Stocks lose ground in volatile trading

Benchmark KSE-100 index drops by 397 points to settle at 41,301

The Pakistan Stock Exchange (PSX) remained under pressure throughout the week as economic and political tensions flared up, which kept trading volumes low and pushed the benchmark KSE-100 index to close the week in the red.

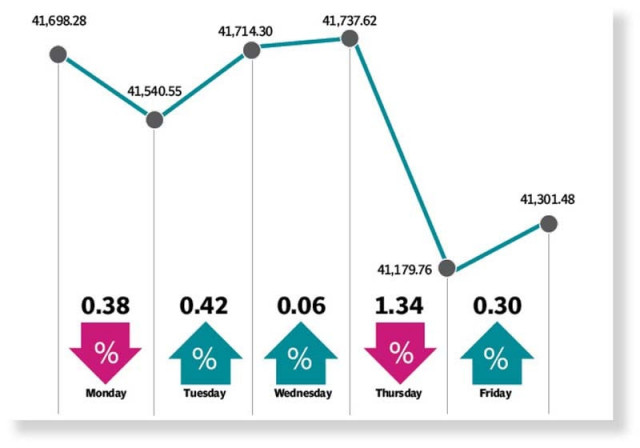

The trading week commenced on a negative note as political and economic uncertainty played on investors’ mind. The market, however, reversed direction on Tuesday on investor optimism in the wake of expected $10 billion investment by Saudi Arabia. The positivity pulled the index out of the red zone.

Despite the uptrend, investors remained cautious and in the absence of major positive triggers, trading remained dull on Wednesday but the market managed to close with minor gains.

However, the index lost ground on Thursday despite Engro Corporation’s announcement that it would buy back 70 million shares at an estimated cost of Rs20 billion. The bourse tried to advance but succumbed to profit-taking.

Late session buying, after index’s movement between red and green zones, helped the market to recover in a roller-coaster session on the last day.

The KSE-100 index closed the week down by 397 points, or 0.95%, at 41,301 compared to the previous week.

“KSE-100 witnessed a downward trend during the week due to lack of political and economic stability, closing at 41,301 points, down 1% week-on-week,” said JS Global analyst Muhammad Waqas Ghani.

Sector-wise, refineries (-4.5%), chemical firms (-4%), OMCs (-2.9%) and banks (-1.8%) were the key underperformers whereas textile companies (+2.7%) and fertiliser producers (+1.6%) were the key outperformers.

Foreigners turned net sellers with the highest selling witnessed in banks ($12 million), he said.

On the news front, the government of Pakistan in the T-bills auction raised Rs1.62 trillion against its target of Rs1.35 trillion.

Data for worker remittances showed a month-on-month decline of 5% in November 2022 to $2.1 billion, the lowest level since August 2020, while State Bank of Pakistan’s (SBP) reserves remained stable during last week at $6.7 billion.

Petrol price was slashed by Rs10 per litre to Rs214.8 whereas diesel price was cut by Rs7.5 per litre to Rs227.8.

On the international front, OPEC stuck to its 2023 oil demand growth forecast of 2.3% year-on-year, citing relaxation of zero Covid policy in China as a major upside to demand.

ADB, on the other hand, revised its growth target downwards for Asia from 4.9% to 4.6% in 2023, the JS analyst said.

Arif Habib Limited, in its report, said that the market commenced trading on a negative note, carrying forward the momentum from last week owing to concerns over weak economic indicators.

The market briefly turned positive given the ADB’s approval of $554 million financial package for rehabilitation work post-floods. Moreover, the IMF shared that discussions with Pakistan related to the ninth review were productive, keeping the momentum positive.

“However, the market turned negative again in the latter part of the week due to increase in political noise,” it said.

Furthermore, remittances declined by 14% year-on-year in Nov 22. In addition to this, LSM output plummeted by 3.6% month-on-month (7.75% year-on-year) during Oct 22.

SBP’s foreign exchange reserves depicted a dip of $15 million, reaching $6.64 billion. With this, Pakistani rupee depreciated by Rs0.54, or 0.24% week-on-week, against the US dollar and settled at Rs224.94.

The index closed at 41,301, losing 397 points (or 0.95%) week-on-week. In terms of sectors, positive contribution came from miscellaneous (164 points) and fertiliser (110 points).

Negative contribution came from banks (232 points), chemical (92 points), automobile assemblers (83 points), power (68 points) and food and personal care products (61 points).

Stock-wise, positive contributors were Pakistan Services (167 points), Systems Limited (132 points), Engro Corporation (115 points), Pakistan Tobacco (20 points) and Oil and Gas Development Company (10 points).

Negative contribution came from Millat Tractors (77 points), United Bank (70 points), Hub Power (68 points), Bank AL Habib (58 points) and Lotte Chemical (44 points).

Foreigners’ selling continued during the week, which came in at $9.6 million compared to net selling of $6.3 million last week, the AHL report added.

Published in The Express Tribune, December 18th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ