The Pakistan Stock Exchange witnessed a lacklustre trading week as jittery investors weighed the impact of rising political turmoil in the country coupled with the persistent rupee depreciation.

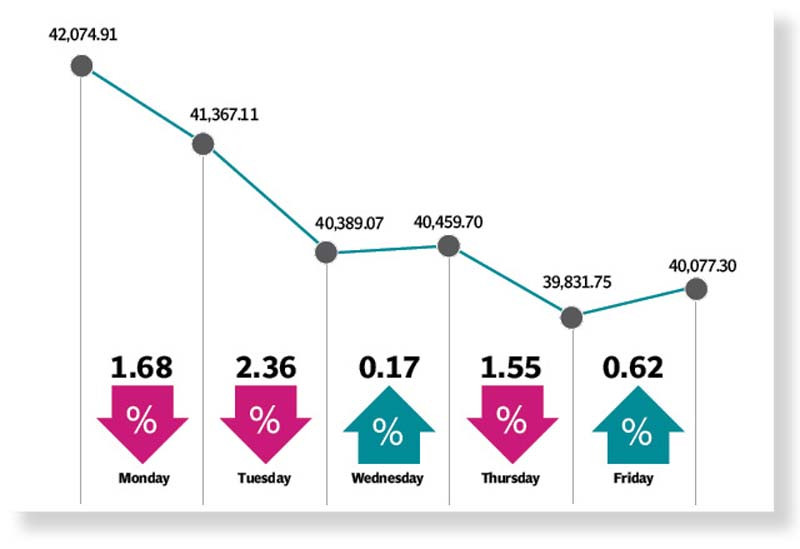

Subsequently, the benchmark KSE-100 index closed the week with a loss of 1,998 points at 40,077.

The week started on a negative note as sceptical investors rushed to offload their holdings. Investors’ interest remained subdued as political uncertainty gripped the bourse.

Moreover, the persistent slide of the rupee against the US dollar, which touched a new record low at Rs228.37 in the inter-bank market, restrained investors from taking fresh positions.

Market talk suggests the rupee recorded the largest drop this week after 1998.

However, the bourse took a breather on Wednesday and recovered marginally but it failed to sustain the bullish trend and could not address market’s fears of rapid increase in inflation.

The bourse remained under selling pressure as it witnessed consistent depreciation of the rupee, which dragged the index below 40,000 points.

However, value buying lifted the KSE-100 index above the 40,000-point mark on Friday after a lacklustre trading session on political uncertainty and inflationary concerns with a hefty decline in the value of the rupee.

The index failed to close the week in the green as it settled at 40,077, down 1,998 points week-on-week.

“Delay in clarity about the IMF programme and political uncertainty after the by-elections in Punjab took a toll on the equity market, taking the benchmark index down by 1,998 points to 40,077,” said JS Global analyst Muhammad Waqas Ghani. Negative sentiment was fuelled by consistent depreciation of Pakistani rupee against the greenback, which closed at an all-time low of 228.37 (down 23% CYTD).

Market participation dropped during the week as average volumes decreased 8% week-on-week, while traded value declined 31% week-on-week, the analyst added.

Individuals remained key buyers with net buying of $5m. On the other hand, mutual funds remained net sellers, offloading $7.6m worth of equities.

Engineering (-8.2%), refinery (-8.1%), cement (-7.3%) and OMC (-6.6%) sectors were among the major underperformers during the week.

In other news, Fitch downgraded its credit outlook on Pakistan to negative following Moody’s, which had downgraded the country last month.

Finance Minister Miftah Ismail held a press briefing during the week to control damage and assured that the government would be able to manage funding gap of $4b soon with the help of friendly countries and that the IMF programme was on track.

Moreover, according to data released by the State Bank, foreign exchange reserves decreased 4% on a weekly basis, said the analyst.

Arif Habib Limited, in its report, said that political uncertainty took a toll on the market during the week.

Pakistani rupee continued to depreciate during the week, reaching an all-time low of Rs228.37 amid depletion of foreign reserves and uncertainty over funding from friendly countries.

Moreover, IMF is assessing which friendly countries are willing to provide financial aid to Pakistan before disbursing the loan of $1.2b.

Given the situation, the pressure was felt by the market, taking the index below 40,000 points.

In addition to this, Fitch downgraded Pakistan’s rating outlook to negative. However, a slight rebound was observed on the last trading day.

The market closed at 40,077 points, losing 1,998 points (down by 4.75%) week-on-week.

In terms of sectors, positive contribution came from Sugar and Allied Industries (3 points) and Close-End Mutual Fund (2 points).

On the flip side, the sectors which contributed negatively included Commercial Banks (499 points), Fertiliser (294 points), Cement (245 points), Oil and Gas Exploration Companies (187 points) and Power Generation and Distribution (110 points).

Meanwhile, stock-wise positive contributors were Shakarganj Limited (3 points), HBL Growth Fund (2 points), Highnoon Laboratories (2 points), Murree Brewery Company (1 point) and Dolmen City REIT (1 point).

However, negative contribution came from Habib Bank (152 points), Lucky Cement (92 points), Engro Corporation (92 points), Engro Polymer and Chemicals (91 points) and Hub Power Company (90 points).

Foreign buying was witnessed this week, clocking in at $3.43m compared to a net buy of $1.40m last week. Major buying was witnessed in Technology ($1.98m) and All Other Sectors ($0.75m).

On the local front, selling was reported by Mutual Funds ($7.76m) followed by Insurance Companies ($2.22m).

Average volumes clocked in at 163m shares (down by 8% WoW) while average value traded settled at $21m (down by 31% WoW).

Published in The Express Tribune, July 24th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1725784957-0/Tribune-Pic-(17)1725784957-0-165x106.webp)

1724760612-0/Untitled-design-(12)1724760612-0-165x106.webp)

1731884290-0/image-(9)1731884290-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ