PSX posts gains for third week

Despite profit-taking, positive macros help benchmark index notch up gains

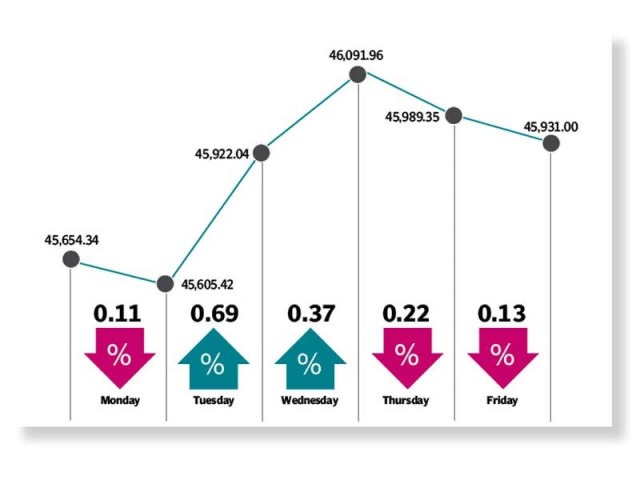

The Pakistan Stock Exchange (PSX) continued its upward drive this week but at a slower pace as profit-booking in three out of the five sessions eroded gains. Consequently, the benchmark KSE-100 index finished with a meagre 277 points increase during the week ended January 15.

It was the third successive weekly rise as investors’ remained buoyant ahead of the corporate results announcements, hinting that the earnings season will be relatively better compared to the first quarter results of the current fiscal year 2020-21.

Trading began on a positive note on Monday morning as market participants acknowledged the encouraging data of remittances, which stood above $2 billion for the sixth successive month in December, announced by the central bank last week.

Moreover, remarks by State Bank of Pakistan (SBP) Governor Dr Reza Baqir in an interview that Pakistan was in talks with the International Monetary Fund (IMF) to put its fiscal support programme back on track caused optimism.

However, the momentum could not be sustained and the sentiment turned negative in the wake of news regarding increase in power tariff by Rs1.06 per unit on account of fuel cost adjustment for October and November 2020, which caused the market to snap the three-day winning streak on Monday.

Fortunately, the trend changed in the following session and the market recovered partially on the back of upbeat car sales data, which showed a 15% jump in demand in December 2020 on a year-on-year basis.

A recovery in international crude oil prices, which spiked to 11-month high on Tuesday, enhanced investors’ interest in local oil sector stocks and subsequently, both oil-related sectors received substantial investment. Continuing the positive momentum, the bourse surpassed the 46,000-point mark on Wednesday after a hiatus of more than two and a half years.

Read: Bearish trend continues at PSX

Market participants rejoiced over the upbeat large industries’ output data released by the Pakistan Bureau of Statistics. The large-scale manufacturing (LSM) output grew 7.4% in the first five months of current fiscal year on the back of a sustained growth momentum for the third successive month.

Further support to the bourse came after Moody’s ratings agency maintained a stable outlook on Pakistan’s banking sector, which led stocks to perform better.

The tables, however, turned dramatically, as the bourse turned bearish eroding all gains of the last two days of the trading week. Investors opted to book profits amid weakening international oil prices for the last two trading days of the week. The market failed to sustain the 46,000-point mark and remained in the red until Friday.

“We expect the market to remain positive on the back of healthy earnings expectations, which will drive the index,” stated Arif Habib Limited report. “Moreover, ongoing roll out of vaccines across the globe will most likely keep equity markets buoyant.”

Investor participation remained subdued as average daily traded volume increased 9% week-on-week to 682 million shares while value traded clocked-in at $129 million, down 16% on a weekly basis.

In terms of sectors, positive contributions came from technology and communication (168 points), power generation and distribution (66 points), engineering (41 points), glass and ceramics (37 points) and textile composite (34 points). On the flip side, negative contributions came from fertiliser (63 points), tobacco (30 points) and oil and gas exploration companies (27 points).

Scrip-wise, positive contributions were led by Systems Limited (89 points), TRG Pakistan (82 points), International Industries (42 points), Kot Addu Power Company (42 points), and Ghani Glass (37 points).

Foreigners turned net sellers this week as foreign selling clocked-in at $2.1 million compared to a net buy of $3.4 million last week. Selling was witnessed in cements ($0.9 million) and FMCG ($0.8 million). On the domestic front, major buying was reported by individuals ($24 million and banks / development finance institutions ($1.2 million).

Among other major news of the week was; Byco Petroleum began construction of plants for Euro 5, 6 gas and diesel, bank deposits surged 22% year-on-year, central banks foreign reserves recorded a decline of $12 million, and the government raised oil prices by Rs3.2 per litre.

Published in The Express Tribune, January 17th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ