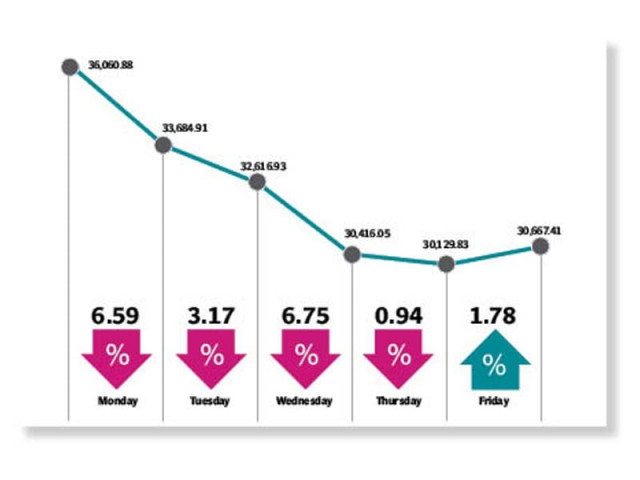

Weekly review: KSE-100 dives 15%, records biggest weekly losts since 2008

Stocks battered as fears of impact on economy of corona pandemic intensify

Weekly review: KSE-100 dives 15%, records biggest weekly losts since 2008

Stocks took a heavy battering following escalating fears of severe impact on the economy as more countries moved towards a lockdown amid rapidly mounting cases of the coronavirus pandemic.

This was the largest point-wise decline in history, while in percentage terms it was the biggest plunge since December 2008, according to an AHL report.

Monday witnessed a bloodbath at the KSE-100 index tanked by a historic 2,300 points to a four-month low level. The massive selling pressure had triggered a halt to trading activity for 45 minutes - the fourth in two weeks.

The trading stopped automatically after the PSX’s second benchmark KSE-30 Index fell 5% and failed to recoup losses within a five-minute window.

Local investors took cues from world markets, which recorded significant losses as international oil prices also tumbled. “Amid the gloom, oil took a battering, down 20% week-on-week at $27/bbl (WTI), reaching multi-decade lows,” stated a JS Research report.

The sell-off at the PSX persisted for four successive sessions during the week as panic and chaos reigned. The outgoing week saw trading halt for four out of five sessions as the index plunged to alarming levels.

In a bid to arrest the decline and lend some support to the stock markets, central banks across the globe slashed interest rates. However, the move failed to tame the bearish markets.

Meanwhile, the State Bank of Pakistan cut the interest rate by 75 basis points to 12.5%. The marginal decrease disappointed investors that had been expecting a rate cut of 100-300bps.

A swift reaction also came following the announcement of a near-lockdown in Sindh and comments by the prime minister that virus cases were likely to rise. Furthermore, Moody’s ratings agency lowered Pakistan’s growth forecast to 2.5% in FY20 in the wake of the virus outbreak that played the role of a catalyst in the market’s crash.

Reacting to these developments, investors opted to shun risky assets and adopted a ‘dump-and-run’ strategy.

Most traditional safe-haven assets were also under pressure as battered investors looked to unwind their positions, leading to wide discrepancies between various markets.

Interestingly, a pullback was also on the cards after the constant hammering and it was further boosted by news of an economic package that could be announced shortly by the government. After four bearish sessions, the stock market took a U-turn on Friday in the wake of a recovery in international crude oil prices. Moreover, renewed foreign investor interest and a strong economic outlook amid falling energy prices also pushed the index up.

On the global front, most markets rallied as the volatile week ended. A wave of policy efforts had halted a global scramble for cash that sharply boosted the dollar this week and had helped staunch the steep nosedive in global equity markets. However, Wall Street see-sawed on Friday after New York’s governor ordered residents to stay at home, rattling investors who had taken comfort from fiscal and monetary stimulus measures to counter the coronavirus shock and ease unusually volatile markets.

That said, average daily volumes for the outgoing week were down by 10% to 239 million shares likewise value traded decreased by 33% to $55 million.

Contribution to the downside was led by commercial banks (down 1,484 points), cements (729 points), oil and gas exploration companies (537 points), power generation and distribution (424 points), and fertiliser (408 points).

Scrip-wise, major losers were HBL (down 372 points), UBL (366 points), LUCK (361 points), HUBC (334 points), and MCB (264 points). On the other hand, PAKT (up 9 points), and IBFL (up 2 points) were the major gainers of the week.

Foreigners offloaded stocks worth of $20 million compared to a net sell of $23 million last week. Major selling was witnessed in commercial banks ($6 million) and cements ($5 million). On the local front, buying was reported by insurance companies ($23.5 million) followed by individuals ($19.5 million).

Published in The Express Tribune, March 22nd, 2020.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ