Accountability court acquits Raja Pervez Ashraf in illegal appointments case

Court takes decision in light of NAB (Amendment) Ordinance 2019

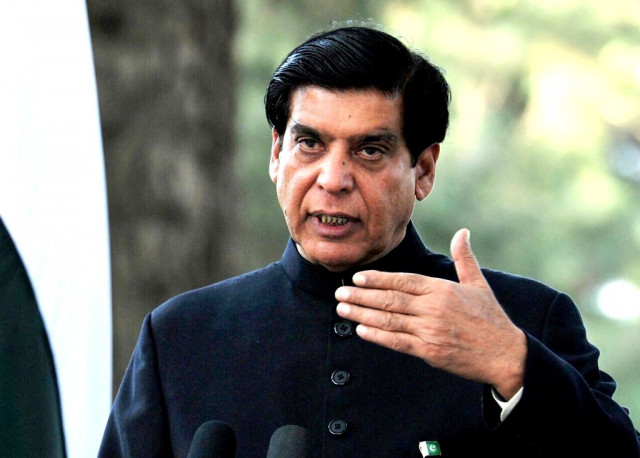

Former PPP premier Raja Pervez Ashraf. PHOTO: AFP/FILE

The reference, filed by the anti-graft watchdog in 2016, accused the former minister of misusing his powers by appointing 437 people in Gepco without merit.

Former secretary water and power Shahid Rafi, former Gepco board of governors including Saleem Arif, Malik Muhammad Razi Abbas and Wazir Ali were also accused in the case.

What do the amendments say?

In December 2019, President Dr Arif Alvi promulgated the NAB (Amendment) Ordinance 2019 in a move to limit the sweeping powers of the anti-corruption watchdog to act against any individual accused of financial corruption at will.

The new law offers more protection to public office-holders or government officials while at the same time excludes several financial sectors from the purview of the anti-corruption watchdog.

Under the ordinance, the government mandates the NAB chairman to submit a report on complaints against the bureau to the federal government. Earlier, the NAB chief used to submit such a report to the president.

The development has triggered a debate with some analysts calling it “NRO-Plus”.

Upon the promulgation of the ordinance, inquiries and investigations shall stand transferred to the respective authorities or departments which administer the relevant laws of taxation, levies or imposts in question.

Trials shall stand transferred from the relevant accountability courts to the criminal courts which deal with offences under the respective laws pertaining to taxation, levies, or imposts in question.

With regard to procedural lapses in any government project or scheme, it says no action under the ordinance shall be taken against any holder of public office unless it is shown that the holder of public office has materially benefitted by gaining any asset or monetary benefit which is disproportionate to his known sources of income, or where such material benefit cannot be reasonably accounted for, and there is evidence to corroborate the acquiring of such material benefit.

Importantly, it reads, no action under the ordinance shall be taken against any holder of public office in any matter pertaining to the rendition of any advice, opinion or report, unless it is shown that the holder of public office has materially benefitted by gaining any asset or monetary benefit which is disproportionate to his known sources of income, or where such material benefit cannot be reasonably accounted for.

Surprisingly, the ordinance states that the valuation of immovable properties, for the purposes of assessing as to whether a holder of public office has assets disproportionate to his known sources of income, shall be reckoned either according to the applicable rate prescribed by the district collector or the Federal Board of Revenue (FBR), whichever is higher. “No evidence contrary to the latter shall be admissible,” it adds.

NAB probes Rs280m scam in GCU foreign faculty programme

It also states that an act done in good faith and in discharge of duties and performance of official function shall not, unless there is corroborative evidence of accumulation of any monetary benefit or asset which is disproportionate to the know sources of income or which can’t be reasonably accounted for.

The ordinance makes it mandatory for NAB to obtain approval of a scrutiny committee, comprising NAB chairman, cabinet secretary, SECP chairman, FBR chief, and a law ministry representative, before acting against any government official.

It further states that NAB would not seize property of government officials without the orders of the court. If the national graft-buster cannot complete an investigation against a suspect within three months, the accused would be entitled to bail, it added.

The proposed amendment text suggested that NAB should now only be able to proceed in corruption cases worth Rs500 million or more. Earlier, the minimum limit was Rs50 million.

The NAB jurisdiction over matters relating to tax, stock exchange and IPOs has been curtailed. The FBR, SECP and building control authorities would be the sole authorities mandated to act on all such matters.

Undeterred by politician’s threat: NAB

Under the ordinance, NAB officials have been barred from giving statements to the media on an inquiry or investigation before the filing of formal reference.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ