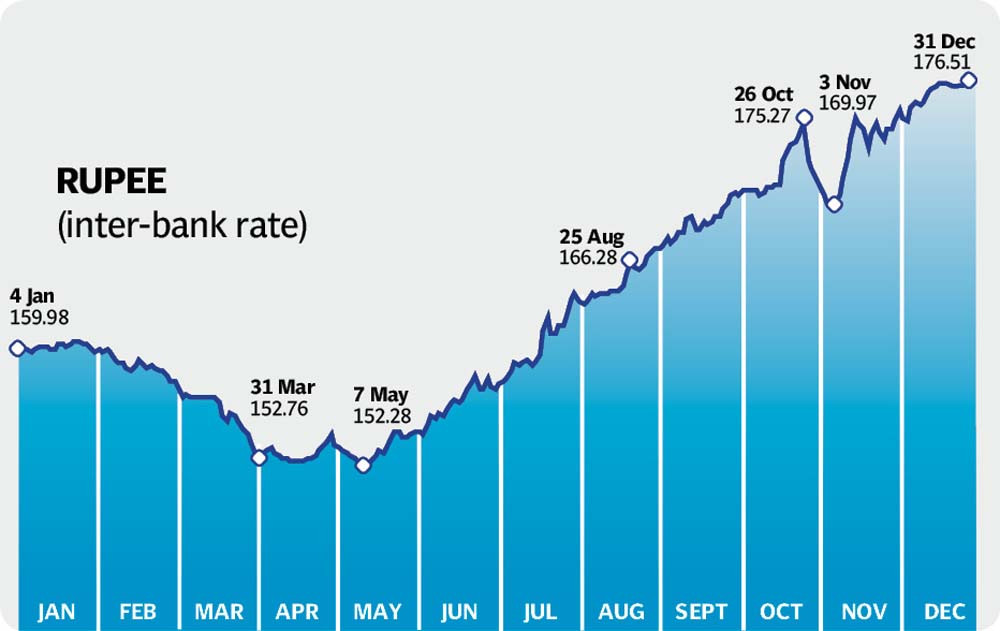

A never ending slide of the rupee

Currency dives due to widening current account deficit, climbing imports

The rupee had a disastrous year as it kept hitting new lows due to a host of reasons including a ballooning current account deficit, swelling imports and pause in the International Monetary Fund (IMF) loan programme.

The Pakistani currency eventually snapped the prolonged weakening streak and recovered 1% (or Rs1.73) in the last two days of 2021 and closed at a four-week high of Rs176.51 against the US dollar in the inter-bank market on Friday.

Earlier on December 29, the currency hit an all-time low of Rs178.24 against the greenback, according to the central bank data.

The nominal recovery in the last two days, however, failed to make a big difference as the currency cumulatively dropped 10.5% (or Rs16.68) to Rs176.51 in the last one year.

It has lost almost 16% (or Rs24.24) to date since hitting the 22-month high of Rs152.27 in May 2021.

Experts said that the rupee may recover to around Rs175 under the current cycle of uptrend. It is expected to stabilise at this level for a couple of months and drop to Rs178 by the end of June 2022.

They said that the rupee may hit Rs180-185 by the end of December 2022.

“The rupee may see usual depreciation of 4-5% during calendar year 2022,” BMA Capital Executive Director Saad Hashmi said while talking to The Express Tribune.

The rupee recovered slightly in the last two days in the wake of approval of a mini-budget to generate an additional revenue of around Rs350 billion. It recovered because the mini-budget was a condition for the resumption of $6 billion IMF loan programme, which has been on hold since June.

“The presentation of mini-budget implies that the IMF board will revive the loan programme during its sixth review of the economy on January 12,” Hashmi said.

The resumption of the loan programme will result in receipt of next tranche of $1 billion sometime in January or February 2022.

Besides, the country may immediately witness cumulative inflows of $5-6 billion through the sale of Sukuk (Islamic bond) in the international market and receipts from multilateral and bilateral lenders including the World Bank and Asian Development Bank (ADB).

The expected inflows would increase the supply of dollars in the inter-bank market against the falling demand for imports as global commodity prices have started receding. The development will help the rupee to recover to around Rs175 under the current cycle and maintain the level in the short run.

Earlier, the rupee lost value mostly during second half (July-December) of 2021 in the wake of persistent increase in import bill amid rising global commodity prices, increase in aggregate demand in the economy and delay in resumption of IMF loan programme.

Besides, historic jump in the import bill in November 2021, record high trade deficit, robust current account gap and spike in inflation reading at 11.5% in the month all contributed towards the rupee depreciation during the year.

The development encouraged the central bank to aggressively increase the benchmark interest rate by 2.75 percentage points during October-December to 9.75% at present. The rate hike would not only aid in curbing inflation and narrowing down current account deficit from February 2022 onward but also help rupee strengthen and stabilise against the greenback during the first half (January-June) of 2022.

The emergence of financial crisis in Afghanistan in August 2021 also contributed towards depreciation in domestic currency as US denied access Taliban government access to Kabul’s foreign exchange reserves. Moreover, traders on both sides of the Durand Line were believed to be illegally buying dollars from Pakistan to feed Afghans.

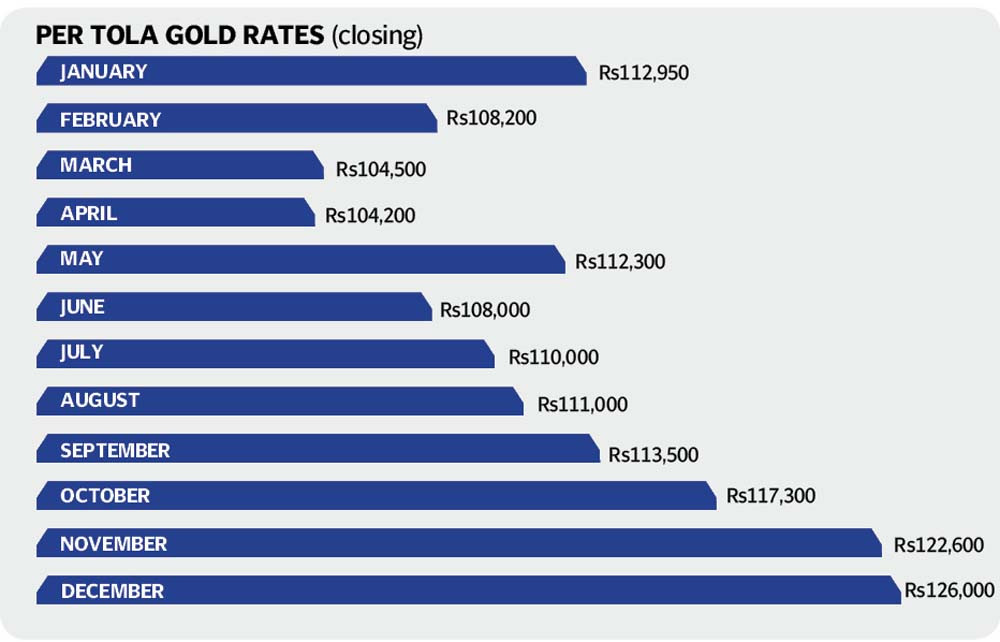

Gold maintains its shine

The gold retained its shine throughout 2021 as its price increased 10.5% (or Rs12,000) to Rs126,000 per tola (11.66 grams) on Friday.

Investors poured money in the precious yellow metal to safeguard their positions during the year.

“Gold remains a safe haven against inflation. People invest in the commodity to avoid depreciation in rupee,” AA Gold Commodities Director Adnan Agar said the other day.

Gold hit all-time high of Rs132,000 per tola in late October. The gold price in dollar value, however, is hovering at around $1,800 per ounce these days.

Agar said that gold would trade between $1,700-1,800 per ounce in global markets as global commodity prices have stared easing, meaning that inflation would come down during 2022.

Published in The Express Tribune, January 1st, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ