PSX retreats on economic concerns

Investors trade cautiously on pre-budget uncertainty, opt to book profits ahead of holidays

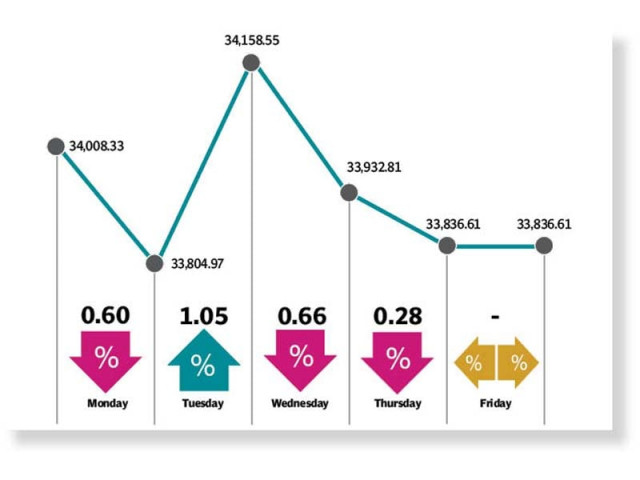

The week kicked off on a negative note as investors traded cautiously ahead of budget announcement on June 12. Additionally, weak external account data also spurred profit-taking during the outgoing week among participants who appeared weary of building long positions prior to the Eid break.

In a significant development, the State Bank of Pakistan (SBP) slashed the policy rate by a further 100bps last Friday, effectively bringing it down to 8%. Cumulatively, the SBP has slashed 525bps in the four MPC meetings - two scheduled and two emergency - since March. The economic concerns overshadowed the central bank's monetary response to the coronavirus-induced decline in economic activity (another 100bps cut in policy rate to 8%).

Pakistan's current account deficit soared 64-fold in April to $572 million from $9 million in the previous month of March. Meanwhile, concern over projections by the International Monetary Fund (IMF) regarding economic indicators also tempered any gains at the bourse.

Interestingly, the market returned to its winning ways on Tuesday as a rally in shares of oil companies, driven by an increase in global crude prices, propelled the index higher. A buying spree was also seen in pharmaceutical stocks as investors pinned hopes on a possible discovery of coronavirus cure. As a result, the pharmaceutical sector remained entirely in the green.

In another hitting development, Moody's Investors Service put top five Pakistani banks under watch for possibly downgrading their long-term local and foreign deposit and credit ratings, suspecting Islamabad may default on repayment of debt to global "private-sector creditors", which would also weaken the banks' ability to operate.

The following two sessions saw the index plummet as investors resorted to book profits ahead of the long Eid holidays. Moreover, significant selling pressure was seen in banking sectors after Moody's statement.

Thursday was the last trading day of the week before market closed for Eid holidays, as the Pakistan Stock Exchange remained closed Friday on account of Jummatul Wida.

Participation slowed as average volumes were down 6% week-on-week to 205.5 million, while average value traded increased 18% to $47.5 million.

In terms of sectors, negative contributions came from commercial banks (162 points) as Moody's placed five Pakistani banks on review, fertiliser (114 points), and cement (95 points). Scrip-wise, negative contributions were led by ENGRO (52 points), FFC (43 points), and MCB (36 points). Whereas, oil and gas exploration companies (120 points) and food and personal care products (32 points) emerged as the top gainers.

Foreign offloading during the week arrived at $8.77 million compared to a net sell of $10.91 million last week. Selling was witnessed in oil and gas marketing companies ($2.36 million), banks ($2.11 million) and fertiliser ($1.69 million). On the domestic front, individual accumulated stocks worth $11.37 million, while buying by insurance companies arrived at $4.94 million.

Other major news of the week was: T-bill yields dropped, budget to be unveiled on June 12, Moody's puts banks on review amid govt's weakening support capacity, Rs200 billion raised from power sukuk issue, Asian Development Bank (ADB) approved $300 million loan to boost Pakistan's Covid-19 response, and corporates started resuming plant operations.

Published in The Express Tribune, May 23rd, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ