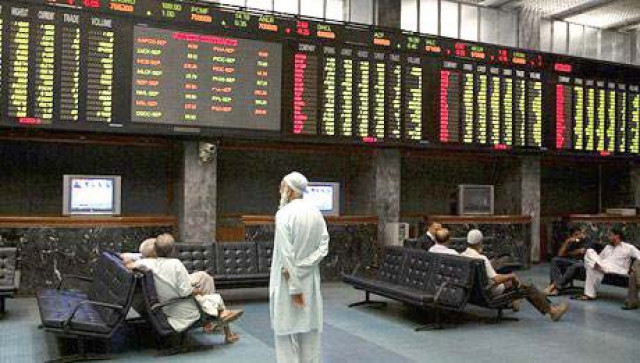

Stocks go up on hopes of government agreeing to broker recommendations

Stocks gained as investors were hoping that the government would agree to some recommendations by brokers.

The KSE-100 gained 239.83 points, 2.54 per cent, to end at 9,676.71. Volumes were healthier as 138 million shares were traded compared with 99 million shares on Wednesday.

Investors are concerned the government could try to tax gains made before July 1 and demand quarterly tax returns instead of the annual filing preferred by brokers, said dealers.

The government had previously agreed with the exchange that the capital gains tax would be levied only on profits made from the start of the 2010/11 fiscal year on July 1, according to dealers.

“The stock market management briefed the brokers this morning and said there was a possibility that the government will accept some of their demands,” said analysts.

It was clarified that National Assembly Standing Committee on Finance has recommended that individual investors be exempted from filing quarterly returns on CGT, said BMA Capital’s analyst Hammad Aslam.

This led to some optimism amongst the investors and the index posted gains, according to dealers.

“In our view the development bodes well for the market as 50 per cent of the traded volumes are contributed by retail investors who are now being saved from the hassle of filing quarterly returns,” said Aslam.

However, dealers said the market is expected to remain jittery until the issue is settled.

“Stock market continued yesterday’s positive rally today. Senate committee having turned down KSE’s proposal to exempt CGT on shares bought before July 1, 2010, the market remained positive throughout the day. The investors instead celebrated the possible relaxation of advance tax for retail investors,” said JS Global Capital’s analyst, Muzzamil Mussani.

“With most negatives regarding the CGT now behind us, feel investors will now seek value to buy selective stocks. Also, the market will eagerly await Tuesday’s meeting between the stock market regulator and stake holders on the proposed ‘Margin Trading product, that will surely improve market sentiment, if it is okayed,” said Elixir Securities’ analyst Sara Shahid.

The total exchange value stood at 4.88 billion and most blue-chip stocks closed in the green today.

During the day’s trade 244 stocks closed higher, 151 declined and 17 remained unchanged in value.

MCB Bank and Oil and Gas Development Company were both up 4.2 per cent and PTC was up by five per cent.

FABL closed up for second consecutive day after the announcement of it acquiring RBS. It was up by one per cent at closing today.

On the corporate front, PPFL (Pakistan premier Fund Limited) and PSAF (Pakistan Strategic Allocation Fund) topped volumes and continued to rise on the second consecutive day on announcement of conversion into open ended funds.

Published in the Express Tribune, June 18th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ