Pakistan seeks $15b loans in FY21

The money will be used to service maturing external public debt

Representational image. PHOTO: REUTERS

Out of the $15 billion estimated external borrowings in fiscal year 2020-21, nearly $10 billion or - two-thirds, will be used to return the maturing loans, excluding interest payments, said sources in the Ministry of Finance. The remaining slightly over $5 billion will become part of the external public debt that has already increased to $86.4 billion as of end March this year.

The estimated $15 billion borrowings will be the highest loans to be taken by the country in a single year, highlighting challenges that every government faced due to the deepening debt trap. The Pakistan Tehreek-e-Insaf government, like its predecessor, has also remained unable to fully capitalise non-debt creating inflows like exports, remittances and foreign direct investment.

Because of inability to enhance non-debt creating inflows, Pakistan’s $12 billion gross official foreign currency reserves held by the State Bank of Pakistan (SBP) are largely the product of borrowings - a phenomenon that was also common in the Pakistan Muslim League-Nawaz (PML-N) era.

For fiscal year 2020-21, the International Monetary Fund (IMF) has projected SBP’s reserves at $15.6 billion in its April report, which will again be impossible without borrowings, as the Fund sees only a slight increase in exports and marginal decline in remittances in the next fiscal year.

The Ministry of Finance has estimated the gross receipts of $15 billion from bilateral and multilateral lenders, commercial banks, issuance of Eurobonds and the IMF for fiscal year 2020-21, according to the sources.

Pakistan’s heavy reliance on foreign creditors can be gauged from the simple fact that from July 2018 to June 2021, it will have taken $40 billion new loans. Out of this $27 billion would be consumed in paying old loans and rest $13 billion will be added in external public debt.

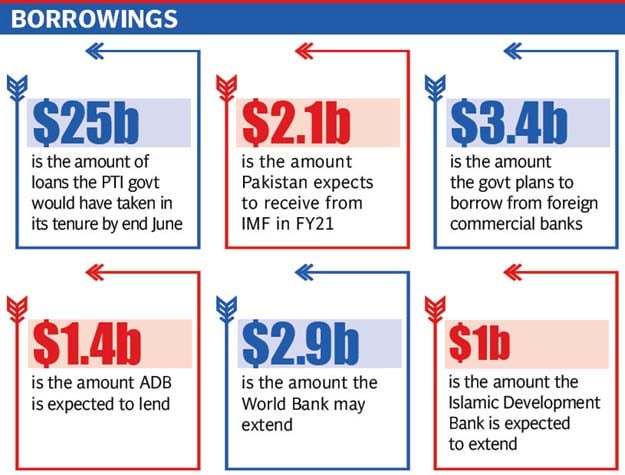

As per the official estimates, by end June this year, the PTI government would have taken nearly $25 billion loans in its tenure and $16.5 billion were to be consumed in paying principal loans.

The estimated fresh borrowing in next fiscal year will be 7% or $1 billion higher than the outgoing fiscal year’s revised estimate of $14 billion worth of external inflows, said the sources.

Pakistan is currently under the IMF programme but the programme technically remains suspended for the last few months. The PTI government is trying to revive it from July by fulfilling the IMF’s conditions in the upcoming budget.

The materialisation of the $15 billion external loans will also depend upon the revival of the IMF programme, as the government has included loans from the IMF and budgetary support from the World Bank and the Asian Development Bank (ADB).

Pakistan expects to receive $2.1 billion from the IMF in the next fiscal year, subject to successful completion of quarterly reviews. This year the IMF gave $2.8 billion, including $1.4 billion emergency Covid-19 assistance.

The government still has a plan to borrow $3.4 billion from foreign commercial banks, which will essentially be rollovers of the existing commercial loans. If Pakistan avails the G-20 debt relief, it may not be able to contract fresh commercial loans till December 2020.

The bilateral inflows are estimated at just $770 million due to completion of major ongoing projects of China Pakistan Economic Corridor.

Pakistan has estimated $6 billion loans from the multilateral creditors in next fiscal year. The ADB is expected to lend $1.4 billion as against $2.8 billion in this fiscal year. The World Bank may extend $2.9 billion in new loans after all its policy loans did not materialise in this fiscal year, said the sources.

The Islamic Development Bank is expected to extend $1 billion in fresh loans and $500 million receipts are estimated from Asian Infrastructure Investment Bank (AIIB), said the sources.

The government also has a plan to float $1.5 billion Eurobonds in the next fiscal year after it could not float $3 billion Eurobonds this fiscal year. It has to be seen whether the government can venture in international capital markets before December 2020 due to its decision to avail debt relief from G-20 nations.

Published in The Express Tribune, May 31st, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ