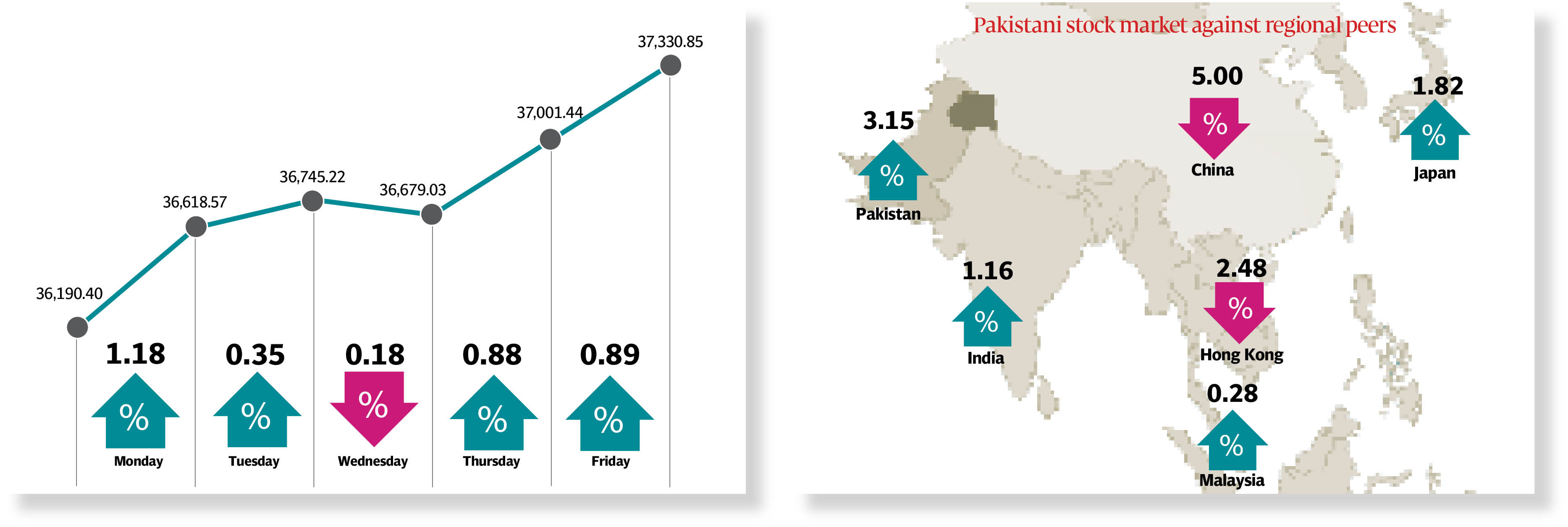

Weekly review: PSX records gains for third successive week

Benchmark index jumps 1,140 points or 3.15% to power past 37,300-mark

It was another good week for the Pakistan Stock Exchange (PSX) as bulls took the index past the 37,000-mark in a remarkable rally. The KSE-100 index ended with a gain of 1,140 points or 3.15% to settle at 37,331 points - marking a positive finish for the third successive week.

Despite the overall upbeat trading, the 13-day winning streak came to an end during the week as the index took respite from the buying activity and succumbed to profit-taking. Regardless of the brief visit in the red territory, optimism following capital injection from local investors, government plans to build low-cost housing fuelled investor interest in cement stocks. Measures announced by the central bank to facilitate the construction sector also rejuvenated sentiments in banking scrips.

Monday kicked off on a positive note as the flattening curve of coronavirus infections in addition to the incentives announced for the construction sector bolstered investors’ confidence. Investors also took cue from the bull-run in global equity markets and took to buying stocks in droves. The prime minister’s initiative to boost the housing market, including 5% bank lending portfolio, sparked buying interest in cement, steel and banking stocks.

Moreover, the improving foreign exchange reserves and record high remittances from overseas Pakistanis also acted as a catalyst in the positive close of the bourse.

Receipt of workers’ remittances exceeded expectations by a staggering 51% to a record high of $2.47 billion in June 2020 compared to $1.64 billion in June 2019.

The receipt of much-needed foreign exchange in these testing times when the Covid-19 pandemic had engulfed the entire world pushed total remittances to an all-time high at $23.10 billion in the previous fiscal year ended June 30, the State Bank of Pakistan (SBP) reported. Euphoria over the encouraging remittances data, coupled with news of oil discovery in Khyber-Pakhtunkhwa (K-P) boosted sentiments at the bourse on Tuesday. Scrips in exploration and production sector invited interest from participants.

The winning streak snapped on Wednesday as the index reversed direction amid range-bound trading. Sentiments were hit by a report from Fitch Ratings, which predicted Pakistani rupee would recover to 163 against the dollar in 2020 and stand at 176 in 2021. Furthermore, news that the Oil and Gas Regulatory Authority (Ogra) had approved increase in re-gasified liquefied natural gas (RLNG) prices by 35% for Sui Northern Gas Pipelines Limited (SNGPL) and by 40% for Sui Southern Gas Company also added to the pressure.

However, the negativity was short-lived as the stock market turned bullish once again on back of investors cheering inception on work on Diamer-Bhasha Dam. The prime minister inaugurated construction works at Diamer-Bhasha Dam that will increase demand for cement and steel. The encouraging news, along with an upsurge in international crude prices, helped lift the benchmark index above 37,000 points.

The last trading day of the week also finished positive though the index oscillated between the red and green zone amid selling pressure. Investors remained concerned over the subdued economic growth and corporate result announcements, which prevented the market from advancing further.

That said, average daily volumes and traded value for the outgoing week were up by 22% and 34% to 426 million shares and $99.3 million, respectively.

Contribution to the upside was led by cements (213 points), oil and gas exploration companies (196 points), fertiliser (149 points), automobile assembler (91 points), and commercial banks (55 points).

Scrip-wise, major gainers were LUCK (85 points), POL (78 points), DAWH (77 points), PPL (75 points), and INDU (63 points). On the other hand, scrip wise major losers were BAFL (13 points), NBP (9 points) ABOT (8 points), SYS (8 points) and COLG (7 points).

Foreigners offloaded stocks worth of $27.37 million compared to a net sell of $9.46 million last week. Major selling was witnessed in E&P ($20.40 million) and fertiliser ($2.61 million). On the local front, buying was reported by individuals ($15.93 million) followed by insurance companies ($14.29 million).

Among major news of the week was; each house in first 0.1m units to get Rs0.3m subsidy: PM, IMF predicted economic recovery in Pakistan next year, remittances hit historic high of $23.1 billion, June passenger cars sales plunged 52% and PM Imran kicked off construction work at Diamer-Bhasha Dam.

Published in The Express Tribune, July 19th, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ