due role in taking Pakistan forward. “You have always contributed to economic growth,” he told the community.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ