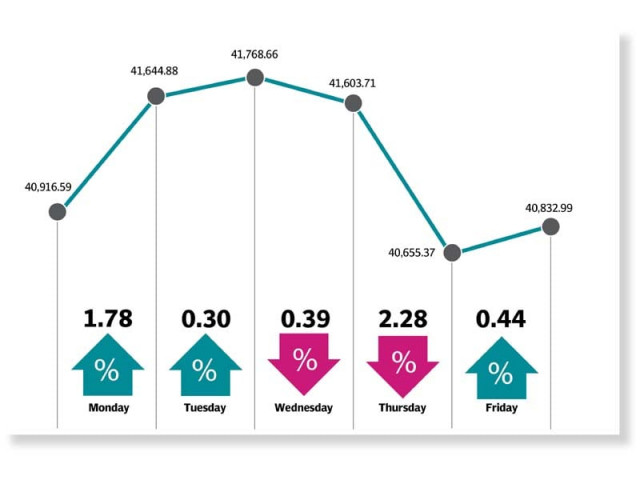

Weekly review: Seven-week winning streak comes to an end

Political developments, tensions at Pak-India border drag KSE-100 down

The outgoing week was marred with momentous developments on the political front, which kept the overall sentiments somewhat frayed.

The week kicked off with a bang as the KSE-100 index shot up to hit a 13-month high after investors engaged in buying exploration and production stocks on news that Pakistan had invited Russia to invest in state-owned oil and gas firms.

Late last week, Pakistan invited Russia to participate in the divestment of government’s shareholding in Oil and Gas Development Company (OGDC) and Pakistan Petroleum Limited (PPL) and become a strategic partner by acquiring shares. The upward momentum was also due to expectations relating to the rollover of deposit amounting $5 billion from UAE and Saudi Arabia was reported.

Market watch: Stocks battered as rate cut hopes dashed

Volatile trading made a comeback on Tuesday as the index witnessed sharp swings on the back of news that the Oil and Gas Regulatory Authority (Ogra) had proposed a 214% hike in gas prices.

Further dent to the market sentiment came after a special court announced its ruling in a case against former president Pervez Musharraf. In an unprecedented judgement in the nation’s history, the special court while hearing the high treason case sentenced the former military ruler to death. The news sent shockwaves throughout the bourse as the index dived nearly 600 points in intra-day trading. Despite this significant development, the index managed to stage a recovery and finish in the green.

The optimism could not be sustained and the index fell into the red zone on Wednesday amid choppy trading. In a late reaction to the Musharraf sentence, some investors resorted to book profits and remain on the sidelines.

The bearish rule continued as the index witnessed the biggest one-day fall in the CYTD. The 948-point plunge came as a result of growing tensions along the Pakistan-India border and a detailed verdict issued in ex-president Pervez Musharraf case, which dampened investor sentiment.

The market made a turnaround on the last trading day of the week and finished positive, however, the verdict in former president Pervez Musharraf’s treason case prevented it from making hefty gains.

Market watch: Stocks hit nine-month high following political clarity

Despite the tumultuous week, participation remained on an upward trajectory, as volumes traded increased 8%, while average value traded jumped 23%.

The unfolding developments on the domestic front stifled the excitement from some positive developments on the external front that came during the latter part of the week. The Executive Board of the International Monetary Fund (IMF) completed its first review of Pakistan’s economic performance under the Extended Fund Facility (EFF) that allows disbursement of $452 million. In terms of sectors, contribution to the upside was led by E&Ps and banks. Meanwhile, refinery, engineering and textile sectors took away points from the index. Scrip-wise, SHFA, SHEL, and DAWH emerged as the gainers, while IGIHL, FFBL and GATM contributed negatively to the index, according to a JS Research report.

Among highlights of the week were; the current account deficit dropped a massive 73% to $1.82 billion in the first five months of FY20, State Bank of Pakistan’s (SBP) foreign exchange reserves reached a level of $10.9 billion.

Published in The Express Tribune, December 22nd, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ